Bitcoin drop triggers over $100M in crypto market liquidations in the past 24 hours

Bitcoin drop triggers over $100M in crypto market liquidations in the past 24 hours Quick Take

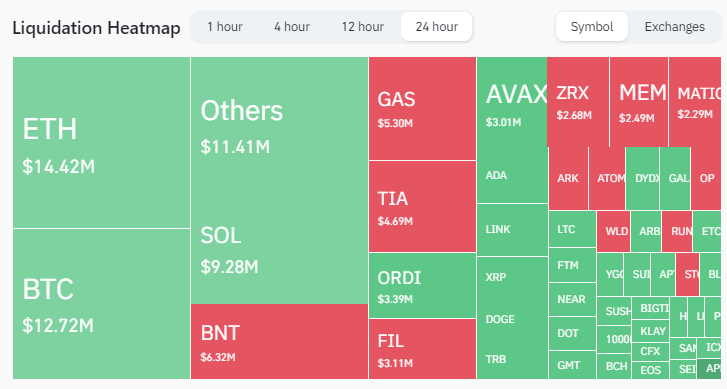

The recent drop in Bitcoin, breaking below the $37,000 level, has resulted in a wave of liquidations across the crypto market, surpassing $100M. Among the major digital assets, Ethereum faced a significant hit with $15M in liquidations, while Bitcoin followed closely with $13M, primarily due to long positions liquidated.

Market leader in crypto exchanges, Binance, bore the brunt of these liquidations, accounting for over half of the total amount, approximately $50M. This indicates the high volatility inherent in the market and the risks associated with leveraged positions.

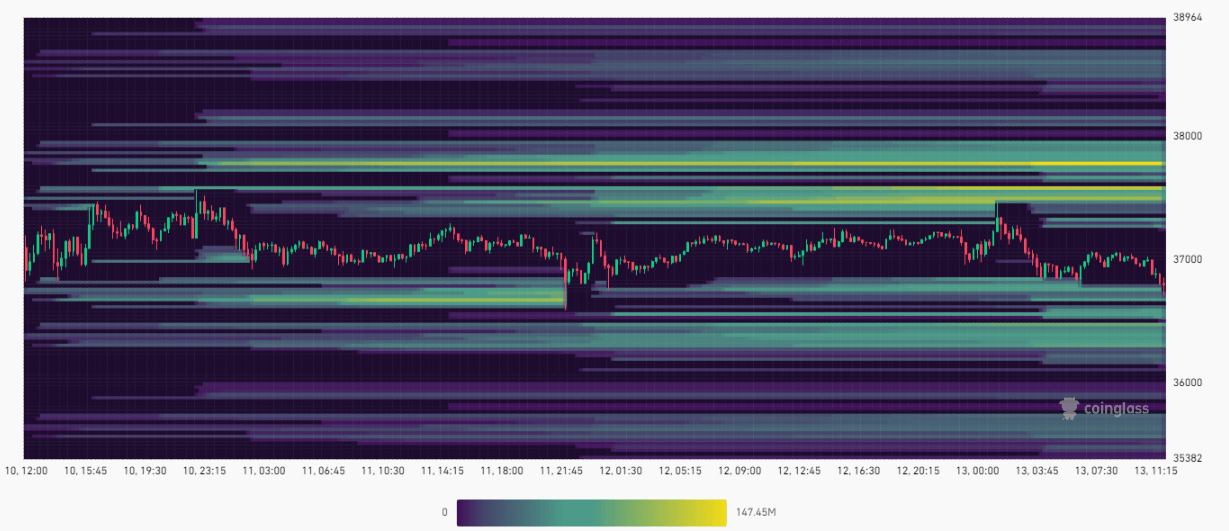

Significantly, a large amount of leverage is currently clustered in the $36,000 to $37,000 range. This concentration suggests that further price fluctuations within this band could trigger additional significant liquidations, adding to market volatility.