Shadowy marketplace Huione launches USDH stablecoin to evade scrutiny

Shadowy marketplace Huione launches USDH stablecoin to evade scrutiny Shadowy marketplace Huione launches USDH stablecoin to evade scrutiny

Huione's USDH stablecoin eludes traditional controls, raising compliance concerns amid its decentralized features.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Blockchain security firm Elliptic reported that Huione—an online marketplace platform used for illicit activities—has launched USDH, a dollar-pegged stablecoin.

According to Elliptic, Huione touts USDH as a solution for users seeking to bypass the restrictions imposed by traditional stablecoins like USDT and USD Coin (USDC). The asset was launched in September 2024.

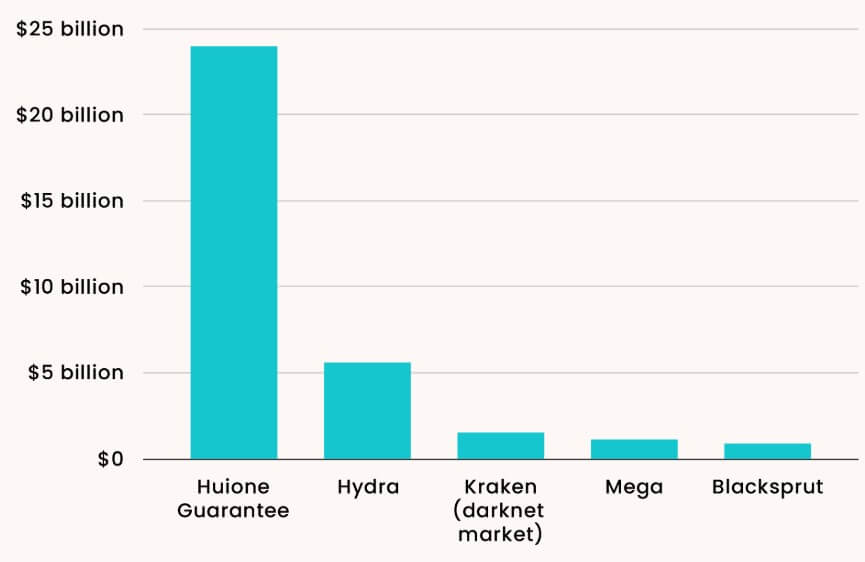

Huione is the largest illicit online marketplace, with transactions exceeding $24 billion. In 2024 alone, it recorded nearly $10 billion in transactions.

USDH

Unlike Tether’s USDT and Circle’s USDC, USDH is not subject to freezing or transfer limitations enforced by issuers. This lack of regulatory oversight makes USDH particularly appealing to bad actors.

Notably, both Tether and Circle have previously taken action against wallets linked to illegal activities. For instance, Tether has frozen wallets associated with stolen funds from North Korea’s Lazarus Group, while Circle also has disabled wallets holding USDC from various crypto hacks.

While Huione continues to support USDT payments, it promotes USDH as a safer alternative. The stablecoin is available on Ethereum, BSC, Tron, and Huione’s proprietary Xone chain.

To broaden its offerings, Huione has introduced a crypto wallet and a decentralized exchange (DEX), and it previously attempted an initial coin offering (ICO) for its HC token. These initiatives aim to boost USDH’s accessibility.

Expansion efforts

Beyond USD, Huione is also diversifying its offerings despite mounting scrutiny. It recently introduced ChatMe, a messaging app designed to mimic Telegram.

ChatMe allows users to create group chats and bots, key tools for Huione’s marketplace operations. Integrated with the Huione Chain, the app supports payments and other blockchain-based features.

In addition, Huione unveiled its first dedicated crypto exchange, Huione Crypto, in September 2024. This platform enables users to trade USDH alongside cryptocurrencies like Bitcoin, ETH, TRX, Solana, and Dogecoin.

Based in Poland, the exchange targets European users and offers language support for the Chinese market.

Huione’s latest developments signal its intent to expand its influence in the crypto space, even as it faces ongoing scrutiny for its controversial activities.

Elon Musk

Elon Musk

USDT

USDT