Two-year Bitcoin DCA experiment demonstrates profit despite volatility

Two-year Bitcoin DCA experiment demonstrates profit despite volatility Quick Take

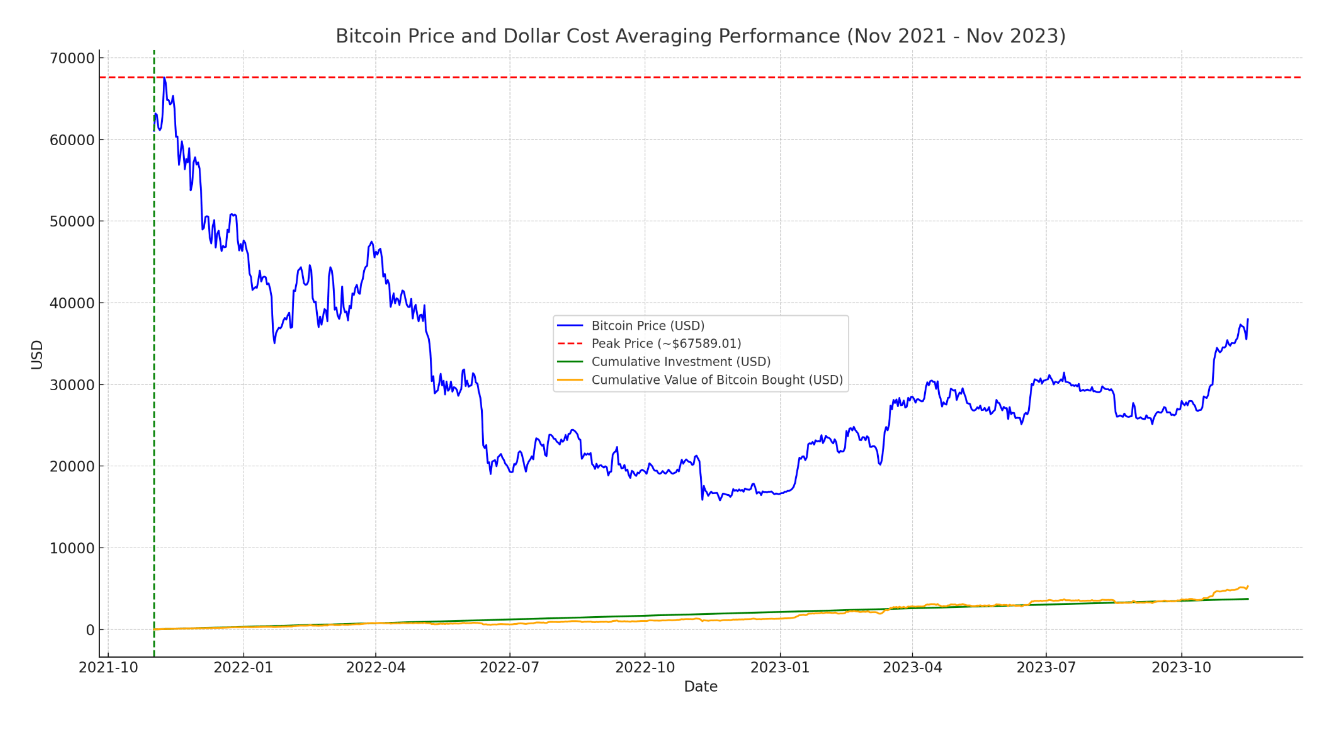

The potency of dollar-cost averaging (DCA) in Bitcoin investment is underscored by data from the past two years. In November 2021, when Bitcoin (BTC) reached a notable high of approximately $67,589, investors could have initiated a daily investment strategy. By investing a modest $5 per day from November 2021 to November 2023, the accumulated investment would total $3,730.

Fast-forward to the present, and the value of that consistent Bitcoin investment, calculated in current prices, has grown to an estimated $5,279.19. This implies a profit of $1,549.19, a testament to the power of DCA strategy. This approach allows investors to spread risks over time, taking advantage of Bitcoin’s price fluctuations.

The green line, rising steadily over time, would represent the cumulative investment in USD, showing the consistency of the $5 daily input. In contrast, the orange line, indicative of the cumulative value of Bitcoin purchased, would sway to reflect Bitcoin’s price changes.

Disclosure: The above is a hypothetical experiment based on historical data and is not investment advice.