Bitcoin mining reaches its largest difficulty ever, here’s what it means

Bitcoin mining reaches its largest difficulty ever, here’s what it means Bitcoin mining reaches its largest difficulty ever, here’s what it means

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Miners on the Bitcoin network are facing the highest difficulty they ever have to generate new blocks, data shows.

Network difficulty has surged to an all-time high amidst massive interest in the crypto space. However, it also means retail miners, hobbyists, and small-scale firms have to concede hashpower to the larger mining corporations, at least until the next adjustment when difficulty pares down.

Bitcoin difficulty shoots up

Data from on-chain analytics firm Glassnode shows the difficulty of mining a single Bitcoin block ramped up by over 3.6% today, a new all-time high (ATH) for the Bitcoin network. The jump was not the biggest, however, but it brings the network to a record high of 17.56 trillion (T). The previous high was in July this year.

#Bitcoin mining difficulty increased by 3.6% and is at an all-time high.

Chart: https://t.co/unDzaUVC17 pic.twitter.com/A00CuQvOJH

— glassnode (@glassnode) August 24, 2020

Mining difficulty is adjusted every two weeks, and can either surge upwards or pare back down. This is because of Bitcoin’s inherent structure, that keeps miners in check by checking the speed of block generation, i.e. if they are being miner too fast or too slow.

Upward adjustments mean a proportional increase in the network’s hashing power — or the amount of available power on the Bitcoin network.

On August 15 this year, Bitcoin’s network hash rate crossed its earlier record high of 136 exahashes per second (EH/s). It then tumbled down in the week after — apparently due to floods in China’s Sichuan province, a region known to house Bitcoin miners and reportedly over 60% of the network’s total hashing power.

But high hash rates don’t necessarily mean well for all participants in the mining industry. High values mean more sophisticated machines conquer the network to provide the computing resources required to keep Bitcoin running.

But for those with smaller setups, it’s a money-losing effort considering the massive electricity requirements and cooling costs.

Hashing difficulty to set a new high next?

BTC.com data predicts the next difficulty adjustment, set for September 7, will bring about yet another increase with the figure marked at over 3.5%. When that happens, it will make the new ATM for Bitcoin’s network difficulty and send it past 18T.

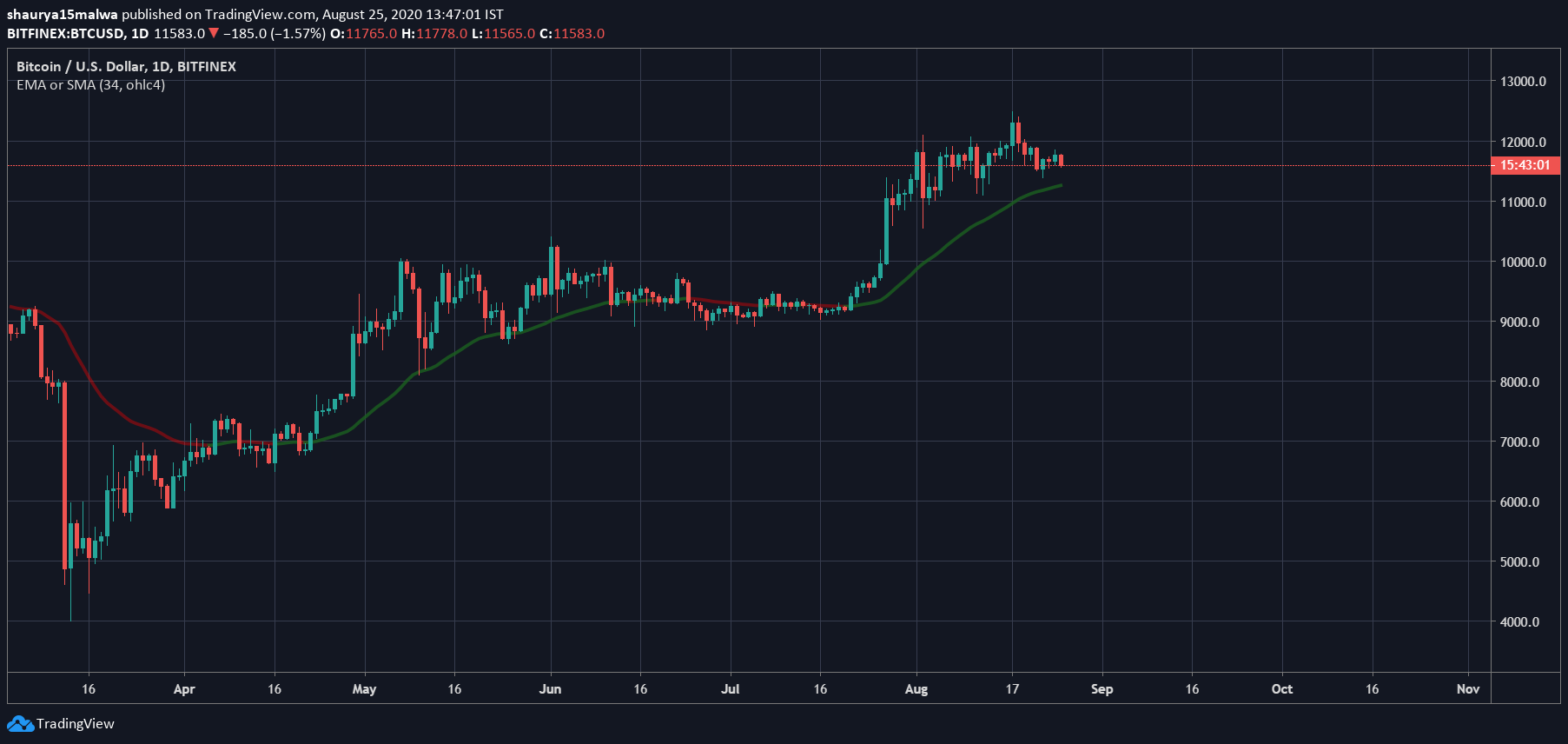

Meanwhile, Bitcoin prices are increasing despite the mining difficulty. The pioneer cryptocurrency has almost tripled its value from sub-$4,000 in March 2020 to hovering in the $11,500 – $12,000 range the past week.

BTC trades above the 34-period exponential moving average on the daily charts and remains in a firm uptrend for now, and is closely correlated with market action in the S&P index as per analysts.