This set of data shows that Bitcoin’s “safe haven” narrative may lead to a price boom

This set of data shows that Bitcoin’s “safe haven” narrative may lead to a price boom This set of data shows that Bitcoin’s “safe haven” narrative may lead to a price boom

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin has seen some heightened volatility over the past few weeks, with much of its recent downside coming about as a result of that incurred by both Gold and the benchmark U.S. stock indices, which have all cratered due to the rapidly mounting economic impacts of COVID-19.

BTC’s close correlation to the traditional markets seen over the past few weeks has done serious damage to the safe haven narrative that many analysts and investors had previously subscribed to.

Despite this, all hope for this narrative is not lost, as one simple data set seems to suggest that investors are rapidly beginning to turn to both Bitcoin and Gold as assets that can help them weather the storm created by the recent economic turbulence.

Google Trends data shows that retail investors are growing interested in Gold and Bitcoin

Bitcoin, which is currently experiencing its first bout of extreme economic turbulence in the traditional markets, has not fared as well as many had hoped it would, with the benchmark cryptocurrency declining from highs of $10,500 to lows of $3,500 in tandem with the declines seen by equities.

Gold – which has been considered to be a safe haven asset for centuries – hasn’t been immune from this economic downturn either, as its price has collapsed from 2020 highs of nearly $1,700 per ounce to its current price of $1,480 per ounce.

Despite these assets’ recent selloff, retail investors appear to be growing increasingly interested in purchasing them as the traditional economy begins showing signs of degrading further.

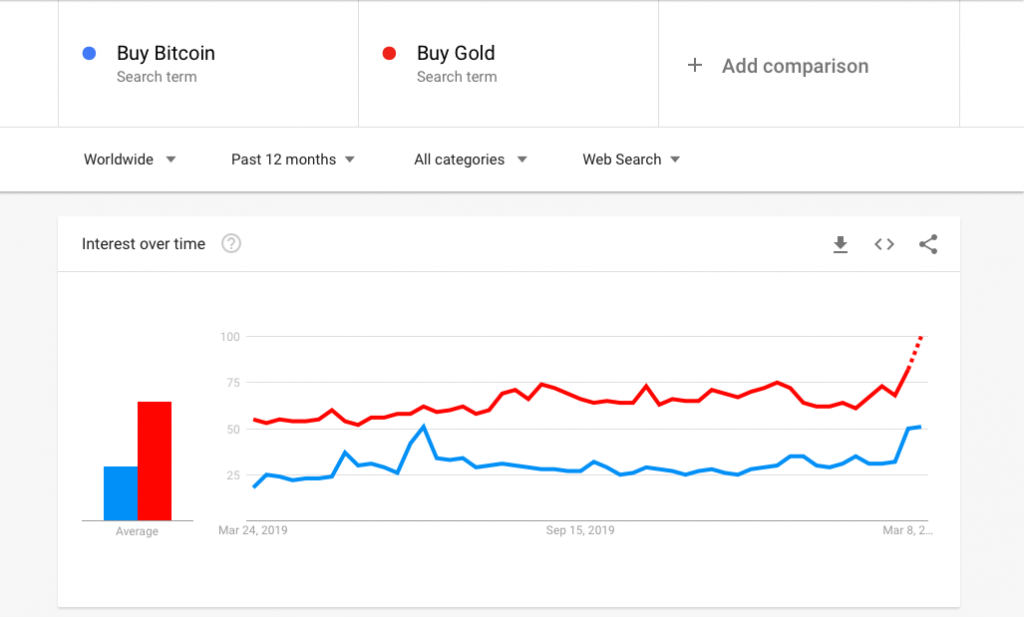

Worldwide search data for the terms “Buy Bitcoin” and “Buy Gold” over the past 12 months both elucidate a massive uptick in searches for the two terms over the past several weeks.

This data led Dan Held – a prominent Bitcoin commentator – to note that “this is not the time to be bearish on Bitcoin.”

BTC begins heavily outperforming traditional markets

This uptick in search volume for the aforementioned terms also seems to be correlating with Bitcoin decoupling from the traditional markets, as the digital asset has climbed significantly from its recent lows while the benchmark stock indices all continue to struggle.

Hodlnaut, another prominent Bitcoin thought leader and advocate, spoke about this occurrence in a recent tweet, questioning what will happen once the world notices this occurrence.

“Last 4 days: S&P down 11%. Dow down 13%. Bitcoin up 49%. What if someone notices…”

If this trend continues to grow in the days and weeks ahead, investors across all different markets may rapidly begin looking to Bitcoin as a safe haven asset that trades independent of the traditional markets, which could be a catalyst for unprecedented growth.