BlackRock IBIT faces near-record low with mere $49 million inflow on March 20

BlackRock IBIT faces near-record low with mere $49 million inflow on March 20 Quick Take

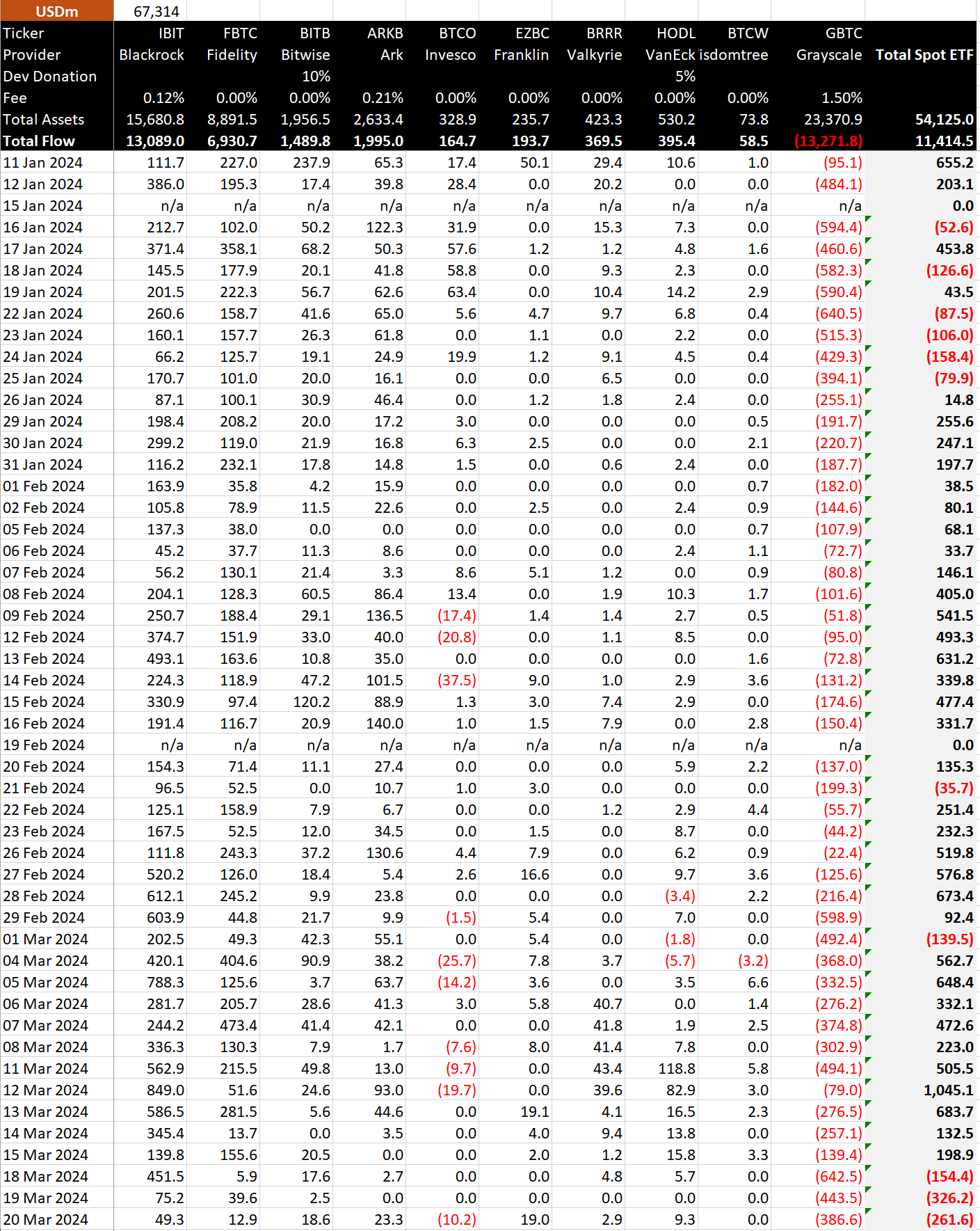

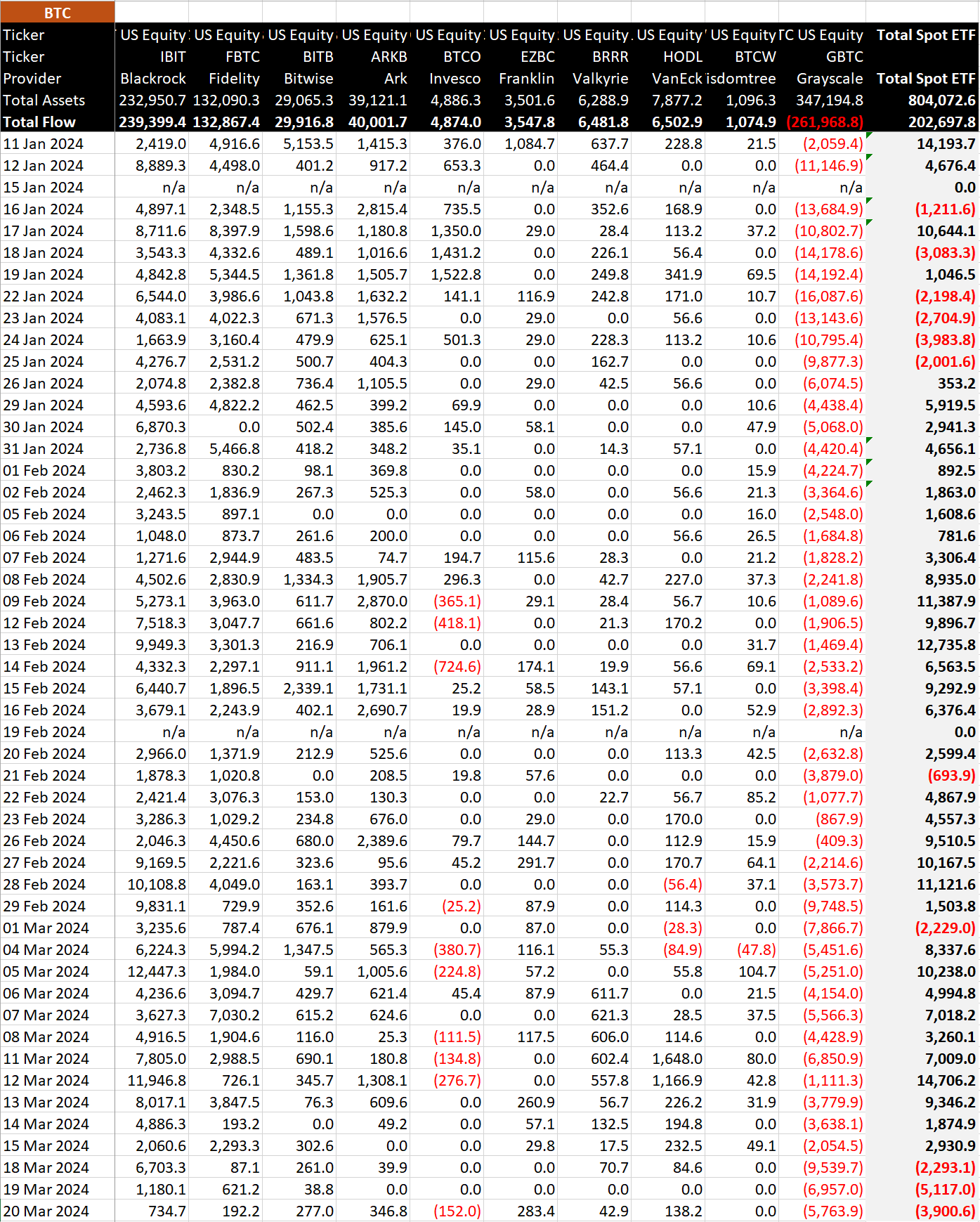

Recent data from BitMEX highlights a downward trend in the Bitcoin Exchange-Traded Funds (ETFs) sector, with the landscape experiencing consecutive outflows for the third consecutive day on March 20.

The cumulative outflow reached $262 million on March 20, equating to approximately 3,901 BTC. Leading this wave of outflows is GBTC, which reported a substantial $387 million outflow, signifying a slight decline in its outflow activity. Over the last three days, GBTC’s outflows have amounted to roughly $1.47 billion. Since Jan. 11, GBTC has encountered a staggering $13.27 billion in outflows, as per BitMEX’s reports.

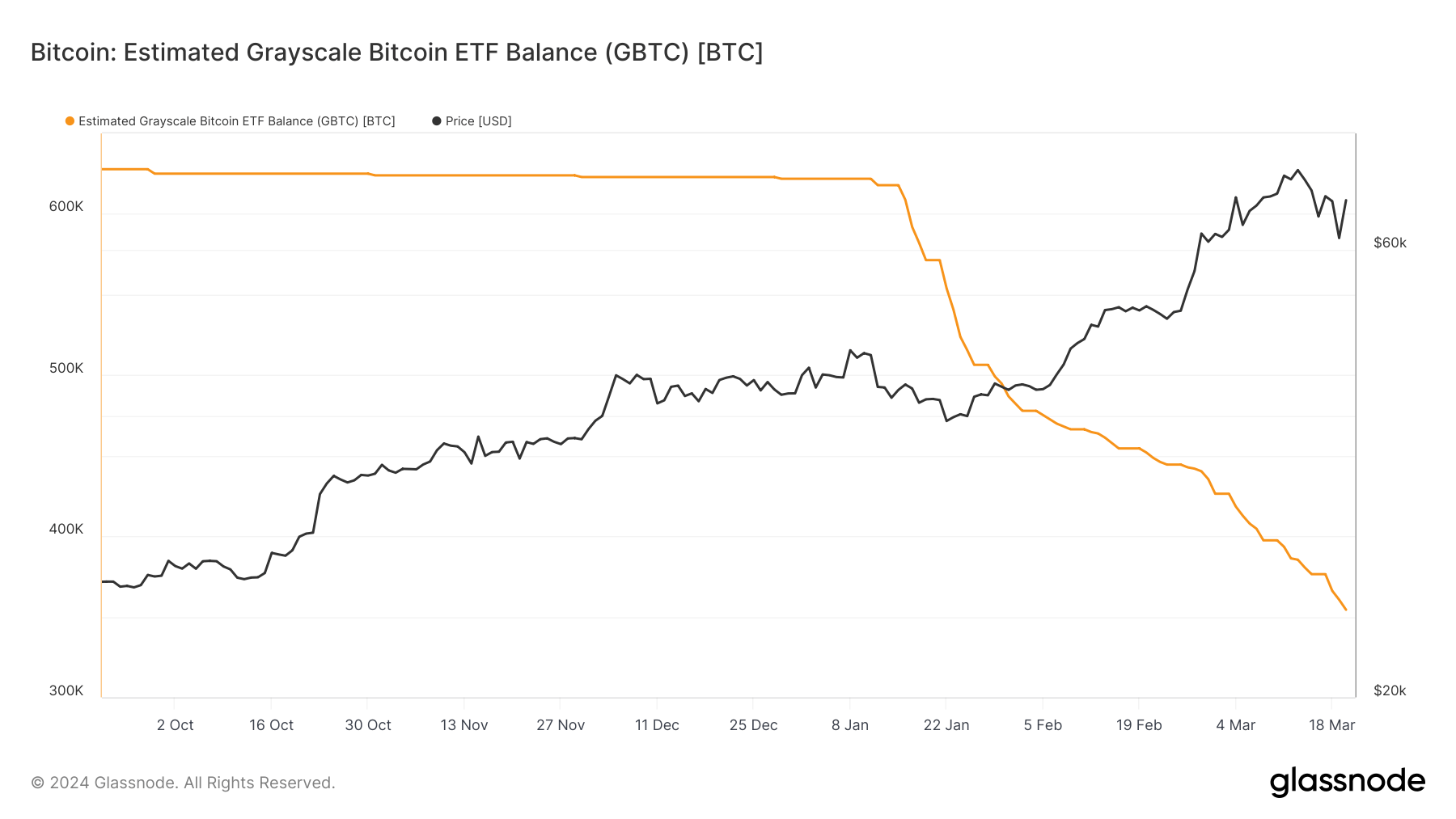

GBTC ETF still holds roughly 350k Bitcoin, a notable decrease from the initial amount of 620k Bitcoin from Jan. 11, according to Glassnode.

Additionally, BitMEX’s data highlights a troubling decline in inflows. BlackRock IBIT reported a $49 million inflow on March 20, its second lowest on record, bringing its total inflows to over $13 billion at an estimated price of $54,300, equivalent to about 239,399 BTC. Likewise, Fidelity’s FBTC has seen a decrease in its inflows, registering only $13 million, or 192 BTC, on March 20.

The total spot Bitcoin ETFs have now accumulated $11.4 billion in net inflows, equivalent to 202,698 Bitcoin.