BTC miner balances poised for selloff as sell pressure increases

BTC miner balances poised for selloff as sell pressure increases BTC miner balances poised for selloff as sell pressure increases

CryptoSlate's analysis of potential all-time high miner capitulation in 2023 and whether mining BTC selloff will occur.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

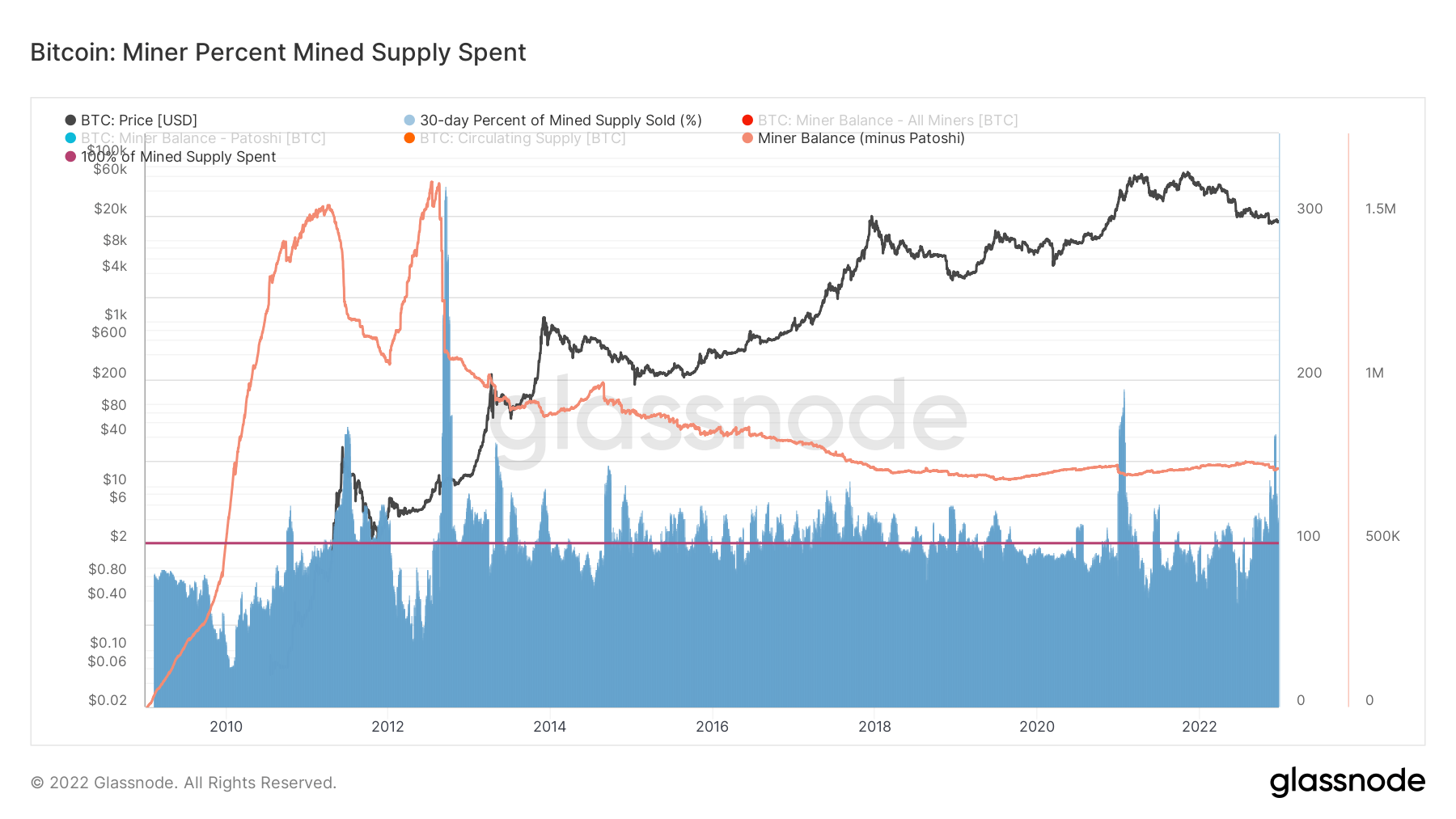

Bitcoin (BTC) miner balances started at 1.82 million BTC at the beginning of the year. Despite peaks of capitulation and significant selloff volume, BTC miner wallets still sit at a flat 1.8 million BTC.

Mining rewards held in BTC miners’ wallets saw a sharp decline starting in August, likely due to the Poolin exodus. This year saw the third-largest BTC selloff by miners over a 30-day period, with 112% of mined supply plus treasury being spent. In contrast, the first and second-largest selloffs occurred during the 2013 and 2021 bull runs, as miners sold their BTC at a profit rather than a loss.

The invasion of Ukraine in February 2022 caused a global energy crisis, resulting in high costs for BTC miners and wiping out potential profits.

The miner balance currently stands at 1.8 million BTC and has remained flat over the past five years, excluding Patoshis coins. This suggests significant sell pressure if miners continue to struggle into 2023.

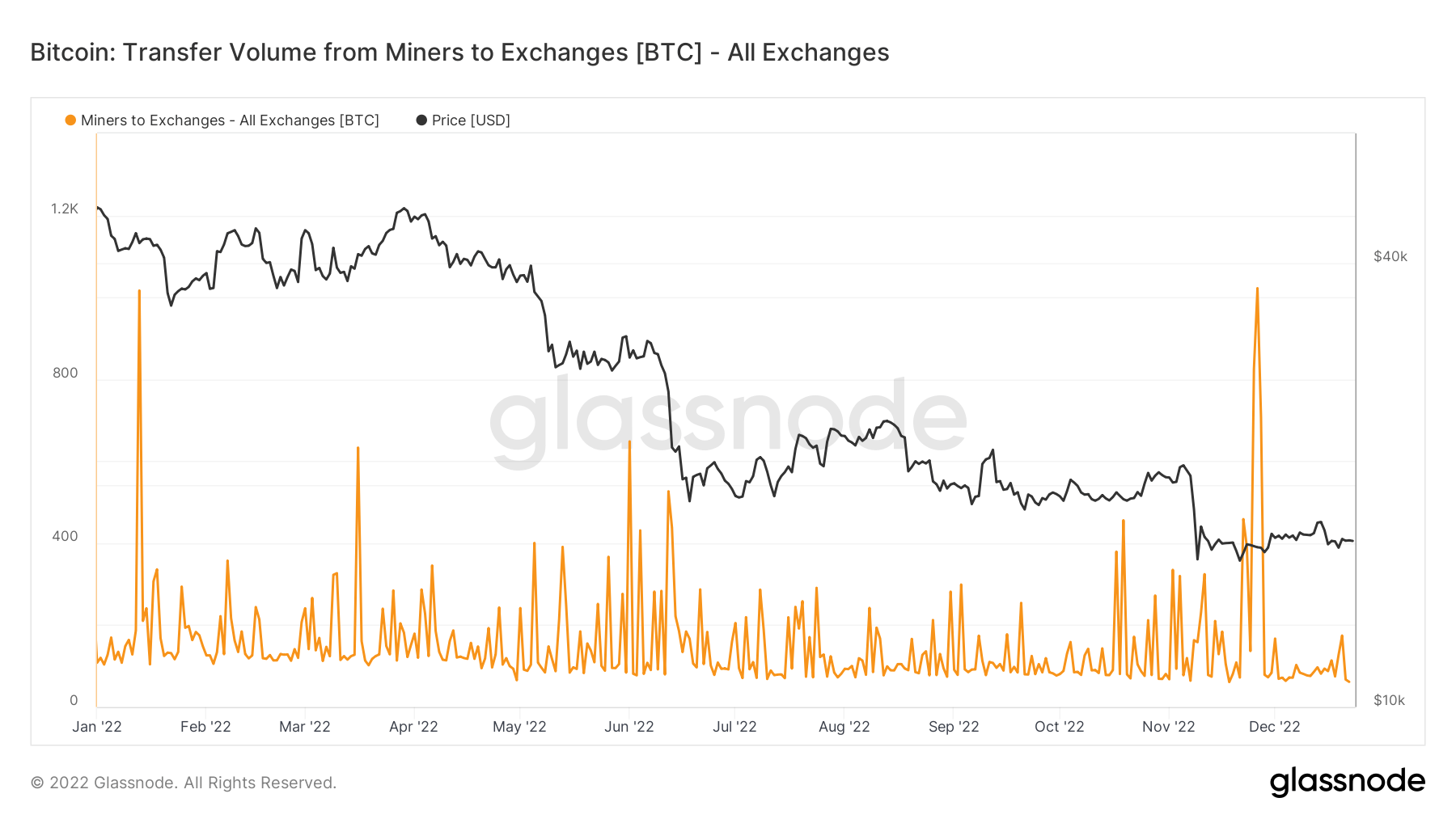

While BTC miners have been offloading their holdings, this is simply miners moving to different wallets rather than sending the BTC to exchanges to be sold.

Approximately 200 BTC has been spent daily since 1000 BTC was sold in late November.

Through 2022, miners selling to exchanges has remained minimal, with approximately 57,000 BTC sold through the year.

With only 57,000 BTC being sold out of a total of 1.8 million BTC and increasing sell pressure, it’s worth considering whether BTC miners are preparing to sell in 2023.

Amid BTC mining company bankruptcy, record-breaking whale BTC selloffs and miner profitability crisis — 2023 miner capitulation is geared towards major selloffs if sell pressure continues to mount.