Bitcoin’s options skew suggests traders are anticipating a sharp decline

Bitcoin’s options skew suggests traders are anticipating a sharp decline Bitcoin’s options skew suggests traders are anticipating a sharp decline

Photo by Jay Heike on Unsplash

Bitcoin’s consolidation trend at the lower boundary of its long-held trading range isn’t showing any signs of letting up anytime soon.

This isn’t stopping options traders from growing increasingly cautious that a downside movement is imminent, however, as short-term BTC options skew has been caught within a firm uptrend over the past week.

This indicates that traders are factoring in heightened chances of a downside movement.

Although there aren’t many overt signs of downside volatility being imminent, there may be a few “external forces” that could soon catalyze a selloff.

Options traders don’t expect Bitcoin’s stability to last for too much longer

Over the past week, Bitcoin has been relatively stable at around $9,200.

Both buyers and sellers have attempted to garner some momentum, although each attempt has proven to be fleeting.

This price action has come about as BTC sees a decline in both its trading volume and liquidity – with both of these factors contributing to its ongoing downtrend.

Because $9,000 appears to be a strong base of support for the digital asset, it remains unclear as to whether or not sellers will be able to break this level.

Options traders, however, do seem to think that a downside movement is imminent.

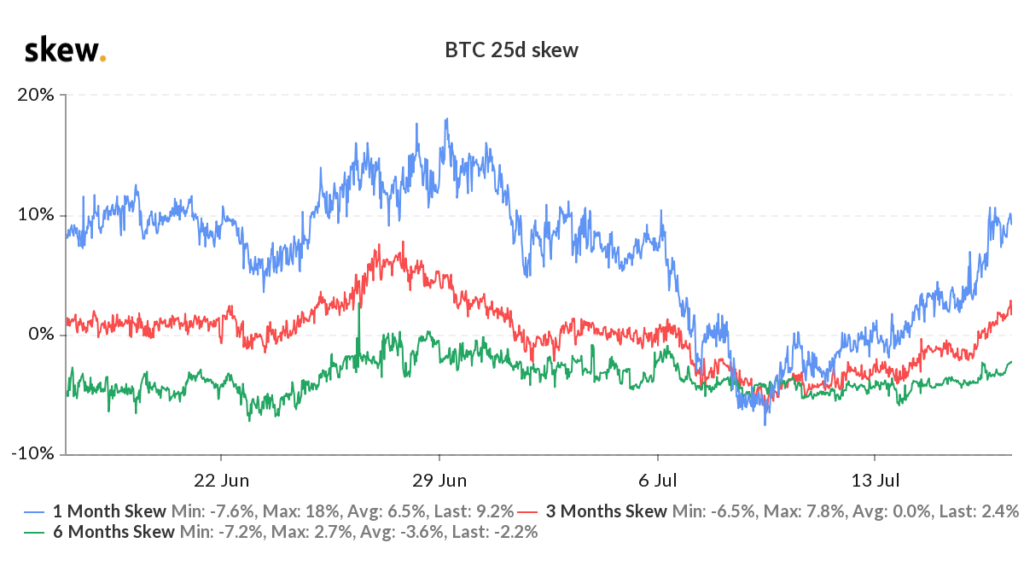

According to data from analytics platform Skew, short-term Bitcoin options skew has seen a notable climb throughout the past week.

“Market turning cautious? Short-term Bitcoin options skew rallied strong this week.”

Options skew essentially represents the implied volatility of specific contracts based on their expiry dates.

Contracts with a high skew indicate that investors are pricing in a higher likelihood of downside volatility.

While looking towards the chart offered by the analytics platform, it is clear that traders are pricing in downside volatility for the next month. This expectation declines while looking towards longer time frames like three months and six months.

What could catalyze this downside volatility?

Although there are no clear catalysts for a sharp near-term decline, one analytics firm revealed that there are some “external forces” stopping Bitcoin from rallying.

CryptoSlate reported on these factors earlier this week, citing a Glassnode report that points towards two primary factors that are stopping BTC from seeing any upwards momentum.

They postulate that lack of clarity surrounding Bitcoin’s status as a “safe-haven” asset and growing uncertainty regarding how this consolidation phase will ultimately resolve are both suppressing its price action.

Because the crypto has been seeing heightened correlations with the S&P 500 in recent weeks, a decline in the stock market could drag it lower.

Until this correlation breaks, investors may continue moving to the sidelines as they await greater clarity into the crypto’s mid-term outlook.

Bitcoin Market Data

At the time of press 11:25 am UTC on Jul. 18, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.56% over the past 24 hours. Bitcoin has a market capitalization of $168.9 billion with a 24-hour trading volume of $13.14 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 11:25 am UTC on Jul. 18, 2020, the total crypto market is valued at at $271.25 billion with a 24-hour volume of $47.62 billion. Bitcoin dominance is currently at 62.28%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)