Q4 2020 will be crazy for crypto, says VC: DeFi, Ethereum 2.0, Libra, and more

Q4 2020 will be crazy for crypto, says VC: DeFi, Ethereum 2.0, Libra, and more Q4 2020 will be crazy for crypto, says VC: DeFi, Ethereum 2.0, Libra, and more

Photo by Antonio Janeski on Unsplash

Save for strong developments with specific altcoins such as Cardano and Chainlink, coupled with the news that PayPal may integrate Bitcoin, the crypto industry has been rather quiet over recent months.

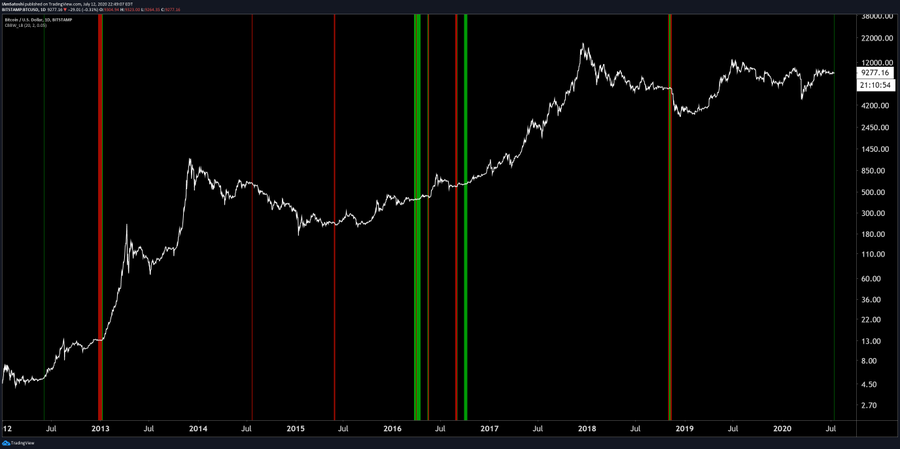

Look no further than the price of BTC, which has flatlined over the past two to three months around the low-$9,000s.

But as Chris Burniske, a partner at the crypto-focused venture fund Placeholder Capital, recently reminded his followers, “odds are it’s going to be a crazy fall” (Q3/Q4) for the cryptocurrency and blockchain industry.

The following is just a list of a number of important events taking place by the end of the year as compiled by Burniske.

There will be a flurry of crypto events in the next few months

- Bitcoin beginning its “post-halving push”: It took the leading cryptocurrency approximately six months after the 2016 block reward halving to begin a steady uptrend higher.

- The likely launch of Ethereum 2.0’s first phase (“phase 0”): Despite some contention from a top Ethereum researcher, most expect the first phase of the blockchain’s notable upgrade to take place by the end of 2020. Analysts say that this launch will have an extremely strong effect on the market.

- Polkadot, an interoperability protocol, will be fully functional.

- The Facebook-led Libra initiative will be launching with its new structure, which was adapted to appeal to regulators.

- ZCash will see its own block reward halving, which may trigger an uptrend after a multi-year bear market.

- The value of coins locked in decentralized finance contracts could surpass $5 billion. Since the start of the year, this metric has trebled from around $700 million to $2.5 billion as of this article’s writing.

- The U.S. Election between Vice-President Biden and President Trump. It isn’t clear how exactly this will affect the cryptocurrency market, but Trump has been outspoken against Bitcoin in the past.

Other events that Burniske himself didn’t identify but his followers did include, the launch of optimistic rollup technology on Ethereum, the launch of Bakkt’s digital asset application for consumers, and a potential public listing of Coinbase shares.

Expect volatility sooner

While it may be a few months until these events, investors should expect volatility in the price of Bitcoin and altcoins much sooner.

As noted by cryptocurrency analyst Josh Olszewicz, the Bollinger Bands, an indicator that is often used in analyzing the volatility of a market, has become the tightest since November 2018.

This has been corroborated by Josh Rager, a popular cryptocurrency analyst. He said that the historical volatility index has reached the ever-important 40 level. As Rager explained, every time the index reached this low of a reading, a strong 30% (or more) move followed.

That’s to say, by historical standards, there’s a high likelihood Bitcoin will soon see a macro spike or drop that will determine the price action of the cryptocurrency market in the months ahead.