These three factors could determine the mid-term fate of Cardano (ADA)

These three factors could determine the mid-term fate of Cardano (ADA) These three factors could determine the mid-term fate of Cardano (ADA)

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cardano (ADA) has been one of the hottest cryptocurrencies throughout 2020, posting gains that have only been rivaled by Tezos and Chainlink.

Increased usage rates and notable development progression has helped drive this uptrend, allowing the cryptocurrency to climb over 270 percent from its March lows.

There are a few critical factors that could influence its trend in the coming few days and weeks.

Some of these factors seem to suggest that the near-term trend will favor ADA bears, as its large transaction count has been diving as it navigates into what on-chain data describes as a heavy resistance region.

That being said, Cardano’s unique positioning within the smart-contract sector does bode well for its mid-term outlook.

Factor 1: Cardano leads smart-contract sector as Shelly development phase progresses

Last week, CryptoSlate reported that Cardano is currently leading the smart-contract sector in terms of price performance, trading up nearly 160 percent since the start of the year.

Data from analytics platform Messari elucidates this trend, showing that ADA was followed by Ethereum in second place and Vechain in third place.

Although the price is not a direct reflection of utility, usage, or fundamental outlook, Cardano has progressed by strides in all these fronts – primarily due to progress in the “Shelly” development phase.

The launch of Shelly is anticipated to provide the blockchain with a massive boost to its scalability, while also introducing a new delegation and incentive structure that will help it become more decentralized.

This will likely continue influencing its growth in the months ahead.

Factor 2: On-chain data signals ADA is approaching massive resistance

In the near-term, Cardano’s growth may be hampered by the massive resistance that it is rapidly approaching.

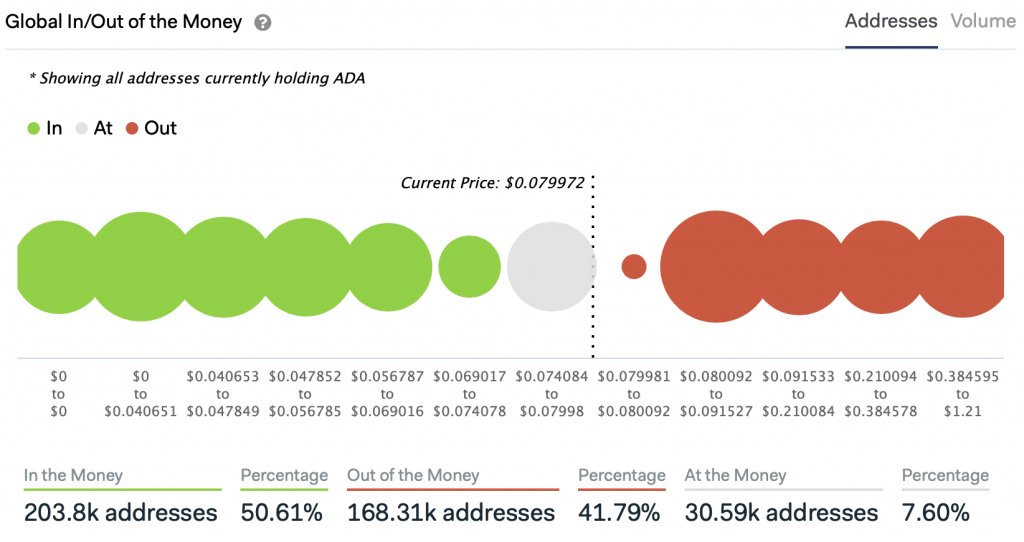

On-chain data from IntoTheBlock’s “In/Out of the Money” indicator reveals that the price region between $0.08 and $0.09 may be insurmountable in the near-term.

Without there being a market-wide uptrend, it doesn’t appear that there are any immediate catalysts that could provide it with enough upwards momentum to surmount this resistance level.

As such, Cardano’s intense momentum over the past several days and weeks may now begin slowing.

Factor 3: Large tx volume plummets

It appears that large investors are taking notice of the cryptocurrency’s imminent resistance, as its large transaction count has reeled lower in recent times.

According to another data set from IntoTheBlock, Cardano’s large transaction count – categorized as those with a value of over $100,000 – has plunged from its weekly highs of 520 to 235 presently, declining consistently over the past several days.

This decline in large ADA tx volume signals that large traders are sidelining as the crypto approaches its heavy resistance, which may signal that it will prove to be insurmountable.

If this number starts climbing in tandem with a price surge, it would be emblematic of large buyers backing Cardano’s momentum.

Cardano Market Data

At the time of press 9:47 pm UTC on Jun. 29, 2020, Cardano is ranked #11 by market cap and the price is up 3.67% over the past 24 hours. Cardano has a market capitalization of $2.17 billion with a 24-hour trading volume of $262.38 million. Learn more about Cardano ›

Crypto Market Summary

At the time of press 9:47 pm UTC on Jun. 29, 2020, the total crypto market is valued at at $260.21 billion with a 24-hour volume of $53.91 billion. Bitcoin dominance is currently at 64.71%. Learn more about the crypto market ›