As the U.S. Senate learned about Facebook’s Libra, it realized that Bitcoin cannot be killed

As the U.S. Senate learned about Facebook’s Libra, it realized that Bitcoin cannot be killed As the U.S. Senate learned about Facebook’s Libra, it realized that Bitcoin cannot be killed

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has been in the spotlight lately after a tweet from U.S. President Donald Trump where he expressed his views on cryptocurrencies, stating that he was “not a fan” of Bitcoin and that its value was highly volatile and based on thin air.

Since then, U.S. Secretary of the Treasury Steven Mnuchin held a briefing about regulating this cryptocurrency because of its use in criminal activity and the threat it poses to the financial system. Mnuchin emphasized that:

“Cryptocurrencies such as Bitcoin have been exploited to support billions of dollars of illicit activity like cybercrime, tax evasion, extortion, ransomware, illicit drugs, human trafficking. Many players have used cryptocurrency to support their maligned behavior—this is indeed a national security issue.”

In addition, the U.S. Senate held two different hearings with Facebook’s David Marcus focused on the Libra cryptocurrency. Due to the history of ethical and regulatory violations that Facebook has had in recent years, many concerns about privacy and trust have been raised among top government officials who argue that consumers data could be jeopardized since the firm will now also control the financial information of its 2.4 billion user base.

“We’d be crazy to give them a chance to let them experiment with people’s bank accounts,” said Senator Sherrod Brown. “It will be delusional to think individuals would trust Facebook with their hard-earned money.”

Even though the U.S. government is trying to intervene in the process in which any tech giant can basically create their own currency and become a bank, as President Trump stated, they could have come to realize that it will be difficult if not impossible to regulate Bitcoin.

According to U.S. Representative Patrick McHenry, a ranking member of the Financial Services Committee, regulators have no means of killing Bitcoin. McHenry believes that other iterations of cryptocurrencies that mimic Bitcoin and are not fully decentralized can be easily shut down, but the process is not as simple when it comes to the pioneer cryptocurrency.

“I think there is no capacity to kill Bitcoin. Even the Chinese with their Firewall and their extreme intervention on their society cannot kill Bitcoin. So, a distributed ledger, full and open, in the essence of Bitcoin, as a first mover in the space [cannot be killed].”

"I think there's no capacity to kill bitcoin" says @PatrickMcHenry #btc pic.twitter.com/DY70tx2TvV

— Squawk Box (@SquawkCNBC) July 17, 2019

In fact, co-founder at Morgan Creek Anthony Pompliano explained in a recent interview with CNBC that with companies such as Facebook there is a CEO and a company to go after that will assume all responsibility for the success or failure in the creation of a new cryptocurrency, but with Bitcoin there is no CEO, so there is nobody who can testify about it in a hearing.

"With Bitcoin, there is no CEO. You can't send a letter or send somebody in for a hearing," @APompliano explained Trump's aversion to crypto last week. https://t.co/WXNYQr4Kpa pic.twitter.com/ztOns1AnFk

— CNBC Politics (@CNBCPolitics) July 17, 2019

As the U.S. politicians become more aware of the decentralized nature of Bitcoin more attention is being drawn towards it and despite all the talks this cryptocurrency has plunged more than 30 percent over the past few days from the recent high of $13,200.

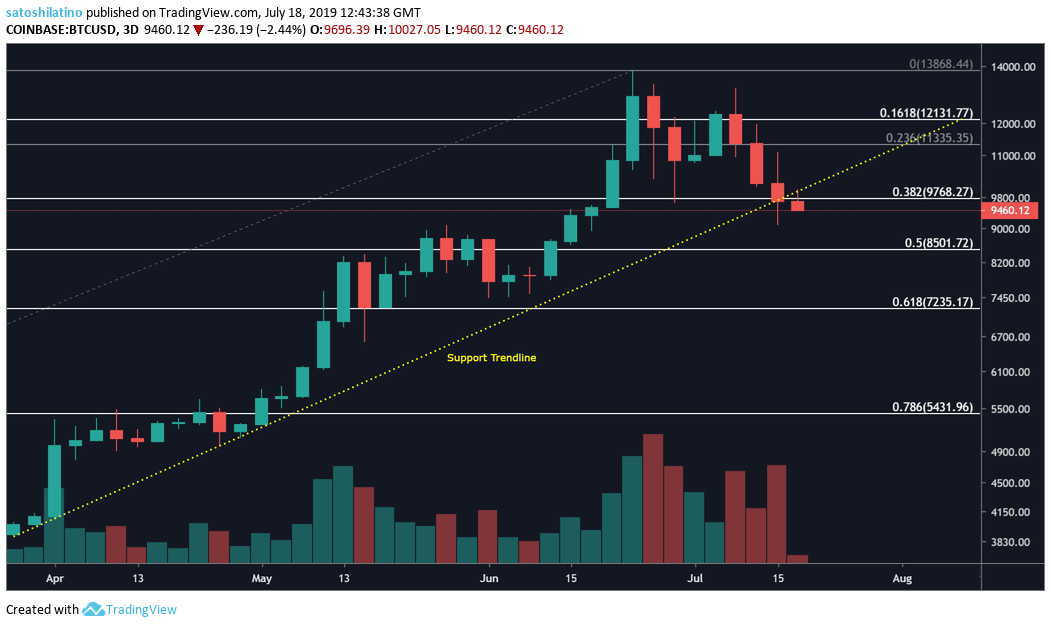

Bitcoin technical analysis

At the moment, BTC has broken below the major cluster of support that was given by the support trendline that developed since mid-March and the 38.20 percent Fibonacci retracement level. A drop down to the 50 or 61.80 percent Fibonacci retracement area could be expected, which are sitting between $8,500 and $7,200.

Bitcoin Market Data

At the time of press 6:42 pm UTC on Apr. 9, 2020, Bitcoin is ranked #1 by market cap and the price is down 6.56% over the past 24 hours. Bitcoin has a market capitalization of $134.73 billion with a 24-hour trading volume of $22.03 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:42 pm UTC on Apr. 9, 2020, the total crypto market is valued at at $204.11 billion with a 24-hour volume of $80.85 billion. Bitcoin dominance is currently at 65.97%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass