First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow

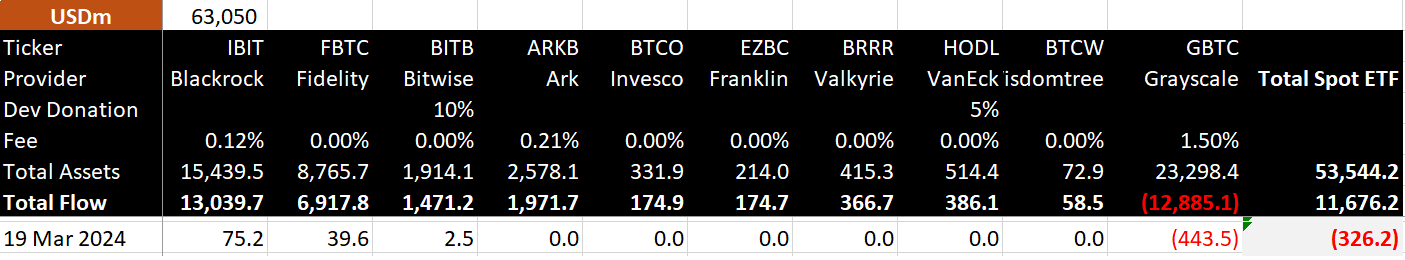

First back-to-back net outflows for Bitcoin ETFs since late January due to $443 million GBTC outflow Bitcoin ETFs saw a second day of outflows on March 19, the first instances of back-to-back outflows since Jan 25. Net outflows totaled $362 million, with Grayscale accounting for all outflows at $443 million. Most funds saw no net movement, with BlackRock, Fidelity, and Bitwise seeing inflows, according to Bitmex Research.

BlackRock recorded just $75 million, Fidelity $39 million, and Bitwise $2.5 million in inflows on a rare poor performance day for the record-breaking Newborn Nine.

On a positive note, while Bitcoin fell approximately 9% on the day, the net outflows amounted to only 2.7% of total inflows since launch and 0.6% of total assets under management.

Further, $117 million was added to funds on a confidently ‘red’ day for Bitcoin. BlackRock, Fidelity, Bitwise, Ark Invest, Franklin Templeton, and Valkyrie are yet to post a single day of net outflows from their funds, regardless of volatility.

The lack of outflows from many funds can be seen as a bullish indicator, as authorized participants appear reluctant to sell Bitcoin even at prices above $60,000.