Ethereum vs. Binance Smart Chain: Who wins in a crypto DeFi battle?

Ethereum vs. Binance Smart Chain: Who wins in a crypto DeFi battle? Ethereum vs. Binance Smart Chain: Who wins in a crypto DeFi battle?

The decentralized finance market has reinvigorated the crypto space from a brutal three-year-bear slumber, with the market now moving towards real-world solutions such as non-custodial lending, loans, credit, and away from just acting as a proxy for digital payments. But where there is technology, there is competition. Ethereum’s laggard blockchain — which has attracted flak […]

The decentralized finance market has reinvigorated the crypto space from a brutal three-year-bear slumber, with the market now moving towards real-world solutions such as non-custodial lending, loans, credit, and away from just acting as a proxy for digital payments.

But where there is technology, there is competition. Ethereum’s laggard blockchain — which has attracted flak for being slow, unscalable in its current form, and encounters high fees during times of demand — has opened up the gates for competitors promising faster deployment, minimal fees, and an overall better blockchain for dApps.

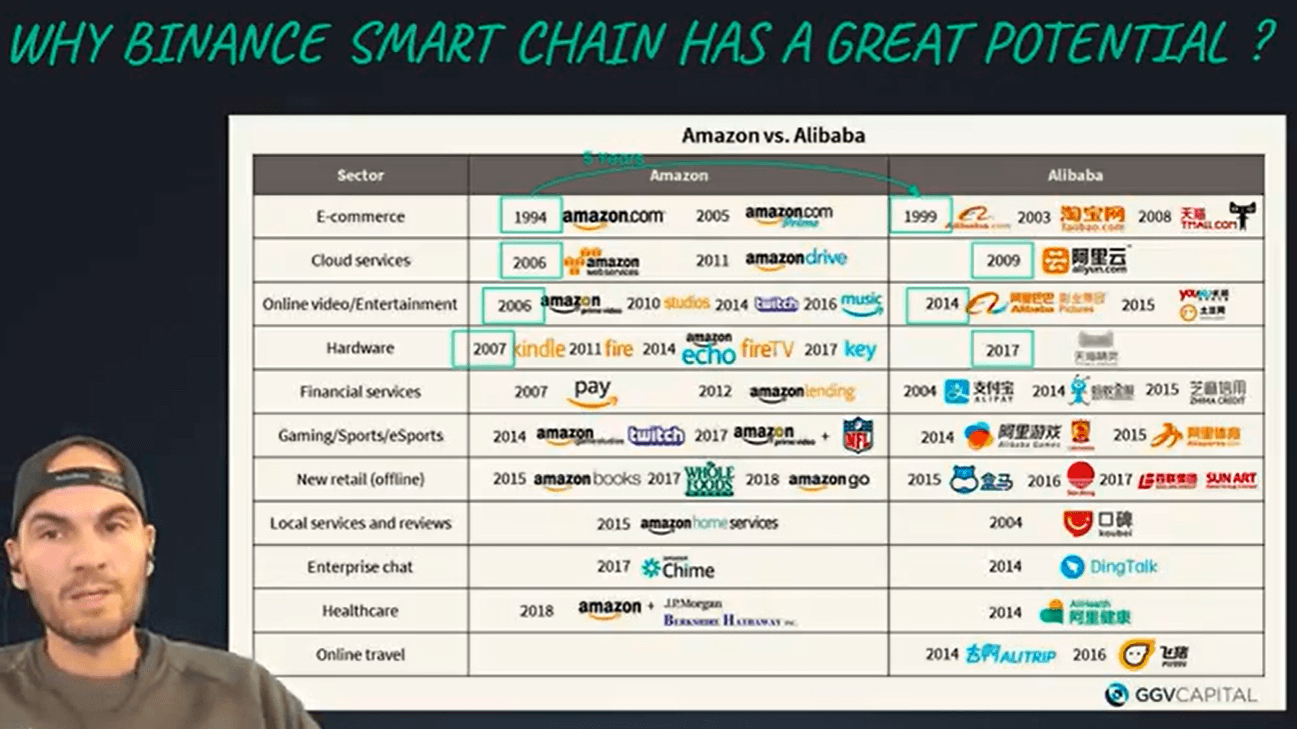

Binance Smart Chain (BSC) is one such blockchain alternative to Ethereum. Maintained and developed by the billion-dollar worth crypto exchange Binance, the blockchain offers a fast environment for developers to deploy dApps and charges only a few cents per transaction, as products like BakerySwap, PancakeSwap, and others have shown.

But does it triumph over Ethereum? Cryptonites host Alex Fazel caught up with SwissBorg co-founder Anthony Lesiosmier this week to discuss just that.

Image: Cryptonites

Lesiosmier, a veteran of the crypto markets and a former institutional equity trader, oversees operations and security across SwissBorg’s wealth management ecosystem and related services, such as earning yield on stablecoins and other cryptocurrencies from within the app!

Here’s what they discussed.

On the speed and scalability of Binance Smart Chain

Lesiosmier started out by analyzing the unique smart contract users on Ethereum and BSC, finding out that while the former boasts a figure of over 40 million, the latter’s 300,000 unique addresses (considering its launch five years after Ethereum) was a sign of quick growth and activity.

Fazel chimed in, noting:

“We know that the Ethereum blockchain already has $12 billion AUM, but we have 300 (unique) projects built on Ethereum, but already 30 projects built on the Binance Smart Chain.”

Interestingly, BSC was first built on an Ethereum client, noted Lesiosmier, making it possible to easily shift assets and services from Ethereum to BSC and thus increasing its appeal among both users and developers.

“They do not have to create a new community of developers. If you know how to code on Solidity, a development language, then you can do the same on the BSC,” said Lesiosmier.

He added:

“And I think that’s very smart because we’ve seen blockchains such as Avalanche, Polkadot and there are many examples in this space, but one of the biggest challenges of all these new blockchains is that while the “engine” of the blockchain itself is better than Ethereum, they don’t have the same community.”

Despite the benefits, BSC has faced flak for being a “centralized” blockchain, compromising that aspect for offering better speed and scalability for users. But Lesiosmier noted the security of Ethereum made Binance’s move worthwhile — especially as the former has seen zero smart contract failures while handling billions of dollars worth of assets.

Yield farming (and risk management)

The duo then dove into the yield farming sub-sector, which had its five mins of fame in July-August but since fizzled out. For the uninitiated, this sees users lock up capital on Ethereum-based projects that is then lent out to other users on interest, with the stakers, in turn, receiving a part of the interest rates.

To illustrate, Lesiosmier set up a farm on BSC-based project PancakeSwap and showed the earnings trickling to his balance on-screen in real-time. The cost? A few cents. (Compared to a few dollars or even hundreds of dollars on Ethereum based on network demand.)

The SwissBorg CSO even explained how multiple farms, such as Cream Finance and others, can actually be used to deposit BNB, earn interest on that, and simultaneously burrow from Cream to farm “riskier” pools. This serves as much-needed risk management and allows users to diversify their funds.

In the end, (warning: spoilers ahead), Lesiosmier suggested that while the Ethereum developers are pioneering newer products and leading in innovative tools for users, they must look to develop things on BSC, for the various reasons listed above instead of shunning the protocol entirely.

(The above is part of an insightful 54-minute Cryptonites interview available for streaming in full below. It has been edited for clarity and brevity.)

CoinGlass

CoinGlass