SEC Chair Gary Gensler to testify before Congress twice this September Jacob Oliver · 11 months ago · 2 min read

SEC Chair Gary Gensler to testify before Congress twice this September Jacob Oliver · 11 months ago · 2 min read SEC Chair Gary Gensler to testify before Congress twice this September

The SEC chair has been called back to the Hill after a summer packed with unprecedented enforcement actions against actors in the crypto industry.

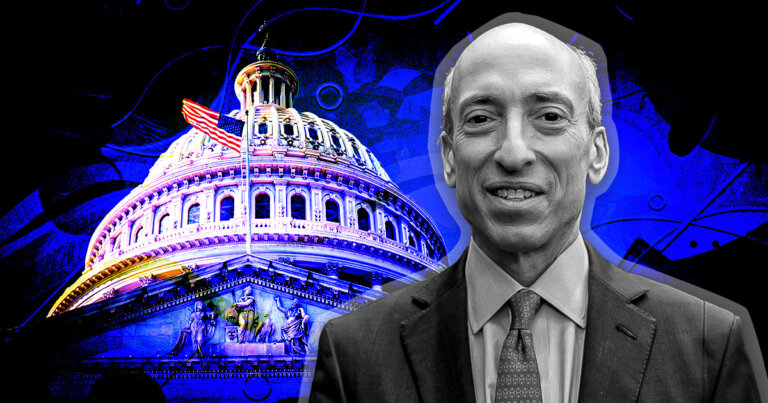

Gary Gensler, chair of the SEC / SEC.gov. Public Domain.

Securities and Exchange Commission (SEC) Chairman Gary Gensler is poised to testify before Congress twice this September — once before the Senate Banking Committee on September 12th and later the House Financial Services Committee on September 27th — according to reporting by Fox Business correspondent Eleanor Terrett.

These scheduled appearances follow a series of criticisms and accusations at Gensler from lawmakers, particularly Republicans. Rep. Patrick McHenry, ranking member of the House Financial Services Committee, has criticized Gensler’s approach to digital asset regulation as overly aggressive, especially given the lack of explicit cryptocurrency guidelines indicating which digital assets fall under SEC’s jurisdiction. McHenry and others have expressed concern over the nature of the SEC’s regulatory approach, which they argue prioritizes enforcement over explicit guideline provision.

Hot seat

Gensler has been under fire for his comments about firms needing to register with the SEC. The House Committee on Financial Services asserted that Gensler’s push for registration is a “willful misrepresentation” of the non-existent registration process, thereby contributing to the escalating debate on the need for clear regulatory guidelines for digital assets in the United States.

However, Gensler has maintained his stance, arguing that most cryptocurrencies are securities and should be regulated as such. In his previous testimony before the House Financial Services Committee, Gensler accused crypto firms of noncompliance with existing securities laws and highlighted the need for these entities to register with the SEC.

Meanwhile, the regulatory approval of Prometheum Ember Capital LLC as a distinct broker-dealer for digital assets has attracted criticism and prompted demands for transparency. Prometheum’s approval, which came shortly after a joint hearing on digital assets, has been viewed by some as an attempt to demonstrate the adequacy of existing regulations for the digital assets sector. Despite this, its connections with Chinese entities and differing views on regulation have sparked concerns and calls for further scrutiny by lawmakers.

Mentioned in this article

Jacob Oliver

Former Editor at CryptoSlateJacob Oliver is a recovering academic and English teacher turned crypto journalist and web3 writer. He holds a Ph.D. from the University of Washington.

News Desk

Editor at CryptoSlateCryptoSlate is a comprehensive and contextualized source for crypto news, insights, and data. Focusing on Bitcoin, macro, DeFi and AI.

Latest Alpha Market Report

Latest Press Releases

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

In this article

Gary Gensler is an American government official and former investment banker who President Joseph Biden nominated to chair the U.S.

Patrick McHenry is an American politician who has been serving as the U.S.