JPEX has launched CryptoPunks and REDHARE NFT INDEX contract

Disclaimer: This is a sponsored press release. Readers should conduct their own research prior to taking any actions related to the content mentioned in this article. Learn more ›

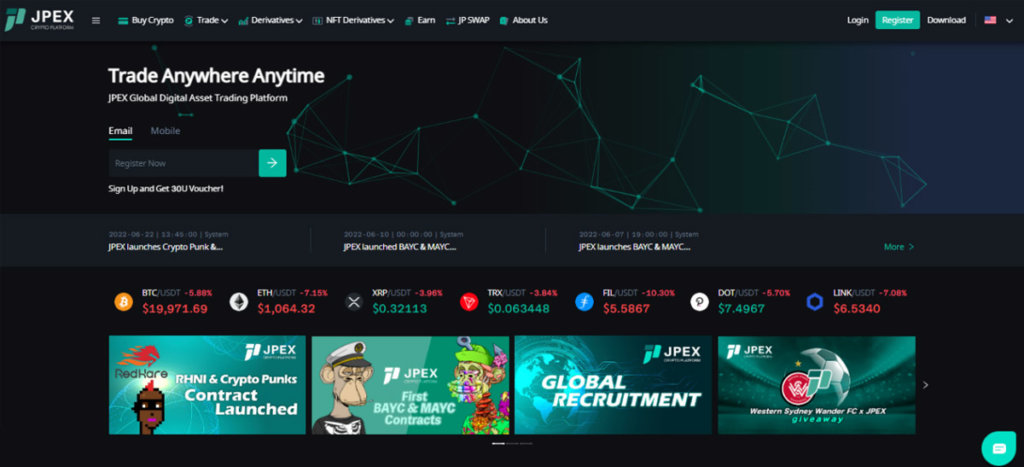

JPEX launched Bored Ape Yacht Club (BAYC) index, CryptoPunks index, Mutant Ape Yacht Club (MAYC) index before, and recently launched Crypto Punk & REDHARE NFT INDEX. These whole series of contracts can provide 40 times leverage, which allows normal investors to participate in investing in top NFT projects with limited funds, and provides investment vehicles for top-tier NFT holders to hedge against the risk. The launch of JPEX NFT contract series become a hot topic for the NFT sector.

JPEX launched the industry’s first contracting product targeted at PFP NFT assets.

PFP profile holders are now facing several major problems. Taking Crypto Punk for instance, as one of the most expensive PFP profile series, the price floor of this asset breaks records everyday with the further falling of the market. This means that users holding this series of NFT assets are under the risk of loss. Viewing from another aspect, this kind of asset lacks liquidity. Usually, you need to list at a price far lower than the price floor to clinch a deal. For example, if the price floor is 65ETH, you need to list at 60-63ETH to clinch a deal. In addition, in the short term, NFT sector capital outflow is accelerated, PFP asset value decline is a definite trend. The fact that holders look for an effective and stable hedging instrument, is the demand from the market.

As a Crypto Punk asset holder, when a certain market trend comes, we can make short selling to the Crypto Punk index contract through JPEX, thus making gains through risk hedging to spot assets. Certainly, under the premise of accurately judging the trend, the 40 times’ leverage JPEX offers is enough to enable investors to make a decision.

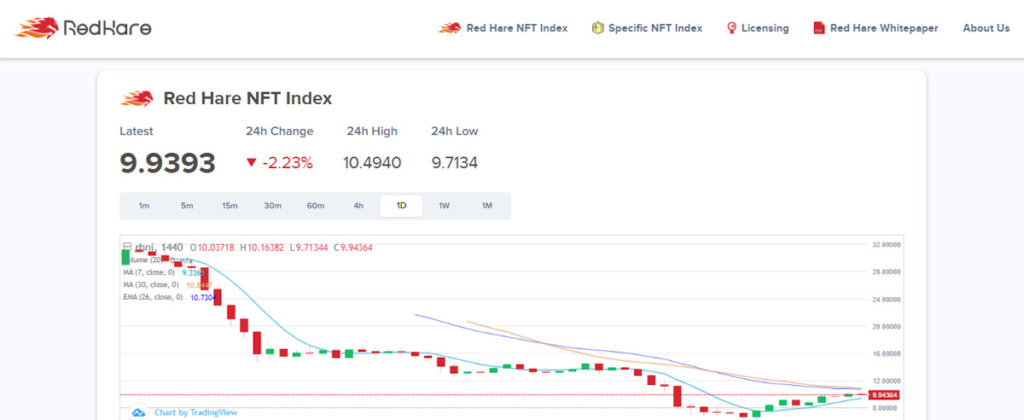

REDHARE NFT INDEX launched by JPEX, is the only hedging tool available to current NFT holders. REDHARE NFT INDEX represents the trend for the whole NFT sector. When the price of NFTs going down, investors can furtherly short sell the REDHARE NFT INDEX(up to 40 times’ leverage), to make up for the loss of holding various NFT assets.

Of course, by buying REDHARE NFT INDEX, investors with various NFTs can also make profits both from the increase of NFT price and contract. For professional NFT collectors and investors, REDHARE NFT INDEX contract can help them furtherly avoid potential risks. In the cryptocurrency market, whale wallets will usually hedge via derivatives, while the series of NFT contracts launched by JPEX initiate a new epoch in hedging against the NFT assets, which is of vital importance to the industry.

NFT INDEX contract launched by JPEX has lower risks and higher potential returns, all of these just satisfy the demand of long-tailed users, to make up the market gap. JPEX’s NFT contract series products have fairly huge room for development.

Currently, JPEX already launched for NFT Index products: CryptoPunks Index, Bored Ape Yacht Club (BAYC) Index, Mutant Ape Yacht Club (MAYC) Index and REDHARE NFT INDEX. JPEX will continually launch individual NFT indices for each top NFT project for more NFT investors to hedge against the risk and provide more investment targets.

As an Australian exchange, JPEX is maintained by development teams from Japan, Australia, and the United States. JPEX, as a well-established trading platform, always focuses efforts on the security of the platform and users’ assets and related mechanisms, and positively looks for global compliance to become the benchmark ecology in the aspect of assets security. It’s worth mentioning that since JPEX launched in 2020, there has been no security issue happened, which reflects the high-security level of JPEX.

On the basis of improving its products, JPEX is continuously expanding its ecology to more financially developed areas. According to the 1st development plan published in the 2nd quarter of 2022, JPEX furtherly illustrated its business focus. JPEX works conscientiously and with commitment in the respect of platform compliance. Currently, JPEX has obtained financial licenses from various countries: Lithuania FCIS, U.S. MSB, Canada MSB, U.S. NFA and Australia ASIC. It announced that JPEX will expand globally in 2022 and 2023, and the target market will include Malaysia, Taiwan and Dubai. JPEX’s business also includes cryptocurrency technology development, optimizing trading platform experience and NFT technology and service, etc. JPEX is always committed to providing more investment opportunities and excellent trading services to users in different areas.

Meanwhile, JPEX is setting foot in the traditional area, except establishing strategic partnerships with renowned listed companies, JPEX is also setting foot in the sports area: JPEX has prompted the NFT jointly with Western Sydney Wanderers Football Club, established a strategic relationship with the Macarthur FC and other high-quality sports partners to prompt the cryptocurrency widely known by the public. JPEX is becoming another renowned crypto ecology setting foot in sports areas besides Coinbase, FTX and OKX.

- Website: https://jp-ex.io/en/home

- E-mail: [email protected]

- Twitter: (@ExchangeJpex): https://twitter.com/ExchangeJpex

- Facebook:(JpexExchange): https://www.facebook.com/JPEX-Japan-Exchange-100535999063470

- Instagram:(@Jpex_official): https://instagram.com/jpex_official

- Youtube (JPEXJapanExchange): https://www.youtube.com/channel/UCeslqL2jMg1kBYR1Fqua3Qw/featured

- Jpex Official Blog: https://www.jpextime.com

JPEX | Fix The Money, Fix The World

JPEX is the easiest place to buy and sell crypto.

CryptoQuant

CryptoQuant