Prominent gold bull on why Ethereum breaking $300 will catalyze a 66% surge

Prominent gold bull on why Ethereum breaking $300 will catalyze a 66% surge Prominent gold bull on why Ethereum breaking $300 will catalyze a 66% surge

Photo by Olivier Russo on Unsplash

Bitcoin’s price action over the past few weeks has undoubtedly been impressive. But even more impressive is that of Ethereum. The second-largest digital asset is up 20 percent since the start of May. Over that same time frame, BTC is up a mere six percent.

While an already impressive move, analysts have begun to conclude that ETH is poised to capture more upside due to technical and fundamental factors.

Ethereum is primed to see an “explosive upmove”

Dan Tapiero — the CEO of DTAP Capital, a prominent gold bull, and the lead of an upcoming cryptocurrency fund — shared on Jun. 3 that Ethereum is “on [the verge] of explosive upmove.”

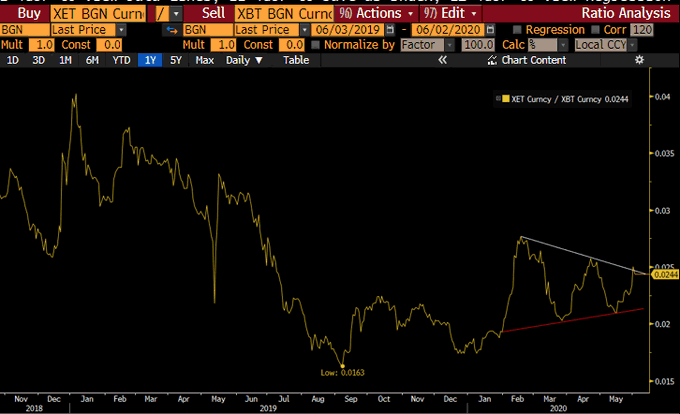

At the current price of $240, the cryptocurrency is about to break past a downtrend that constrained price action over the past year, from the 2019 highs to the 2020 highs. ETH moving through this crucial technical downtrend, then the $300 resistance level “projects [a move] to $500 minimum in the coming 6-12 months,” Tapiero remarked.

Ethereum rallying to $500 would mark a 66 percent rally from $300 and a doubling of current prices.

Chart of Ethereum on verge of explosive upmove.

Are there any upcoming potential catalysts?

Move up through 300 projects to 500 minimum in coming 6-12 months.

Any strong views out there? pic.twitter.com/xLV9wt5CVD

— Dan Tapiero (@DTAPCAP) June 4, 2020

Tapiero’s contemporary in macro analysis and friend, Raoul Pal, shared in the optimism.

Ethereum is poised to outperform Bitcoin, Pal said earlier this week in reference to the chart below, also showing that the asset recently surged past a resistance level:

“It even looks like Ether will outperform Bitcoin at some point (no position yet). Please remember: No tribal attacks about bitcoin vs ethereum. They are two different things and two different ecosystems.”

Fundamentals have never been this strong

Ethereum rallying upwards of 100 percent in the coming months may seem optimistic, but the fundamentals support the expectations of upside, analysts say.

As reported by CryptoSlate previously, Spencer Noon of DTC Capital shared that on-chain analytics should Ethereum as a blockchain network is growing at a rapid clip. He identified ten signs indicating such, some of which are as follows:

- The number of daily active ETH addresses has hit a two-year high — the highest value since the 2018 bull market.

- Ethereum miners are now collecting a vast amount of fees. Analysts found that ETH’s price is somewhat related to fees gathered, suggesting a rally is poised to happen.

- The value of stablecoins based on Ethereum has hit $7 billion, up more than 100 percent since the start of the year.

- Decentralized finance has seen a parabolic uptick in adoption.

- Ethereum applications are absorbing value at a rapid clip.

Furthermore, Ethereum 2.0 has continued to draw closer and closer. The blockchain upgrade is expected to skew the supply-demand dynamic of the ETH market in favor of price appreciation.

Ethereum Market Data

At the time of press 12:57 am UTC on Jun. 9, 2020, Ethereum is ranked #2 by market cap and the price is up 0.75% over the past 24 hours. Ethereum has a market capitalization of $27.39 billion with a 24-hour trading volume of $8.05 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 12:57 am UTC on Jun. 9, 2020, the total crypto market is valued at at $277.54 billion with a 24-hour volume of $71.81 billion. Bitcoin dominance is currently at 64.80%. Learn more about the crypto market ›