Bitcoin fully recovers to pre-crash levels, but signs of a pullback are still on the horizon

Bitcoin fully recovers to pre-crash levels, but signs of a pullback are still on the horizon Bitcoin fully recovers to pre-crash levels, but signs of a pullback are still on the horizon

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has managed to fully recover as optimism grows around the upcoming halving, but a renowned analyst suggests that a correction could be underway.

Bitcoin is back above $9,000

The bullish impulse behind Bitcoin seen over the past three days allowed it to recover the gains lost during the March market meltdown. The flagship cryptocurrency surged more than 22 percent during this time period. It went from trading at a low of $7,700 to reach a high of $9,440.

Moving above $9,000 also helped BTC get back to the levels predicted by the stock-to-flow (S2F) ratio following a deviation caused by the crash in March, according to Glassnode.

The on-chain data and intelligence provider explained:

“Bitcoin’s price has historically followed the S2F Ratio, and its recent increase back above $9000 puts it back on track to continue hitting these forecasts.”

Under the assumption that scarcity drives value, the S2F anticipates that the upcoming halving could trigger a rapid increase in price. As Bitcoin’s rate of issuance is set to drop by 50 percent, miners will soon be rewarded 6.25 BTC per block instead of 12.5 BTC.

The significant reduction in the rate of inflation makes the S2F predict that BTC will hit $95,000 sometime next year.

On-chain metrics explode

Regardless of the price projections by this mathematical model, Glassnode noted that multiple on-chain indexes also recovered substantially alongside price.

On-chain volumes, for instance, experienced a greater increase than transaction count. The divergence between these metrics suggests that “the activity is being driven by larger investors, rather than traders and market opportunists.”

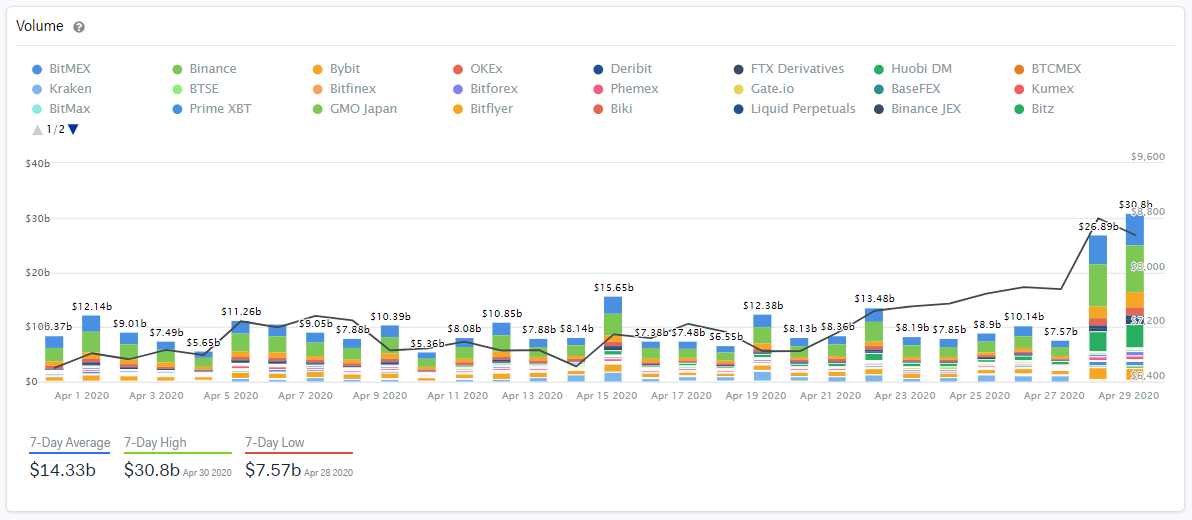

Along the same lines, IntoTheBlock reported that BTC perpetual swaps volume skyrocketed on Apr. 29. As the pioneer cryptocurrency began rising towards $9,000, the trading activity and positioning across multiple crypto derivatives exchanges rose substantially.

IntoTheBlock affirmed:

“Bitcoin perpetual swaps volume saw a big recovery on Wednesday, increasing the volume by a staggering 255%. On Thursday, the volume for perpetual swaps reached a 30-day high of $30.8 billion.”

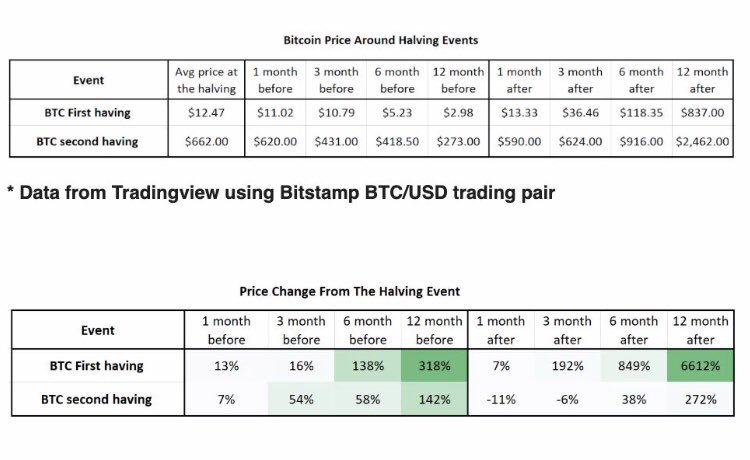

Even though these metrics reveal that interest for Bitcoin is rising as its block rewards reduction event approaches, there is evidence that suggests that the short-term outcome after the halving is not always positive.

A retracement on the horizon

Soona Amhaz, General Partner at Volt Capital, recently published a graph on Twitter that shows that one month after the most recent halving BTC’s price was down by more than 11%. And two months later, it was still down by 6%.

Moreover, the head of Hedge Fund Telemetry, Thomas Thornton, said that the bullish momentum behind Bitcoin is getting excessively “overbought.” A high relative strength index (RSI) in combination with a TD sequential 13 made Thornton exit his long BTC positions.

The trading veteran now expects a steep correction that could take Bitcoin to $7,000.

As the flagship cryptocurrency enters a period of exuberance and high volatility, it is always recommended to employ a solid risk management strategy to avoid adverse market conditions.

Bitcoin Market Data

At the time of press 5:36 am UTC on May. 3, 2020, Bitcoin is ranked #1 by market cap and the price is up 3.11% over the past 24 hours. Bitcoin has a market capitalization of $168.26 billion with a 24-hour trading volume of $44.28 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 5:36 am UTC on May. 3, 2020, the total crypto market is valued at at $256.4 billion with a 24-hour volume of $150.08 billion. Bitcoin dominance is currently at 65.63%. Learn more about the crypto market ›