Binance’s share of Bitcoin spot market falls more than half since February peak of 85%

Binance’s share of Bitcoin spot market falls more than half since February peak of 85% Binance’s share of Bitcoin spot market falls more than half since February peak of 85%

Data suggests the war on crypto is taking its toll on Binance — the firm is set to shift focus away from Canadian and U.S. market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Binance’s market share of the Bitcoin spot market continues trending downwards — suggesting the war on crypto is taking its toll on the world’s largest exchange.

Shifting Bitcoin spot volume dynamics

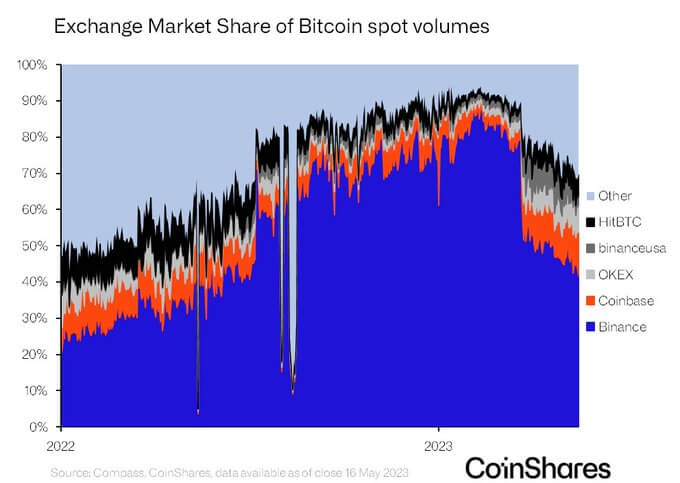

CoinShares’ Head of Research, James Butterfill, posted a chart of Bitcoin spot volume by centralized exchange (CEX) market share.

It showed five specific CEXs and an additional category labeled “Other” but did not specify the other CEXs that make up this category.

Since 2022, Binance’s share of the Bitcoin spot market has been trending higher – from 20% to 85% by February 2023. From March onwards, a dramatic fall-off saw a dip to 50% before trending down to approximately 40% at present.

It was noted that, at the start of 2022, “Other” CEXes accounted for half of the Bitcoin spot market — decreasing as Binance’s dominance increased. However, “Other” CEXs are making a strong comeback since March.

Coinbase and OKEX are emerging as prominent winners amid the shifting market dynamics — reclaiming their former glories, as seen in early 2022.

CFTC sues Binance

On March 27, the Commodities Futures Trading Commission (CFTC) filed against Binance, company CEO Changepeng Zhao (CZ,) and Compliance Head Samuel Lim over allegations of violating commodities regulations.

Around this time, several CEXs also came under regulatory actions, including Kraken — which, in February, agreed to a $30 million settlement with the Securities and Exchange Commission (SEC) over charges of failing to register its staking service as a security product.

Likewise, Coinbase received an SEC Wells Notice informing the company of pending litigation in March. At the time, Coinbase CEO Brian Armstrong said he was confident that the company is operating legally and “welcomes a legal process.”

Last month Coinbase sued the SEC to force the agency to share its rule-making decision process. Chief Legal Officer Paul Grewal commented that the agency had not given clear guidelines on how the law applies to companies operating in the crypto sector.

The frequency of enforcement actions — in conjunction with unclear rules — led some to conclude that U.S. regulators are waging war on crypto.

Last week, Binance announced it was leaving the Canadian market, saying it could no longer operate in the region. Similarly, CZ said he was looking at ways to reduce his stake in Binance U.S. — suggesting intent to focus on other jurisdictions.