The value of crypto locked in DeFi has passed $3B; Will this propel token prices higher?

The value of crypto locked in DeFi has passed $3B; Will this propel token prices higher? The value of crypto locked in DeFi has passed $3B; Will this propel token prices higher?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

There’s now over $3 billion worth of crypto locked within the decentralized finance ecosystem.

This marks a stunning 200 percent climb from what this number was just over a month ago, with this growth backing the strong uptrend seen by many DeFi-related tokens.

It appears that a few primary factors are backing the growth this metric has seen, including the launch of new protocols and tokens, yield farming’s mounting popularity, and an increase in the amount of value locked within decentralized exchanges and derivatives.

For the relatively small DeFi token sector to continue extending its parabolic growth, users must continue heavily interacting with protocols.

The total value of crypto locked within DeFi passes $3 billion

Over the past five weeks, investors and users have poured over $2 billion worth of crypto into DeFi protocols, leading the total value locked (TVL) to surpass $3 billion.

This marks a 200 percent climb from early-June, at which time the TVL was just over $1 billion.

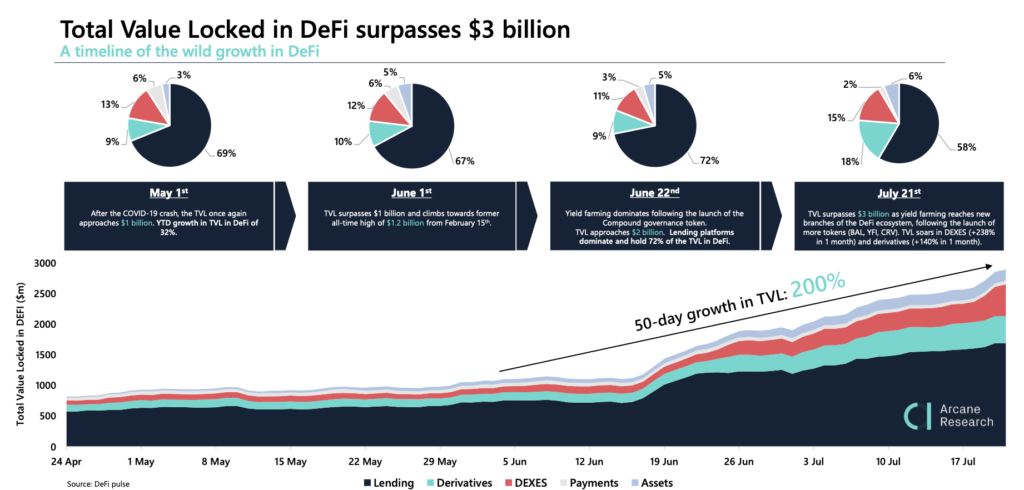

Arcane Research graphed this growth in a recent report, also illustrating how the TVL is distributed.

As seen on the above graph, in late-June, 72 percent of the crypto within the ecosystem was locked within lending. This has since shifted, with this fragment of the ecosystem now accounting for only 58 percent of the total TVL.

The decline in lending’s dominance over the sector has come about due to the growth seen by DeFi derivatives and decentralized exchanges (DEXes), which now account for 18 percent and 15 percent of the TVL, respectively.

Arcane Research spoke about the breakdown in their report:

“TVL surpasses $3 billion as yield farming reaches new branches of the DeFi ecosystem, following the launch of more tokens (BAL, YFI, CRV). TVL soars in DEXES (+238% in 1 month) and derivatives (+140% in 1 month).”

Payments and assets only account for a combined 8 percent of the present TVL.

Will DeFi tokens continue rising as the TVL grows?

As money continues flooding into DeFi protocols, it will likely create a tailwind that helps lift the prices of the token’s related to the sector higher.

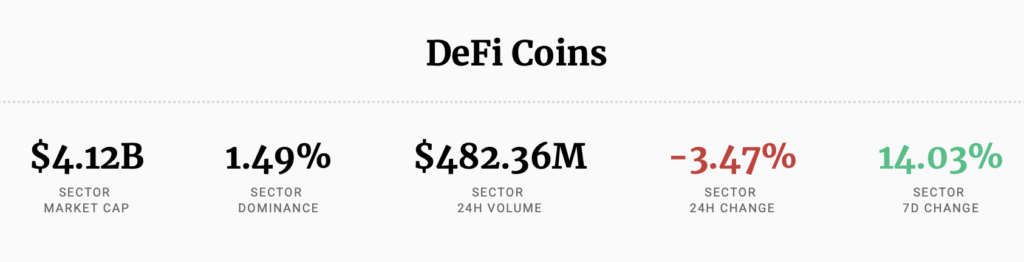

Although there is a historical connection between TVL and the market cap of the DeFi token sector, the amount of capital tied in DeFi tokens currently exceeds the ecosystem’s TVL by over $1 billion – as seen while looking towards CryptoSlate’s proprietary data:

This indicates that a lot of speculative money is betting on these crypto tokens. Still, it is possible that this growth will remain sustainable as long as the dollar value of the locked crypto continues growing.