Bitcoin’s correlation with equities places BTC in a precarious position; 3 factors to consider

Bitcoin’s correlation with equities places BTC in a precarious position; 3 factors to consider Bitcoin’s correlation with equities places BTC in a precarious position; 3 factors to consider

Photo by ???✨ on Unsplash

Bitcoin has been flashing some immense signs of overt weakness throughout the past several days, and this appears to be reflected in its price action as it trades around the lower boundary of its long-held range at $9,300.

There are a few factors that now indicate that the selloff seen earlier today may just mark the start of a much larger trend shift.

If the crypto fails to post a sharp rebound in the coming hours and days, this grim outlook could be validated and BTC may enter into a mid-term bear market.

Bitcoin posts sharp selloff following yesterday’s rejection at $10,000.

At the time of writing, Bitcoin is trading down over six percent at its current price of $9,270.

This marks a notable decline from daily highs of $10,050 that were set at the peak of yesterday’s fleeting rally.

Today’s decline appears to be the first sustained downtrend seen in the time following the multiple rejections BTC has posted at $10,000 over the past couple of weeks.

Because sellers have proven that this region remains insurmountable, there is a strong possibility that it will decline even further in the foreseeable future.

This bearish triple-top formation is still in play

Over the past six months, BTC has faced three distinct rejections at $10,500 that sparked far-reaching selloffs.

These rejections have put into play what is described as a “triple top” – a formation that is rather rare and tends to be followed by intense price declines.

One pseudonymous analyst named DonAlt recently offered a chart showing the clarity of this technical pattern, pointing to downside targets sitting within the $7,000 region and the mid-$5,000 region.

“We now got a triple top in play. That makes the support areas I outlined even more attractive as a buy.”

BTC’s correlation with the stock market remains high

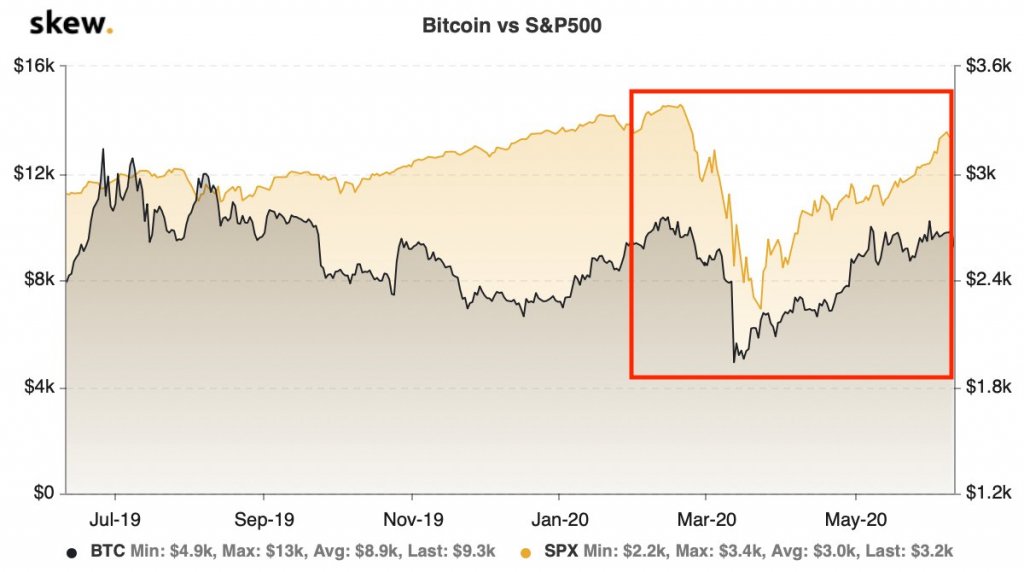

Another factor that could hold some heavy influence over Bitcoin’s price action in the near-term is its striking correlation with the traditional markets.

This coupling first developed in late-February when US equities began incurring an intense downtrend.

As seen on the below chart from Skew, this correlation has persisted in the time since.

Today, all the benchmark stock indices shed a massive amount of value, with the S&P 500 declining by over 4 percent and the Dow Jones falling by nearly 5 percent following a bearish economic outlook offered by the Federal Reserve.

The confluence of the traditional market’s weakness and Bitcoin’s bearish market structure does point towards BTC seeing further losses in the days and weeks ahead.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)