Bitcoin’s plunge to $26.1k triggers massive reset in crypto market dynamics

Bitcoin’s plunge to $26.1k triggers massive reset in crypto market dynamics Quick Take

The recent plummet of Bitcoin to $26.1k was a massive liquidation event, underlined by significant changes in the cryptocurrency’s perpetual funding rate and open interest.

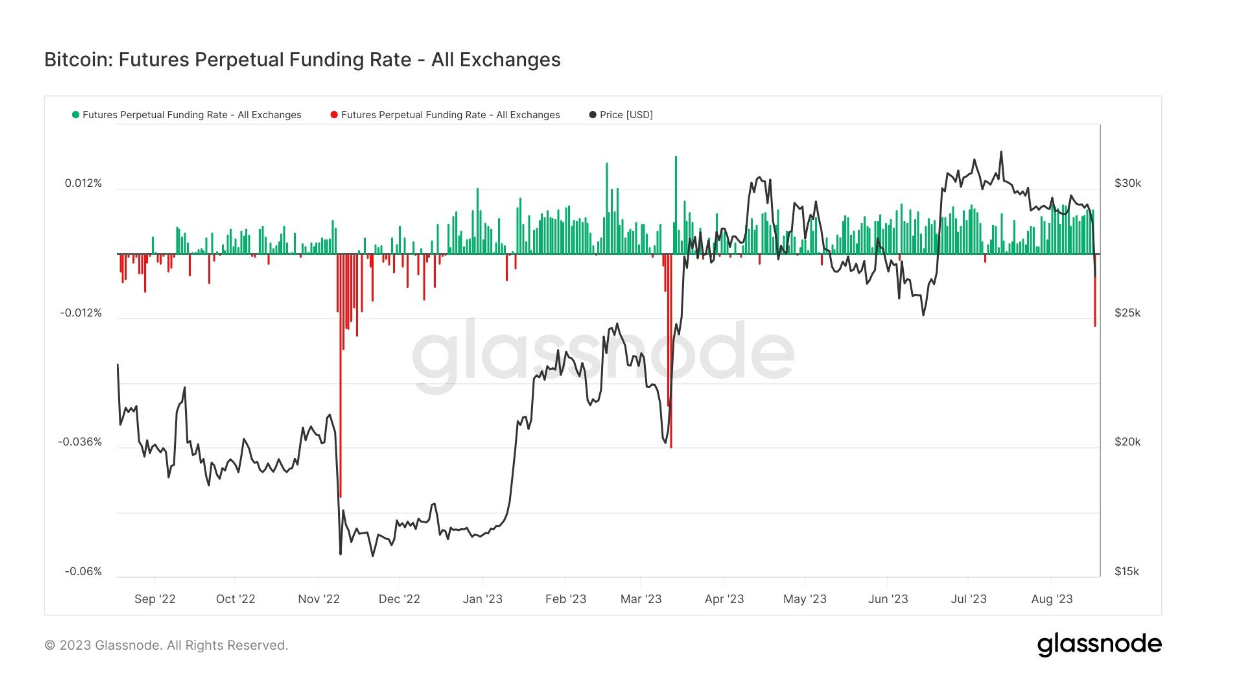

The perpetual funding rate, a mechanism used by exchanges for perpetual futures contracts, which usually sees long positions periodically pay short positions when positive, has shifted into the negative terrain.

This change implies a reversal of roles where short positions periodically pay long positions, a clear indicator of market anxiety.

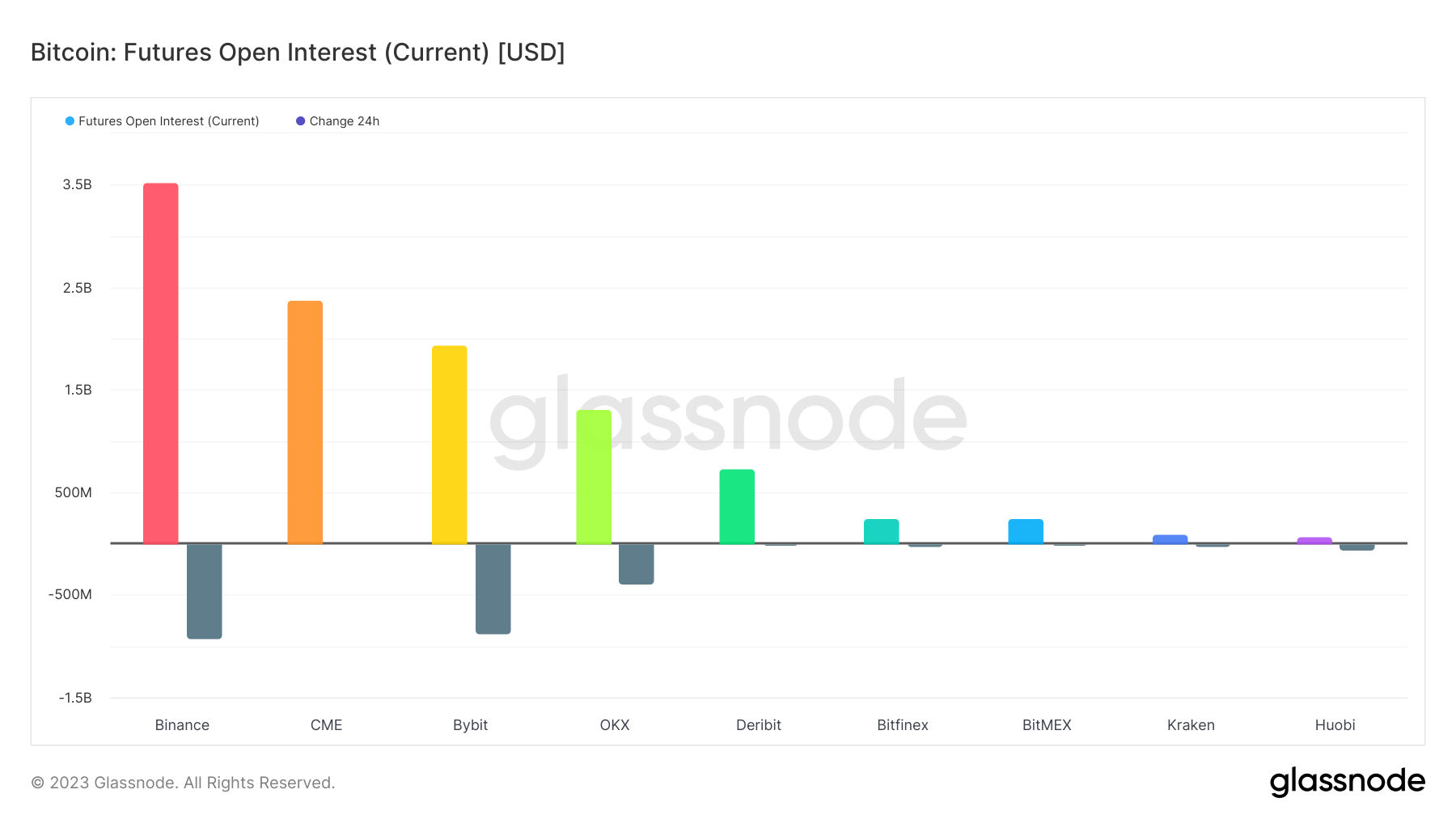

Simultaneously, we witnessed a significant drop in open interest, a measure of the total number of outstanding derivative contracts, such as futures that have not been settled.

There was a striking obliteration of $1B worth of liquidations, resulting in a massive reset. Specifically, around 60,000 Bitcoin open interest contracts were wiped out in the process, a significant percentage of which were associated with leading exchanges like Binance, Bybit, and OKX.

This mass liquidation event has reset the market dynamics, paving the way for potentially novel investment strategies and market behaviors in upcoming trading sessions.