NFT fever returns as sales surge to $10.7 billion on Ethereum, Solana, and other blockchains

NFT fever returns as sales surge to $10.7 billion on Ethereum, Solana, and other blockchains NFT fever returns as sales surge to $10.7 billion on Ethereum, Solana, and other blockchains

A recent blockchain industry report revealed that the third-quarter sales volumes went up from $1,3 billion in Q2 and $1,2 billion in Q1.

Photo by Beata Ratuszniak on Unsplash

Sales volumes of non-fungible tokens (NFTs) surged to $10.7 billion in the third quarter of 2021, according to DappRadar’s latest blockchain industry report.

The popular data acquisition and analysis company noted that the third-quarter figure increased 704% from the previous three-month period, as the play-to-earn (P2E) movement evolved into one of the key drivers behind the industry’s incremental growth.

The game

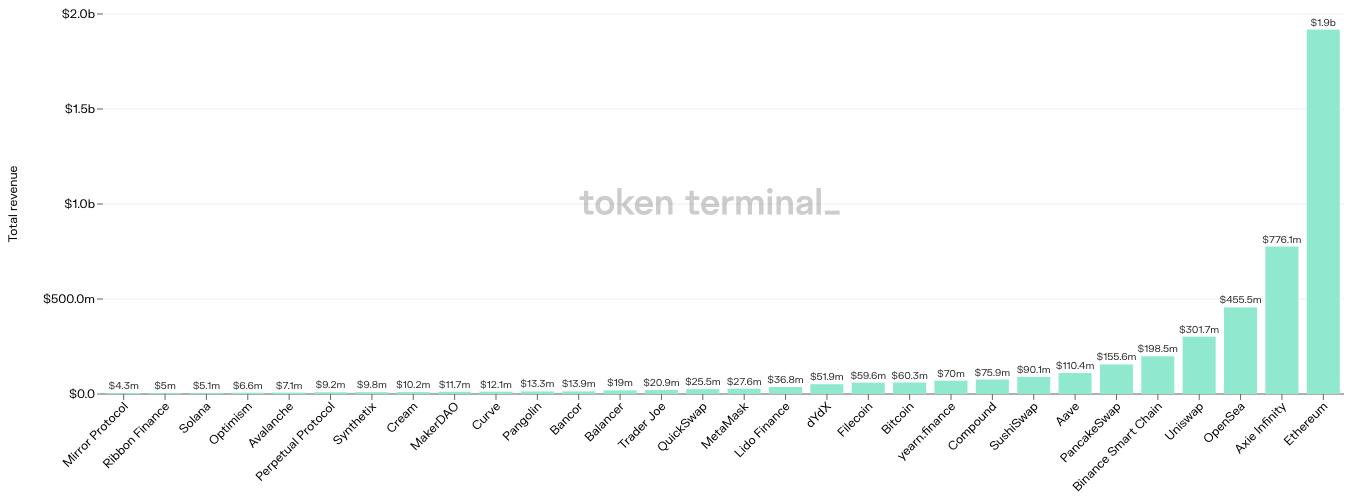

Axie Infinity became the most traded NFT collection ever. According to DappRadar’s data, in September, it surpassed $2 billion in all-time trading volume and became the first Dapp to reach that high.

“Currently, Axie Infinity’s historical trading volume ascends to $2,18 billion. To put that in perspective, the closest collection is CryptoPunks, lagging $800 million behind,” read the report, noting that the game continues to excel since its move to the Ronin sidechain solution.

We've raised a $152 M Series B led by @a16z for @SkyMavisHQ!

✨The funds will be used to fuel the expansion of Axie Infinity and Ronin, our scaling solution for digital nations.https://t.co/5vRXmHarlp

— Axie Infinity?? (@AxieInfinity) October 5, 2021

The report also pointed out that the game surpassed 1,5 million active users during Q3 while calling it the “spearhead of the P2E movement.”

“In addition, during this quarter, Axie generated over $776 million in revenues. Easily surpassing entire blockchains like BSC and Bitcoin,” the report added.

GameFi movement

According to DappRadar, the newly created synergy between games and NFTs is resulting in a “more visible footprint on both ends.”

Games continue driving usage within the industry, with Unique Active Wallets (UAW) connecting to game Dapps increasing 140% quarter-over-quarter, while, during the same period, DeFi and NFT connected wallets decreased by 11% and 2%, respectively.

“The play-to-earn movement became a key driver in the space, NFTs turned towards greater utility and secured record volumes,” Head of Finance and Research at DappRadar, Modesta Jurgeleviciene, commented on the trend.

Whilst Axie Infinity continues to outperform the competition, DappRadar’s report touched on another game Dapp that attracted attention during the third quarter of 2021.

“Splinterlands managed to attract 238,000 UAW in September, bringing the quarter average to 108,000 unique wallets. The quarterly usage represents a staggering 1,376% growth quarter-over-quarter,” according to the report.

A trading card game hosted on the Hive blockchain is one of the Dapps that sustains an entire blockchain, representing 95.6% of Hive’s traffic.

“In contrast to traditional games, NFT allows blockchain gamers a true sense of ownership on their playing items. And they have become a fundamental part of the NFT space as a whole,” concluded the report, underscoring that in Q3, in-game items generated $2,3 billion in trading volume, representing 22% of the total NFT volume.