BlackRock now top 15 public Bitcoin holder as marketing kicks off

BlackRock now top 15 public Bitcoin holder as marketing kicks off BlackRock now top 15 public Bitcoin holder as marketing kicks off

As BlackRock's ETF snatches Bitcoin, competition heats up in the digital asset market.

Quick Take

Two days into the trading of the Bitcoin spot ETF, BlackRock, the world’s largest asset manager, has already accumulated approximately 11,500 BTC. This places the firm among the top 15 public holders of Bitcoin, accounting for roughly 0.056% of the total Bitcoin supply, according to Newhedge. This swift accumulation suggests a significant commitment from BlackRock towards the digital asset market, further underscoring the growing mainstream acceptance of digital assets.

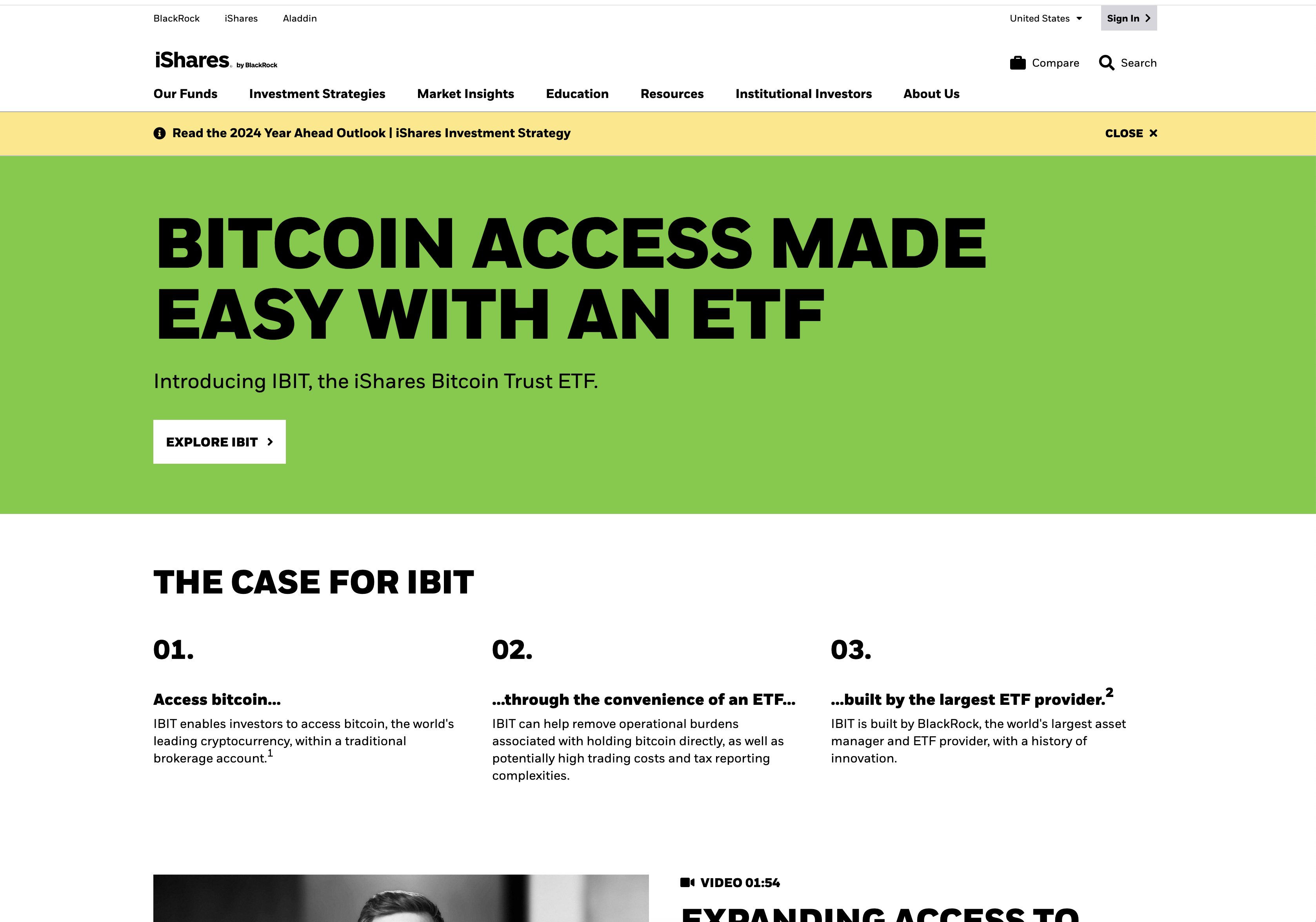

In tandem, the marketing strategies adopted by ETF issuers indicate a brewing competitive landscape. A clear example is the promotional material for its IBIT ETF circulated by BlackRock. The firm is leveraging aesthetic and linguistic strategies to appeal to a broad audience. The light color scheme, coupled with phrases like “Bitcoin access made easy with an ETF,” reflects an attempt to demystify Bitcoin investment and cater to a new age of investors.

This is further substantiated by BlackRock’s video advertisement, which senior Bloomberg ETF analyst Eric Balchunas describes as featuring soft new-age music and a suited yet tie-less spokesperson.

As the Bitcoin spot ETF market evolves, these marketing efforts are predicted to intensify, presenting a novel facet of competition in the digital asset industry.