Research: Is ETHBTC about to reclaim its pre-merge high?

Research: Is ETHBTC about to reclaim its pre-merge high? Research: Is ETHBTC about to reclaim its pre-merge high?

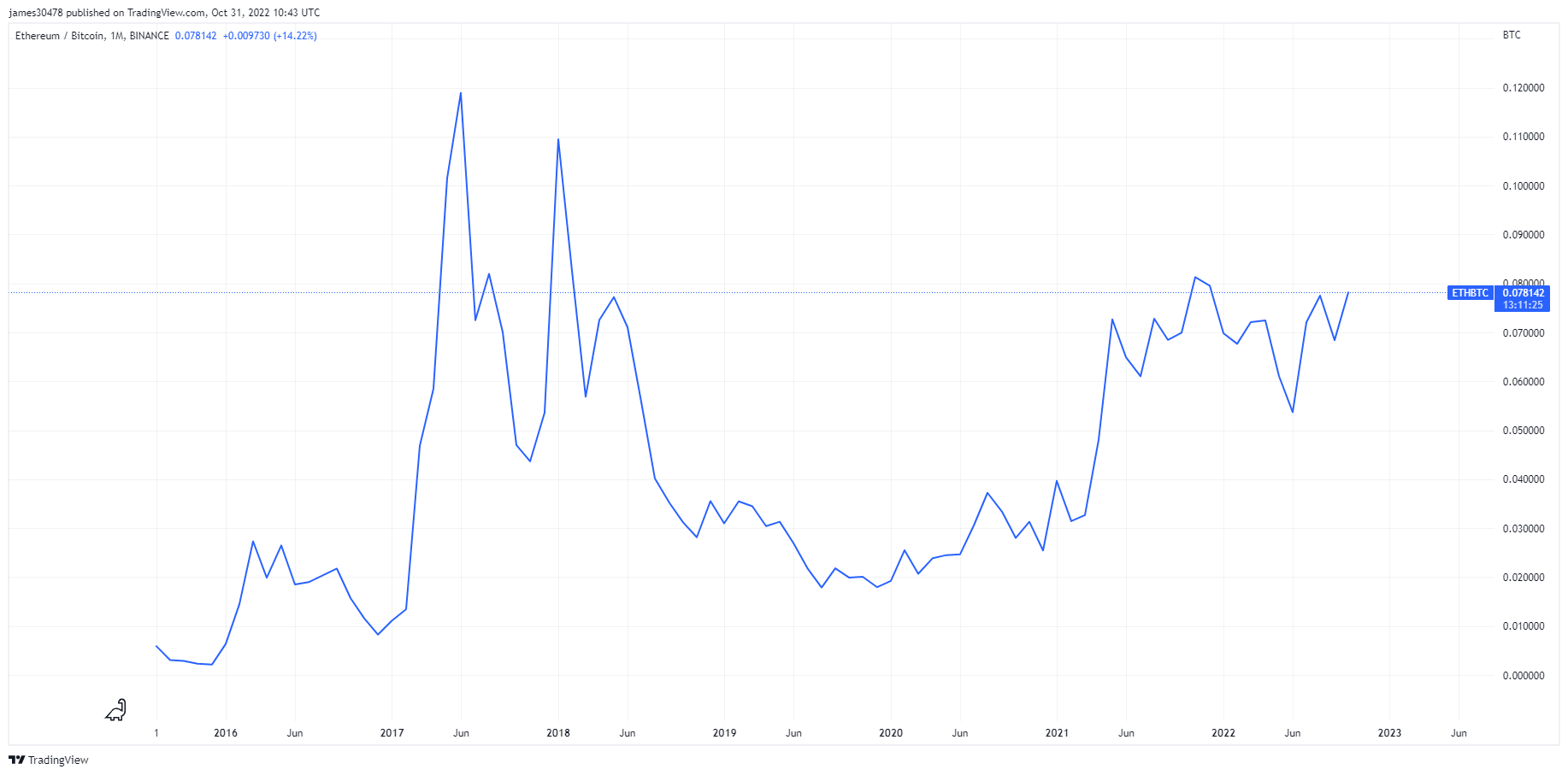

Ethereum is again gaining pace on Bitcoin as it retests the key resistance of 0.075BTC. Can it regain its previous high?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The 2022 high for Ethereum denominated in Bitcoin was 0.084BTC just before The Merge, and a recent rally has investors considering if Ethereum could regain its pre-merge high.

Ethereum made strong gains against Bitcoin ahead of The Merge on Sept. 15. However, the second-largest cryptocurrency by market cap failed to reach the all-time high set back in 2017.

Ethereum reached 0.12BTC around June 2017 and 0.1BTC in 2018. Since then, Ethereum has struggled to stay above the key resistance of 0.075BTC, according to CryptoSlate’s analysis of Glassnode data.

Ethereum dropped as low as 0.018BTC during the bear market of 2019. Yet, this cycle Ethereum has performed far better, retesting the 0.075BTC resistance in November 2021 and again following The Merge in September.

Following a retracement at the start of October, Ethereum is once again gaining pace on Bitcoin — currently sitting around the 0.075BTC mark.

There are several possible catalysts for Ethereum’s resurgence against Bitcoin. While there has been limited innovation in the core technology behind Bitcoin, Ethereum has seen a major overhaul of its network.

Ethereum experienced its first deflationary month following The Merge as supply declined for the first time in its history. At its current trajectory, the total supply of Ethereum will decrease by 0.07% over the next 365 days. A reduction in total supply is often viewed as a bullish indicator of future price action.

Several factors could alter Ethereum’s projected supply growth, such as the amount of ETH locked into staking and the amount of ETH burned from network transactions. Data related to the supply and burn of Ethereum can be found on ultrasound.money.

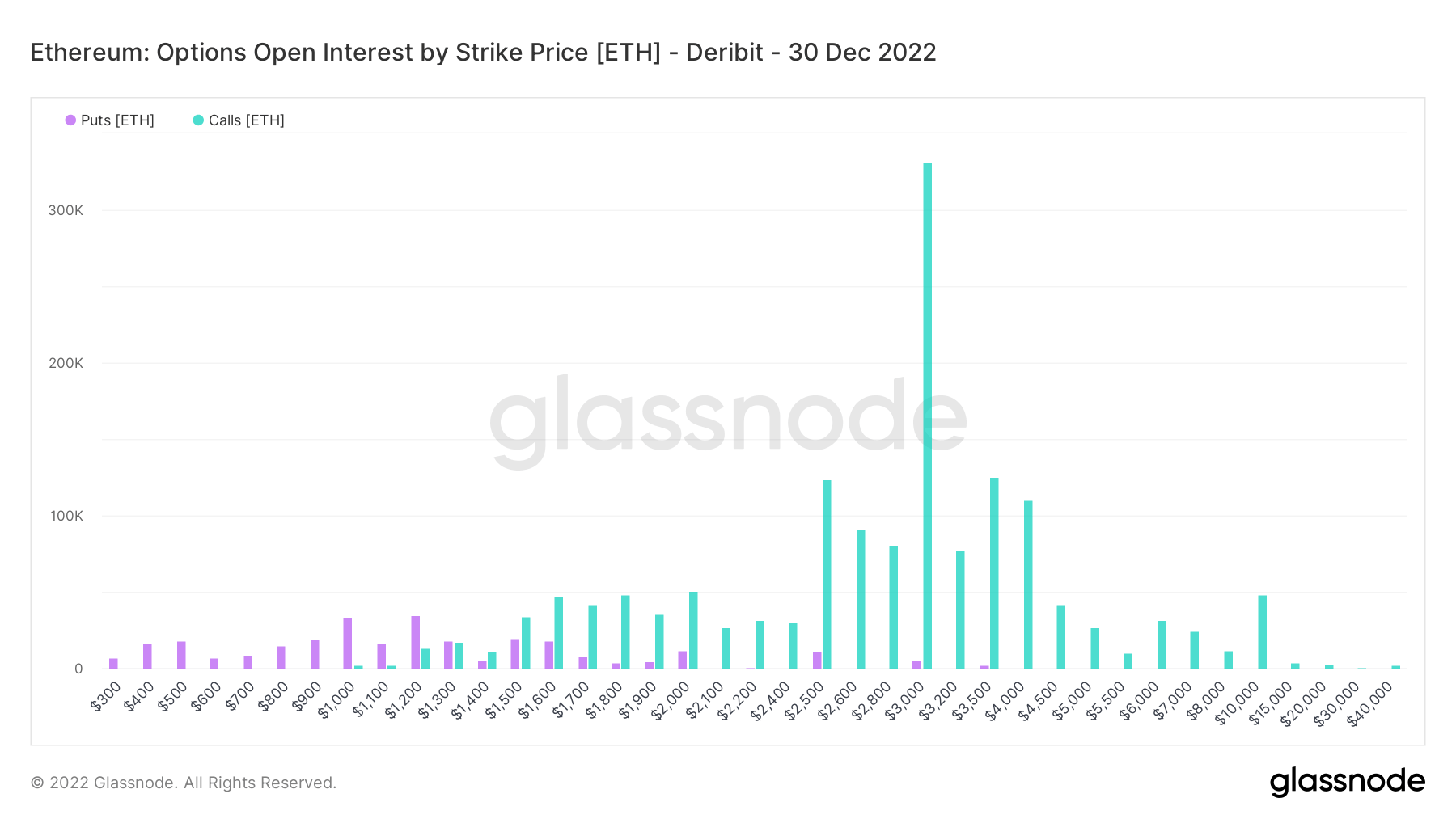

Further bullish outlook for Ethereum during the fourth quarter is further supported by reviewing options open interest. There is an overwhelming number of calls for $3,000 on derivatives exchange Deribit expiring on Dec, 30.