Ethereum’s daily active address count is flashing a major warning sign for ETH

Ethereum’s daily active address count is flashing a major warning sign for ETH Ethereum’s daily active address count is flashing a major warning sign for ETH

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum’s price action over the past several weeks has proven to be highly disappointing for investors, as it has been underperforming both Bitcoin and many of its other peers despite it seeing unprecedented fundamental strength.

Many analysts are now debating whether or not the decentralized finance sector – which has been driving the cryptocurrency’s fundamental strength – will ultimately allow ETH to accrue any value.

One indicator of the cryptocurrency’s underlying strength is now beginning to flash a major warning sign, potentially signaling that ETH has formed a long-term top.

If confirmed, a peak in the number of Ethereum daily active addresses could cause the token’s price to plunge significantly in the coming weeks.

Ethereum’s daily active address count rockets despite dwindling price

Ethereum’s price action has been lackluster over the past few weeks, with sellers forcing it below the lower boundary of its multi-month trading range late last week.

In the time since, it has been unable to break back above this level – which sits at $230 – and has formed an incredibly close correlation to Bitcoin.

This price action has come about despite the Ethereum network seeing unprecedented usage rates. Recently, ETH’s daily transaction count rocketed past one million for the first time since the bull run seen in late-2017.

Multiple other fundamental metrics have seen similar growth over the past couple of months.

Unlike in 2017 and 2018, when Ethereum’s fundamental growth was driven by the ICO mania, this growth is now being driven by the DeFi sector – which is widely thought to be a far more sustainable trend than ICOs.

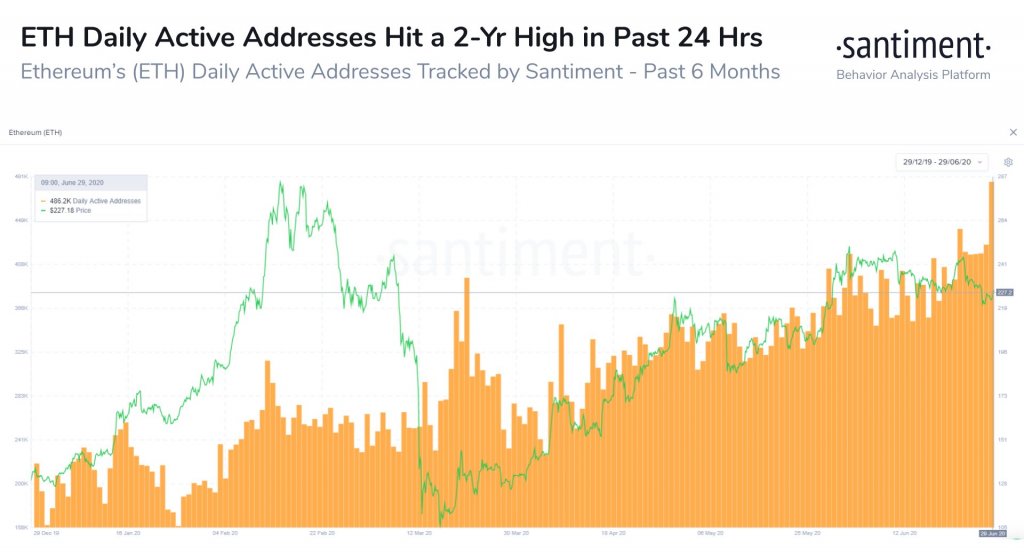

This has driven the crypto currency’s daily active address to hit a 2-year single-day high of 486,000 addresses – according to data from research platform Santiment.

“The number of daily addresses interacting with ETH has spiked in the past 24 hours to a 2-year single day high of 486,000 addresses! The last time Ethereum’s address activity was this high was on May 5th, 2018.”

Here’s what this could mean for ETH

Although being a sign of immense user activity, the cryptocurrency’s daily active address count could be peaking, which tends to front-run Ethereum price declines.

One algorithmic trader who posts under the name “Ape/rture” pointed to this pattern in a recent tweet, explaining that it is “hard to be bullish on ETH” while taking into account the sharp rise seen while looking towards this metric.

“It’s hard to be bullish on ETH when you see something like this happen. Peaks of the Daily Active Addresses line up with market tops.”

If this metric begins seeing a sharp decline in the weeks ahead, it could be signaling that Ethereum has topped out and that it will shed more of its value in the days and weeks ahead.