Crypto Demand in South Korea Surges as Bithumb Records 15 Percent of Total Volume

Photo by Pixabay on Pexels

Over the last 48 hours, the daily trading volume of crypto exchanges in South Korea has surged substantially by a range of 10 to 15 percent.

Bithumb, the largest cryptocurrency trading platform in the local market by trading volume, has seen a spike in daily trading volume of the Bitcoin-to-South Korean won pair, which has become the second most liquid trading pair in the global market after the Bitcoin-to-US dollar pair on Bitmex.

In the past 24 hours, Bithumb has cleared $581,487,870 in Bitcoin-to-KRW trades, reportedly processing $2.7 billion in cryptocurrency trades.

Major Cryptocurrency Exchanges Rebound

Upbit, the second largest exchange in the cryptocurrency exchange market of South Korea, has seen an increase in its daily trading volume of over 186 percent due to an abrupt surge in demand for Bitcoin Cash (BCH).

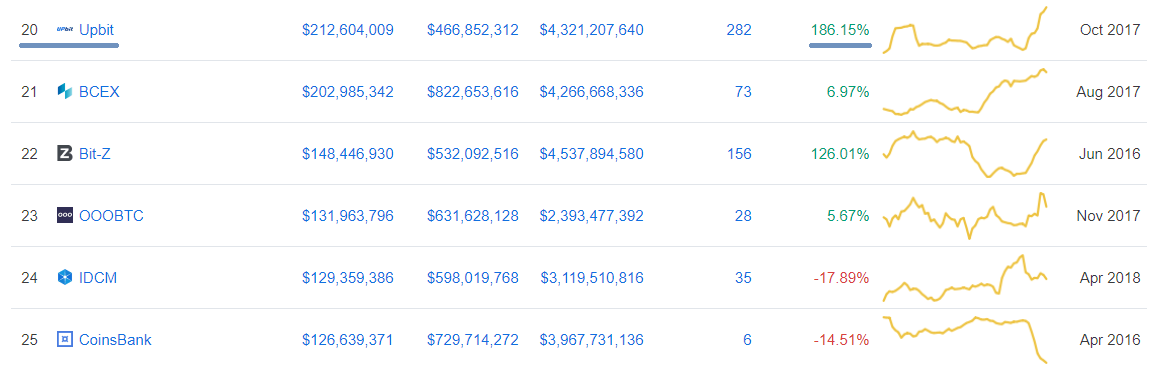

Daily trading volume of Upbit, data provided by CoinMarketCap

The significant increase in the volume of BCH on Upbit can be attributed to the 30 percent rise in the price of BCH over the last three days. Since Nov. 2, the price of BCH has risen against both Bitcoin and the US dollar due to the anticipation towards the scheduled Nov. 15 hard fork.

Coinbase and other leading cryptocurrency exchanges have announced support for the original roadmap of Bitcoin Cash set forth by ABC, which have led investors to portray confidence towards the asset. The Coinbase team said:

“Twice a year, the Bitcoin Cash (BCH) network hard forks as part of scheduled protocol upgrades. The next BCH hard fork is scheduled for Nov 15, 2018, and Coinbase is prepared to support the published roadmap from bitcoincash.org. However, unlike previous BCH hard forks, there is a competing proposal that is not compatible with this published roadmap.”

But, the rise in the volume of Bithumb and other major cryptocurrency exchanges in the local market has primarily been triggered by a growing demand for Bitcoin, the most dominant cryptocurrency in the market.

A sudden rise in demand for BTC was unexpected given the stability of the asset since Aug. 9. For nearly three months, BTC has remained in a tight range of $6,300 to $6,800, unable to initiate a large upwards movement.

Throughout the past week, the government of South Korea and local financial authorities have released several positive statements regarding cryptocurrencies and the digital asset exchange market.

Financial Services Commission (FSC), the main financial watchdog of South Korea, formally stated that banks are permitted to provide virtual bank accounts to crypto exchanges. The public statement of FSC commissioner Choi Jong-gu established a precedent for the cryptocurrency exchange market, and with it, digital asset trading platforms will no longer face issues in obtaining banking services.

The Seoul Central District Court also ruled in favor of a local cryptocurrency exchange in a dispute with Nonghyup, a major commercial bank in South Korea, and emphasized that banks have to provide fair, transparent, and stable services to crypto exchanges.

This Week in Crypto South Korea ??

1. Government says banks can work with crypto exchanges, no boundaries

2. Court sides with crypto exchange in dispute with bank over banking services

3. Ministry of Science and ICT exploring legalization of ICOThis is what progress looks like

— Joseph Young (@iamjosephyoung) November 4, 2018

Renewed enthusiasm towards the government’s positive stance towards the cryptocurrency market and its intent to regulate the sector with practical regulatory frameworks could have led to an increase in demand for cryptocurrencies from local investors.

Where Does the Market go Next?

Apart from Bitcoin Cash, the daily trading volume of most major cryptocurrencies remain relatively low. While the volume of BCH has increased by seven-fold in 72 hours, the volume of Bitcoin has increased slightly from $4 billion to $4.4 billion.

Still, considering that the volume of Bitcoin hovered at around $3.2 billion, a 30 percent increase in the volume of BTC is significant.

Bitcoin Cash Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin Cash is ranked #4 by market cap and the price is up 4.68% over the past 24 hours. Bitcoin Cash has a market capitalization of $9.77 billion with a 24-hour trading volume of $1.2 billion. Learn more about Bitcoin Cash ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $211.25 billion with a 24-hour volume of $13.82 billion. Bitcoin dominance is currently at 52.72%. Learn more about the crypto market ›

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 0.74% over the past 24 hours. Bitcoin has a market capitalization of $111.43 billion with a 24-hour trading volume of $4.24 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $211.25 billion with a 24-hour volume of $13.82 billion. Bitcoin dominance is currently at 52.72%. Learn more about the crypto market ›