Why an analyst is proposing Ethereum’s inflation should drop to match that of Bitcoin

Why an analyst is proposing Ethereum’s inflation should drop to match that of Bitcoin Why an analyst is proposing Ethereum’s inflation should drop to match that of Bitcoin

Photo by Anas Mulia on Unsplash

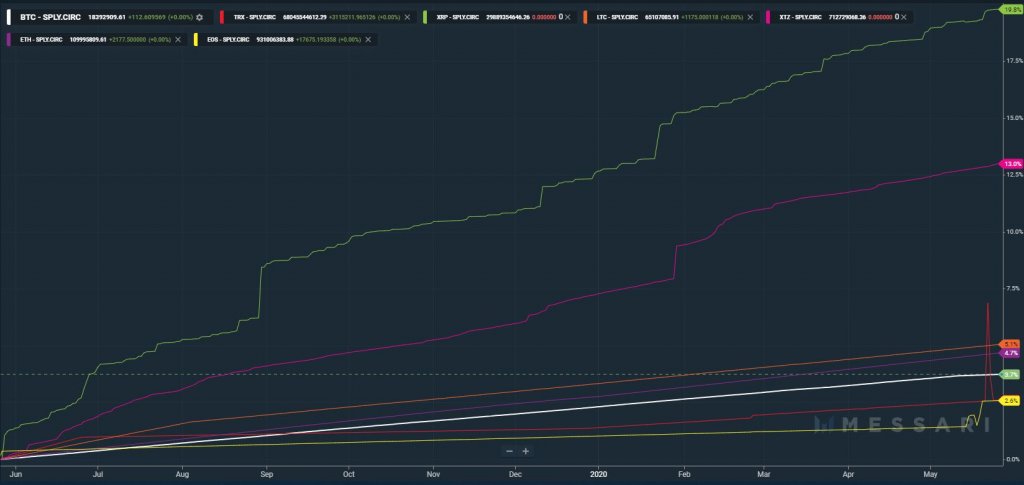

Unlike Bitcoin, whose inflation rate is now below the target rate of most Western fiat currencies, Ethereum is not that scarce of an asset or form of money. As reported by CryptoSlate previously, the second-largest cryptocurrency’s supply grew 4.7 percent over the past 12 months.

This is not as high as the 12-month growth of XRP’s supply at 20 percent, or XTZ’s at 13 percent, but it’s far from low.

Some say that ETH’s inflation makes it unattractive as an asset to hold. Cryptocurrency entrepreneur Marc van der Chijs, who founded Canadian Bitcoin mining firm Hut 8, said in 2017:

“ETH is not suitable for investment because of inflation. People tend to forget that.”

Notably, this comment was made when the inflation rate of Ethereum was much higher than it is today, but the point still stands: if an excess supply of an asset enters a market, it should underperform.

Hence, cryptocurrency analyst Morgan Bennett recently suggested that the Ethereum community should agree to decrease block rewards, thus resulting in a reduction in ETH inflation.

Ethereum should decrease block rewards, an analyst argues

On Jun. 3, Bennett released an over 20-part Twitter thread outlining the matter, saying that the benefits of decreasing ETH inflation “far outweigh the risks.”

0/ The @Ethereum community should consider lowering the block subsidy.

This would make $ETH much more attractive as an asset to buy and hold, most likely without compromising the security of #Ethereum.

I think the benefits *by far* outweigh the risks.

?Tweetstorm edition? pic.twitter.com/hdtYFqgfHd

— Mo (@MorganTBennett) June 3, 2020

Confirming the comment made by Marc van der Chijs, he argued that Ethereum has become a “weak base currency” due to its high rate of inflation.

“Despite numerous positive indicators, ETH has lost market share in the past two years. Ironically, a large chunk of that share has been lost to its own tokens,” he wrote, referencing how around 50 percent of the value on the entire Ethereum network is stored in ERC-20 tokens.

To fix this, Bennett proposed a block reward reduction to 0.8 ETH per block from two today, which would mean Ethereum’s inflation rate would match that of Bitcoin.

Yes, this would decrease the probability of users mining Ethereum, but he suggested that the drop in issuance should result in higher prices, allowing miners to continue their operations to keep the blockchain secure from attackers.

“Lower ETH issuance would immediately decrease sell pressure. And, unlike the periodic halvings for Bitcoin, this is not priced in. Together with EIP-1559, the issuance reduction can mitigate a design flaw of ETH1.x and become a powerful positive price driver.”

A topic of controversy amongst Bitcoin maximalists

Although Ethereum investors may embrace lower inflation as it should equate to higher prices, some prominent voices in the Bitcoin community have bashed the variability of ETH’s monetary policy.

As reported by CryptoSlate in March, Anthony Pompliano, co-founder and partner at crypto fund manager Morgan Creek Digital Assets, said that Ethereum is “no different than fiat currency.”

He made this comment in reference to ETH’s lack of fixed supply, inflationary supply schedule, and centralized decision-making group — hallmarks of a fiat currency, according to Pompliano.

Indeed, there is no cap on the amount of U.S. dollars in circulation, and the money-printers are politicians and central bankers that aren’t directly controlled by the public. As Pompliano explained further:

“[Ethereum’s structure is similar] to our current fiat monetary policies, where the decision makers can increase or decrease the production of new money coming into the system.”

Network engineer Melik Manukyan echoed this, writing that there are clear uncertainties in ETH’s monetary policy that threaten the “social scalability” of the network, thus increasing the risk of “network fragmentation and disagreements.”

Their argument is even though Ethereum could adopt an inflation rate dramatically lower than that of Bitcoin, that doesn’t make it better than BTC as an investment or as a form of money. In fact, they say that it could make ETH dangerous.