LedgerX suing CFTC for breach of duty in botched Bitcoin futures launch

LedgerX suing CFTC for breach of duty in botched Bitcoin futures launch LedgerX suing CFTC for breach of duty in botched Bitcoin futures launch

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin derivatives provider LedgerX was supposed to launch yesterday after securing a CFTC license last month. Now, LedgerX is suing the CFTC after the regulator said it did not have all the appropriate licenses, butchering the launch.

Complications with LedgerX Bitcoin futures

A vacant space in the U.S. crypto trading market was supposed to get filled yesterday. LedgerX launched its physical Bitcoin futures trading, but it seems the launch has had complications.

LedgerX, a crypto trading company focused on Bitcoin derivatives trading, announced that it has launched the first physically-settled Bitcoin futures in the U.S. However, 24-hours since launch there were still no signs of listed market volumes or of the ‘approved’ contracts on the CFTC website.

The company filed for the requisite licenses with the U.S. Commodity Futures Trading Commission (CFTC) back in November last year and originally planned to launch Bitcoin futures in April. However, they were granted a designated contract market license in late June and have been conducting user acceptance tests throughout the month.

Although the CFTC approved LedgerX as a designated contract market, it has yet to give approval to the company for a derivatives clearing organization license. Both licenses are needed for the futures launch. According to CFTC regulations, the regulator has 180 days to approve or deny a derivatives clearing operator application.

LedgerX chief operating officer Juthica Chou told CoinDesk that because the 180 days had elapsed without objection from the CFTC, the company was under the impression it was clear to proceed with the launch.

After LedgerX announced the launch, it seems the CFTC did not give all the necessary approvals for launching the physically-settled Bitcoin futures after all. As a senior CFTC official, who did not want to be identified, told CoinDesk:

“Every new or amended DCO application needs to be affirmatively approved by the Commission. The absence of a decision does not constitute approval, and entity self-certification is not an option.”

The CEO of LedgerX, Paul Chou, was livid that CFTC did not provide a response within 180 days, and in doing so, caused a miscommunication that botched the launch of the Bitcoin futures, he claims.

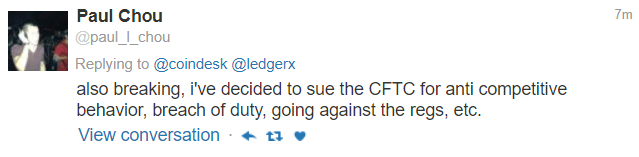

Choi is now threatening to sue the CFTC if they do not “do the right thing,” and he claims he is already talking to the company’s lawyers about legal action. Finally, in a redacted tweet, Chou said he decided to go forward with a lawsuit within 45 minutes of tweeting about the mixup.

LedgerX will bring more people into Bitcoin when launched

LedgerX would have made history by introducing its retail-oriented physically-settled futures contracts. For the first time ever, customers wouldn’t have to depend on the U.S. banking system when trading cryptocurrencies. As Bitcoin is used as collateral, the contract can be settled at any time. This, Chou said, and will enable LedgerX’s customers to trade Bitcoin 24 hours a day, 7 days a week, and 365 days a year.

“Not only are they delivered physically in the sense that our customers can get Bitcoin after the futures expires, but also they can deposit Bitcoin to trade in the first place,” he said. “Cash-settled is cash-in and cash-out, we’re Bitcoin-in and Bitcoin-out,” Chou said.

Apart from giving traders more freedom, the company’s futures would also allegedly be less susceptible to manipulation. John Todaro, the director of research at TradeBlock, said that the cost usually associated with physically-settled contracts disappear with Bitcoin and could be more attractive to non-speculative institutions.

Chou spent the better part of this year “educating regulators” about crypto derivatives, which means that more DCM licenses could be granted soon. But, after the battle with the CFTC this may no longer be the case.

Bakkt is currently waiting on a trusted charter from the New York Department of Financial services before it can be launched. ErisX has already received all of the necessary CFTC approvals but is yet to announce the launch of its futures contracts.