New York Attorney General issues new warning to cryptocurrency investors

New York Attorney General issues new warning to cryptocurrency investors New York Attorney General issues new warning to cryptocurrency investors

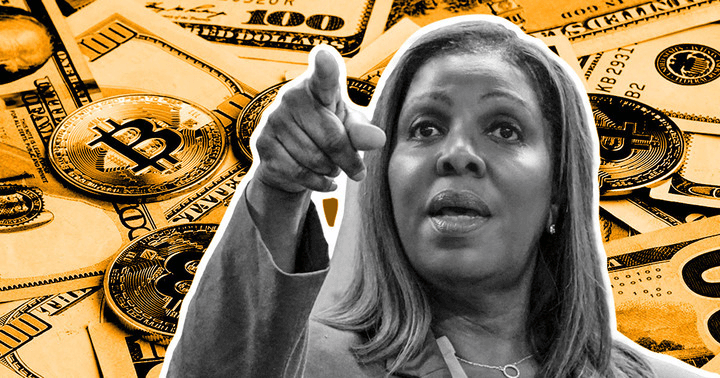

Attorney General Letitia James issues retail cryptocurrency investors a list of warnings to watch out for.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Attorney General Letitia James issued an “alert” on June 2 warning New Yorkers about the dangers of investing in cryptocurrencies.

The message comes as crypto markets continue reeling from the repercussions of the Terra implosion. In May, the total crypto market cap shrunk by $446 billion, marking an eleven-month low for the sector.

James took the opportunity to issue a fresh warning to investors, saying digital assets are among the riskiest investments on the market.

“Cryptocurrencies are subject to extreme and unpredictably high price swings that make them among the most high-risk investments on the market.”

Not James’ first rodeo

The last time Attorney General James issued a similar warning was in March 2021, as sentiment was spiking due to Bitcoin rallying to new all-time highs. However, the message then had a more significant industry focus.

She informed the New York crypto industry members that they would be shut down if they didn’t “play by the rules.”

“We’re sending a clear message to the entire industry that you either play by the rules or we will shut you down.”

Specifically, James referred to state regulatory requirements to register with the Office of the Attorney General’s Investor Protection Bureau. She said that obligated parties who fail to comply would be subject to civil and criminal enforcement.

Her message was clear, the NY Attorney’s Office is clamping down on greedy crypto firms “who take unnecessary risks with investors’ money.”

“Too often, greedy industry players take unnecessary risks with investors’ money, but, today, we’re leveling the playing field and issuing alerts to both investors and industry members across the nation”

Retail cryptocurrency investors beware

But now, James seeks to caution retail investors, saying putting money into cryptocurrency investments “can yield more anxiety than fortune.”

“Too often, cryptocurrency investments create more pain than gain for investors. I urge New Yorkers to be cautious before putting their hard-earned money in risky cryptocurrency investments that can yield more anxiety than fortune.”

In the press release, James mentioned seven specific areas to be aware of regarding digital asset investing. They were:

- Highly Speculative and Unpredictable Value — high volatility and easy price manipulation, e.g., via social media.

- Difficulty Cashing Out Investments — no guarantees around exiting into cash, especially during times of high market volatility and exchange restrictions/platform crashes.

- Higher Transaction Costs — variable fees due to network activity and size of transactions.

- Unstable “Stablecoins” — although not explicitly stated, references Terra UST and vulnerable pegging mechanisms and dubious claims around reserves backing particular stablecoins.

- Hidden Trading Costs — bot-driven markets designed to manipulate prices.

- Conflicts of Interest — Cryptocurrency trading platforms may have interests contrary to their customers.

- Limited Oversight — the industry has no federally regulated exchange, and platforms operating in this space lack general oversight. As such, victims of fraud may have no recourse.