Is Bakkt’s lack of Bitcoin options trading volume a sign of trouble for the crypto markets?

Is Bakkt’s lack of Bitcoin options trading volume a sign of trouble for the crypto markets? Is Bakkt’s lack of Bitcoin options trading volume a sign of trouble for the crypto markets?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The launch of Bakkt – the physically settled Bitcoin futures trading platform – was long viewed as a bullish fundamental catalyst that would help usher in the next era of institutional adoption into the nascent crypto markets.

Unfortunately for hopeful market participants, however, the platform kicked off to an incredibly slow start, and it has since failed to show any signs of expressing any type of overt widespread adoption.

The lack of use surrounding Bakkt’s physically settled BTC options may point to a larger issue plaguing the markets, and one that may not go away any time soon.

Bakkt sees zero options trading volume despite the massive crypto rally

Bakkt – which is backed by the New York Stock Exchange parent company Intercontinental Exchanges (ICE) – first launched their options contract for Bitcoin in early-December, which came just a few weeks after the platform launched their highly-anticipated futures product.

The launch of Bakkt’s options and futures was lackluster to say the least, with their futures product being met with just a few thousand dollars’ worth of trading volume within its first few hours of launching, which only grew gradually in the subsequent days and weeks.

It is important to note that the trading volume surrounding Bakkt’s futures product has warmed up in recent times, although the platform’s options contracts are still incredibly unpopular.

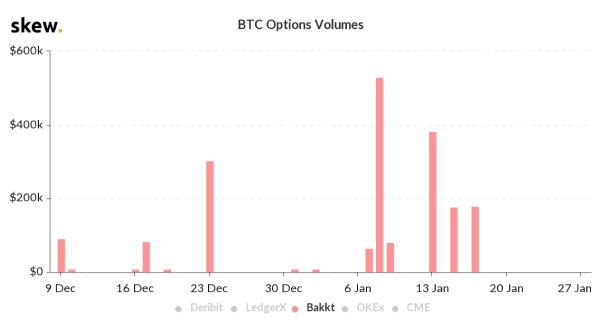

Recent data from Skew – an analytics platform focused on the crypto derivatives market – suggests that it has been ten days since the last BTC option traded on the platform.

They spoke about this in a tweet while referencing a chart showing the volume seen since Bakkt launched their BTC options.

“It’s been 10 days since the last option trade on Bakkt.”

The lack of options trading on Bakkt may point to a bigger issue

Because Bakkt was built around serving large clients – including intuitions, corporations, and family offices – its lack of trading volume signals that these large players haven’t yet taken to the crypto markets.

Although institutional adoption certainly isn’t something that happens overnight, it is something that investors believed the markets would see in the time following Bakkt’s launch late last year.

It is important to note that the long-term significance of Bakkt’s presence within the crypto markets should not be discounted in spite of its lack of major utilization.

Once large investors do warm up to thought of investing in Bitcoin, the availability of a safe, insured, and reputable platform will make their foray into the markets as simple and seamless as possible.

Bitcoin Market Data

At the time of press 1:18 am UTC on Apr. 6, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.27% over the past 24 hours. Bitcoin has a market capitalization of $170.44 billion with a 24-hour trading volume of $29.23 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:18 am UTC on Apr. 6, 2020, the total crypto market is valued at at $257.36 billion with a 24-hour volume of $112.35 billion. Bitcoin dominance is currently at 66.23%. Learn more about the crypto market ›