Coinbase Product Manager: DeFi to change market interactions; how will Ethereum benefit?

Coinbase Product Manager: DeFi to change market interactions; how will Ethereum benefit? Coinbase Product Manager: DeFi to change market interactions; how will Ethereum benefit?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

DeFi, short for decentralized finance, has started to get the attention of some of the biggest companies in crypto.

At the Coinbase Winter 2019 hackathon, the company’s product manager Jacob Horne described DeFi as an opportunity that could change how individuals interact with markets. In a tweet, Coinbase said that the hackathon itself focused on building DeFi-related tools:

“DeFi, or decentralized finance, is an essential part of an open financial system. DeFi tools are censorship-resistant, unbiased, programmable, and available to anyone with a smartphone. For this hackathon, we’re focusing on bringing DeFi to the world.”

$657 million locked in DeFi, mostly platforms built on Ethereum

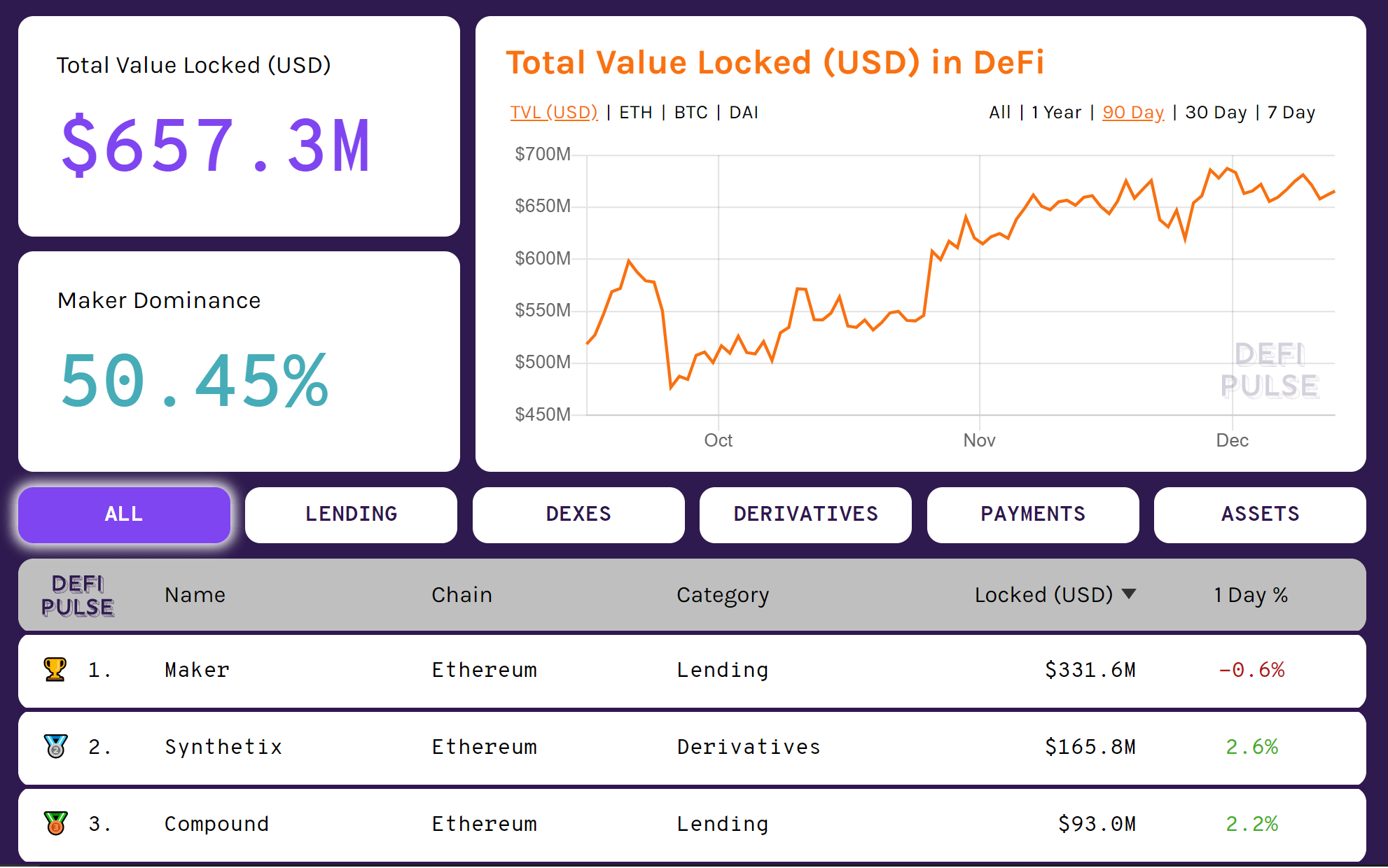

According to DeFi Pulse, a site that analyzes and ranks DeFi platforms, the total value locked in DeFi has reached $657 million in Ethereum. It is up by more than 38 percent since October, within a two-month span.

MakerDao, Synthetix, and Compound, all of which are based on Ethereum, are ranked as the three biggest DeFi platforms currently in the market.

Considering the rapid growth of the space, Horn said:

“DeFi is an opportunity to build financial infrastructure that spans the world, is open to everybody, and starts to change how we interact with markets.”

In essence, DeFi works similarly to existing financial products and banking services that allow individuals to receive and provide loans in exchange for compensation. However, with decentralized platforms, all transactions are processed in a peer-to-peer manner through the use of smart contracts on the Ethereum network.

DeFi is not limited to lending; the Lightning Network of Bitcoin is considered a part of decentralized finance as it enables users to send and receive payments instantly in a distributed ecosystem.

Other areas like decentralized exchanges (DEXes), derivatives, and assets pooled together with major markets like lending form the foundation of DeFi. The sector itself has significant room to grow, as most of the capital locked in DeFi derives from lending and derivatives.

Developers have found it difficult to make DEXes and decentralized payment platforms as seamless as centralized alternatives, which have led other aspects of DeFi to struggle. In that regard, progress with scalability on major blockchain networks like Ethereum that prioritize smart contracts could pave a path for DeFi to grow over the long-term.

Explosive growth, but what needs to improve?

Over the past two years, the DeFi market grew from $10 million to nearly $660 million in Ethereum value alone.

Still, there are significant risks involved in DeFi since all platforms are decentralized. Usability wise, practical scalability solutions have to be adopted by Ethereum to allow decentralized applications to run more seamlessly. In the upcoming months, developers and companies are expected to continue building on top of the existing DeFi infrastructure, based on the recent trend.