Bitcoin remains in firm bear trend until it reclaims $8,000 — here’s why

Bitcoin remains in firm bear trend until it reclaims $8,000 — here’s why Bitcoin remains in firm bear trend until it reclaims $8,000 — here’s why

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has continued to face heightened volatility in the time following yesterday’s sell-off that sent it as low as $6,500, as its price was able to climb nearly $1,000 after tapping this level, signaling that this may be a massive near-term support region for the embattled cryptocurrency.

Analysts are now noting that they believe BTC is still caught in a firm bear trend in spite of the overnight surge from $6,500, and it may not be able to firmly shift this trend until it decisively moves above $8,000.

Bitcoin Stabilizes Above $7,000 as Bulls Fight Back

At the time of writing, Bitcoin is trading up 3 percent at its current price of $7,150, which marks a notable climb from its intra-day lows of $6,500 that were set during the capitulatory sell-off that was experienced yesterday evening.

Bitcoin’s drop to $6,500 marks an extension of the downwards momentum that was first incurred when it failed to find any stability over $10,000 in late-October, and its inability to post any sustainable bounce in the time following the start of its on-going downtrend is a bearish sign.

In the near-term, it appears that Bitcoin’s current position within the lower-$7,000 region is a critical support level, with Mayne, a popular cryptocurrency analyst on Twitter, telling his followers that he is currently watching for a move down towards $6,000, with a dip below this level potentially leading it to $5,400.

“$BTC: On the weekly, we’re at support here. A lot of confluent levels for me, especially $66xx (EQ of weekly block) at the $6k floor. Waiting to see if we form some H4 bullish structure here. If this area fails, I’m watching $5400. That’d be a 79% pullback off the parabola top,” he noted while pointing to the levels marked on the below chart.

Analyst: BTC Bear Market Strong Until Decisive Close Above $8,000

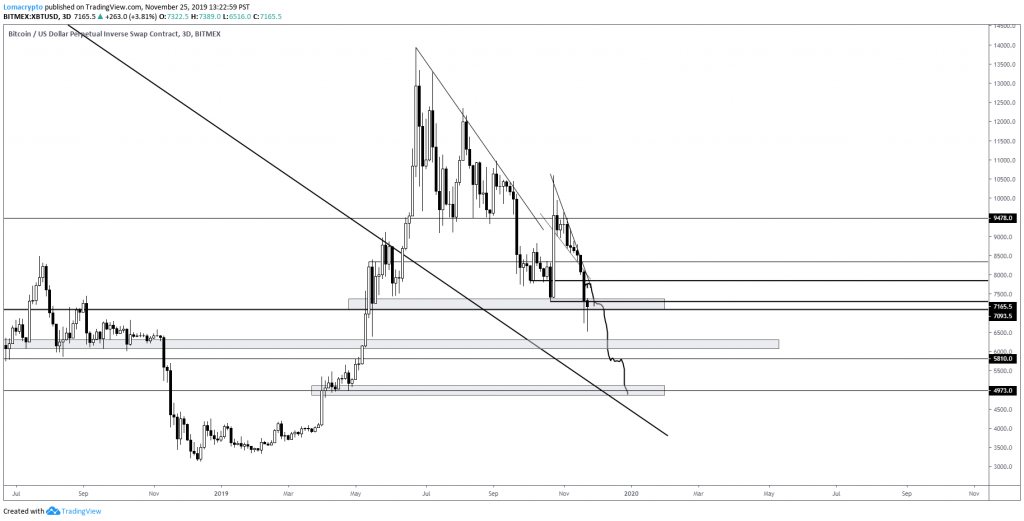

It does seem that the general consensus surrounding Bitcoin amongst analysts is that it is primed to see further losses in the near-term, as Loma — another popular cryptocurrency analyst on Twitter — echoed Mayne’s sentiment in a recent tweet, saying that BTC remains in the firm control of bears until it breaks above $8,000.

“$BTC: Bulls want that to be the end of the dump. That targeted $6,000 – $6,300 support got front-ran and now we make new highs. Bears want this to be a liquidity trap. $7,400 – $7,600 bearish retest and fall over. Won’t fight the bear trend until we reclaim ~$8,00 convincingly,” Loma explained.

Despite the bearish sentiment bearing over the crypto markets, bulls could still step up and propel the crypto significant higher at any moment — but only time will tell as to when, and at what price, this will happen.

Bitcoin Market Data

At the time of press 3:35 am UTC on Nov. 26, 2019, Bitcoin is ranked #1 by market cap and the price is up 5.47% over the past 24 hours. Bitcoin has a market capitalization of $129.6 billion with a 24-hour trading volume of $30.5 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:35 am UTC on Nov. 26, 2019, the total crypto market is valued at at $195.45 billion with a 24-hour volume of $96.34 billion. Bitcoin dominance is currently at 66.27%. Learn more about the crypto market ›