Chainlink nears critical support as data shows long-term “hodlers” may be jumping ship

Chainlink nears critical support as data shows long-term “hodlers” may be jumping ship Chainlink nears critical support as data shows long-term “hodlers” may be jumping ship

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Chainlink (LINK) shocked cryptocurrency investors throughout 2019 and the early part of 2020, with the crypto incurring an unwavering uptrend that allowed it to post multiple parabolic cycles, rarely showing any signs of technical or fundamental weakness.

The 2020 crypto market selloff, however, seems to have done some significant damage to its market structure, with one prominent analyst explaining that it is currently approaching a critical support level that is its last line of defense against a massive selloff.

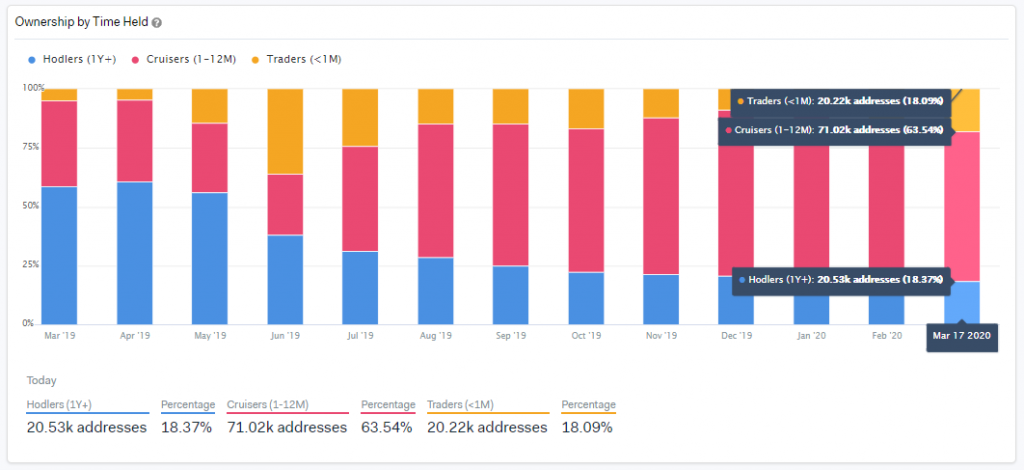

This comes as the percentage of long-term holders of LINK shows a steady decline, while the number of mid-term investors continues growing at a rapid pace.

Chainlink sees brutal selloff; breaks multiple key support regions

At the time of writing, Chainlink is trading down roughly two percent at its current price of $2.27, which marks a slight decline from daily highs of just over $2.30 – around where it has found resistance over the past few weeks.

In the near-term, LINK has been able to establish some strong support around $2.00, which has been ardently defended by bulls over the past week.

While looking towards Chainlink’s BTC trading pair, it has smashed below all but one of the key support levels that had been established throughout the first seven weeks of 2020.

This final support exists at roughly 0.000318, which is just slightly below its current BTC price of 0.000338.

Teddy – a popular crypto analyst – spoke about this key support in a recent tweet, explaining that a bullish reaction there could help catalyze some momentum for the crypto, but also that a break below could be dire.

“Chainlink: Support (1) Brutally broken. Support (2) Brutally broken, and rejected upon retest. Support (3) On its way. If we get a good reaction, will build position there.”

Are LINK’s long-term investors beginning to jump ship?

Recent data from IntoTheBlock elucidates an interesting trend when it comes to Chainlink’s investor base, with the percentage of long-term holders declining as the percentage of mid-term investors begins growing.

“LINK currently has 111.8k addresses with a balance in LINK. Of those addresses with a balance: – 18.37% or 20.5k addresses are holding +1y with 672m LINK – 63.5% or 71.02k addresses are holding between 1-12M with 179.9m LINK – 18% or 20.22k addresses hold <1M with 44m LINK.”

The above chart shows this steady decline (in percentage terms) of long-term holders. This either means that the number is holding steady and that there is a significant influx of mid-term investors flooding into LINK, or that its hodlers are beginning to jump ship.

Either way, its technical weakness, and the ongoing downtrend will likely continue to shift these figures, with a continued decline in the number of long-term investors potentially being a bearish signal.

Chainlink Market Data

At the time of press 8:22 am UTC on Mar. 26, 2020, Chainlink is ranked #14 by market cap and the price is down 0.44% over the past 24 hours. Chainlink has a market capitalization of $793.64 million with a 24-hour trading volume of $244.49 million. Learn more about Chainlink ›

Crypto Market Summary

At the time of press 8:22 am UTC on Mar. 26, 2020, the total crypto market is valued at at $183.7 billion with a 24-hour volume of $129.36 billion. Bitcoin dominance is currently at 65.88%. Learn more about the crypto market ›