AI crypto search interest drops by 64% despite market gains

AI crypto search interest drops by 64% despite market gains AI crypto search interest drops by 64% despite market gains

Analysis shows a decline in AI crypto coin searches, but market cap sees gains, leaving investors wondering about the future of the sector.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Online searches for AI crypto coins have declined by over 64% in the past seven days, despite the sector’s market cap being up 15.76% over the same period, according to CryptoSlate data.

AI coin searches down

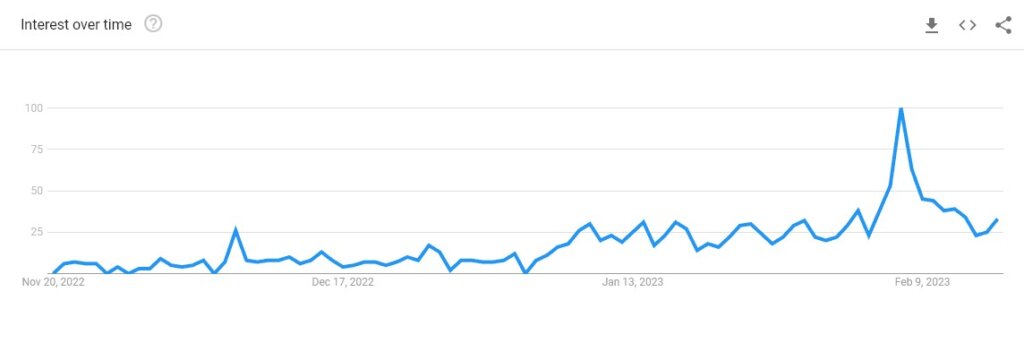

Propreitary data from CryptoSlate also indicates that AI crypto global searches for “AI coins” have continued to decline following a peak on Feb. 7. Google Trends data, which is not in real-time and ends on Feb. 16, shows a sharp rise and fall in AI crypto searches between Feb. 6 and Feb. 10.

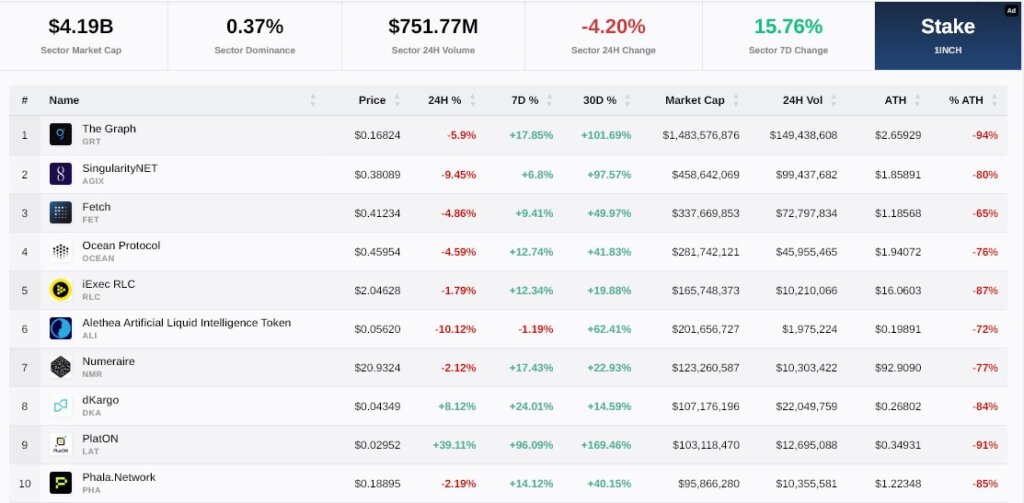

However, the recent decline in search traffic does not correlate with the sector’s market performance, as projects such as The Graph, SingularityNET, Fetch, and Ocean Protocol have seen significant gains over the past week. Additionally, the AI sector has outperformed most of the crypto industry since the start of the year.

AI coin sector

The price of The Graph (GRT) token, the leading AI sector coin, rose 149% in early February, reaching a local high of $0.21. However, it has since retraced by 27% against the Dollar and 31% against Bitcoin, as Bitcoin rose toward $25,000.

The lack of correlation between GRT and BTC is indicative of the AI sector as a whole. Since the start of 2023, interest in AI has exploded following the launch of OpenAI’s ChatGPT in November. The global focus on AI then led to a surge in price for AI crypto tokens from the start of February.

The below chart visualizes the data by showing the price of GRT denominated in BTC instead of dollars. The blue and orange lines represent the price of GRT and BTC, respectively, in dollars.

Correlation with Bitcoin

Following the local high, GRT has begun to move more in line with Bitcoin, aligning with the typical movement of crypto projects driven by Bitcoin’s price action. The chart below tracks the lagging growth of GRT in blue to the price of Bitcoin.

The correlation with Bitcoin and a falloff in search traffic indicate that the AI bubble may have popped. As a result, the retail hype for AI crypto projects could be on the way out, meaning that projects with strong communities and solid fundamentals will now be tested against traders’ desire to take profits.

Comparison to Metaverse pump

Similar price movements occurred following Facebook’s rebrand to Meta in November 2021. Metaverse-related projects such as The Sandbox (SAND) soared 998% in under 30 days before the hype died, and the token slowly declined and fell more in line with Bitcoin’s price movements.

Prior to Meta’s rebrand announcement, SAND tokens, the native token of Sanbox, were valued at around $0.73. Yet, as of press time, SAND is trading back around $0.84, an increase of just 15% after a slow 90% decline.

What’s next for AI crypto?

While the hype around AI crypto projects is reminiscent of the metaverse pump of 2021, most AI projects are still way below their all-time highs. For example, the top 10 crypto AI projects are all at least 72% down on their peak, with some as high as 94%, whereas the metaverse pump took every major metaverse token to heights never seen before.

Therefore, while the initial hype may be over for AI crypto coins, the sector is far from dead, and the signal may have just been separated from the noise.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass