Analysts: Cryptocurrency Interest Remains High, Exchange Revenues are Evidence

Analysts: Cryptocurrency Interest Remains High, Exchange Revenues are Evidence Analysts: Cryptocurrency Interest Remains High, Exchange Revenues are Evidence

Photo by Benjamin Voros on Unsplash

Despite falling prices of cryptocurrencies like Bitcoin and Ether, a few market analysts believe 2018’s extended bear market is a mere price correction, and so-called Bitcoin “obituary” reports are “greatly exaggerated.”

Exchange Fees Indicate Market Interest

According to a report on Bloomberg, Sanford C. Bernstein & Co. analysts pointed out the massive revenues of cryptocurrency exchanges in 2018 – comparing it to the faulty public sentiment of cryptocurrencies losing their sheen.

The analysts noted the $4 billion profits posted by prominent digital asset exchanges indicate a lively trading market – evidence by $1.8 billion in Bitcoin trading fees alone recorded by crypto-bourses.

Christian Bolu led the analyst report, estimating 8 percent of transactional fees equate to several billion for exchanges businesses. Also, only the traditional equity market surpassed such revenue figures.

“The Next Big Thing”

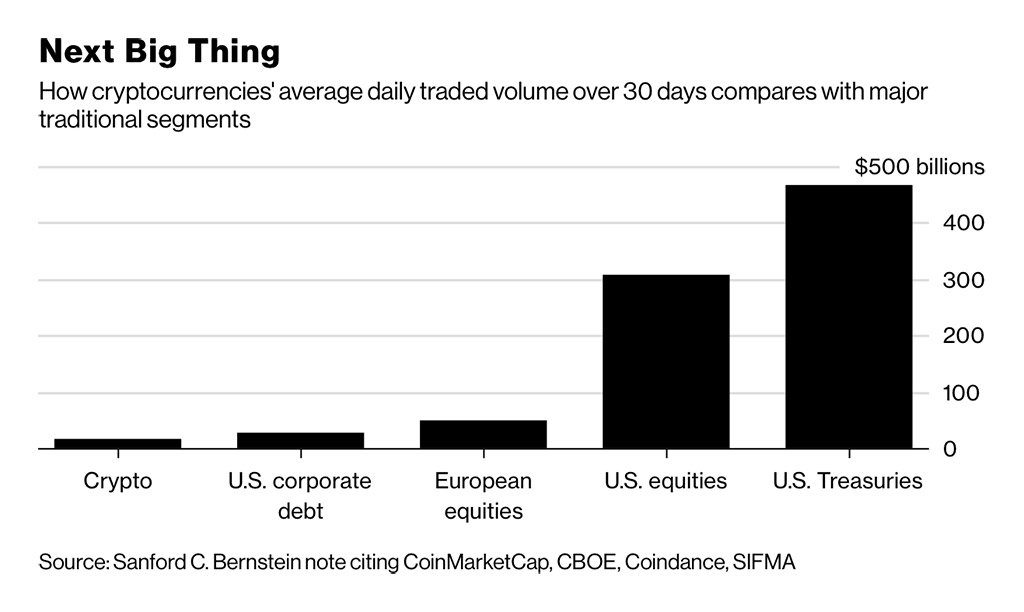

Meanwhile, infographic research displayed cryptocurrencies’ remain a drop in the ocean of traditional finance.

Daily traded volume for all digital assets is an average of $17 billion, against the U.S. equity markets’ $207 billion. To put this in perspective, the total market cap of all cryptocurrencies is a mere $219 billion – lesser than the daily traded volume of the European equity market.

The analysts wrote:

“As the crypto-asset class seasons and institutional demand builds, there are a plethora of opportunities for traditional firms, including custodians, asset management and market-making services”

As reported by CryptoSlate, Wall Street behemoths are all looking to get their share of the cryptocurrency pie – despite regulation pressure and the notorious volatility of the digital asset class.

While Goldman Sachs and Barclays have launched dedicated bitcoin trading desks for clients, other banks are exploring safekeeping services – intending to charge handsome fees in turn of protecting a client’s digital assets. The fees allows them to earn profits from the cryptocurrency market with zero exposure.

Berstein pointed out San Francisco-based Coinbase may end up with an “unassailable competitive position” unless competition from traditional markets increases. The report estimated Coinbase to hold over 50 percent of Bitcoin’s transaction revenue pool. However, it added, that conventional players are unlikely to enter the market any time soon due to the lack of regulations.

Bitcoin Market Data

At the time of press 2:54 am UTC on Nov. 7, 2019, Bitcoin is ranked #1 by market cap and the price is down 2.52% over the past 24 hours. Bitcoin has a market capitalization of $109.81 billion with a 24-hour trading volume of $3.65 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:54 am UTC on Nov. 7, 2019, the total crypto market is valued at at $210.61 billion with a 24-hour volume of $12.5 billion. Bitcoin dominance is currently at 52.10%. Learn more about the crypto market ›