Data shows the community of Chainlink “marines” is growing exponentially

Data shows the community of Chainlink “marines” is growing exponentially Data shows the community of Chainlink “marines” is growing exponentially

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Chainlink stole the cryptocurrency market spotlight after the wild price action it has gone through so far this year.

The decentralized oracle token surged nearly 200 percent since the beginning of 2020 to hit a new all-time high of $5 in early-March. But, as the global financial meltdown unraveled, LINK’s price plummeted to $1.5, which did not stop retail investors from trying to accumulate this altcoin.

Indeed, demand for Chainlink continued trending up allowing its price to recover most of the losses incurred during Black Thursday.

LINK’s ability to rebound sharply after steep declines could be related to the declining supply of tokens held across multiple crypto exchanges, according to Santiment.

Retail investors rush to accumulate LINK

The behavior analytics firm argued that Market participants appear to be buying this altcoin and withdrawing it from trading platforms into their own wallets. An increase in the number of tokens held out of exchanges alleviates a lot of the selling pressure behind Chainlink, subsequently, minimizing its downside potential.

Not only that, retail investors appear to be rushing to buy what the whales are selling. As a matter of fact, Santiment reported that addresses with balances of 100,000 to 1,000,000 LINK have been decreasing significantly over the last couple of months.

Meanwhile, there has been a “strong growth” in the number of addresses with balances of 100 to 10,000 LINK. This group of holders grew by 50 percent over the past six months rising from over 32,000 addresses to nearly 48,000 addresses.

These on-chain metrics reveal that demand for the decentralized oracle token continues rising despite the state of commotion in the global economies. If the trend continues, LINK could be poised for a further upward advance.

A promising future

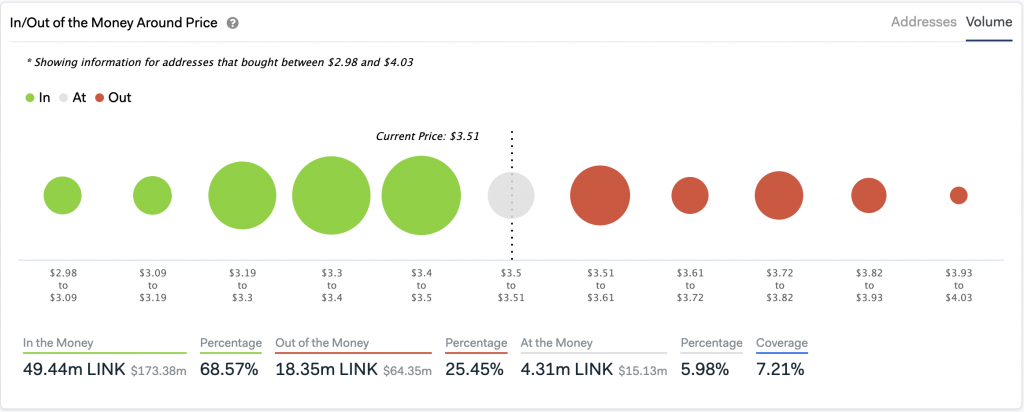

IntoTheBlock’s “In/Out of the Money Around Price” model estimates that the so-called “Chainlink marines” may face strong resistance around $3.6 where roughly 2,500 addresses bought more than 8.3 million LINK.

Breaking above this significant supply wall could send Chainlink to higher highs since there is not any major resistance level ahead of it.

Given the current levels of uncertainty in the markets, Santiment suggests that investors should pay close attention to what the top non-exchange holders are doing. A drop in the amount of tokens they hold, usually translates into a slump in price.

Chainlink Market Data

At the time of press 11:08 am UTC on Apr. 21, 2020, Chainlink is ranked #11 by market cap and the price is down 6.11% over the past 24 hours. Chainlink has a market capitalization of $1.22 billion with a 24-hour trading volume of $494.82 million. Learn more about Chainlink ›

Crypto Market Summary

At the time of press 11:08 am UTC on Apr. 21, 2020, the total crypto market is valued at at $197.4 billion with a 24-hour volume of $142.83 billion. Bitcoin dominance is currently at 63.63%. Learn more about the crypto market ›