Stark contrast of spot-to-futures ratio between Bitcoin and Ethereum

Stark contrast of spot-to-futures ratio between Bitcoin and Ethereum Definition

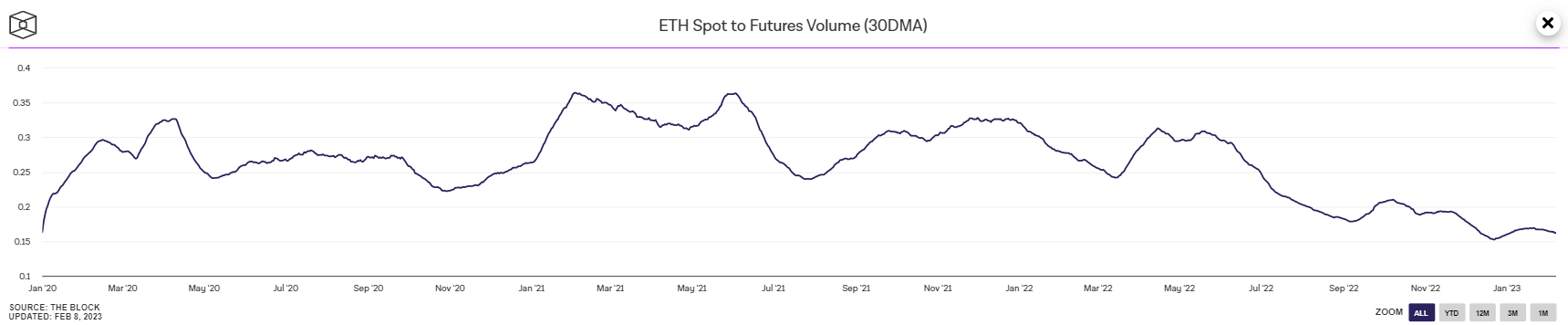

Daily spot market total volume for ETH divided by ETH futures trading volume.

Quick Take

- For a healthy ratio and sustainable price action, it is important to have a high spot-to-futures ratio.

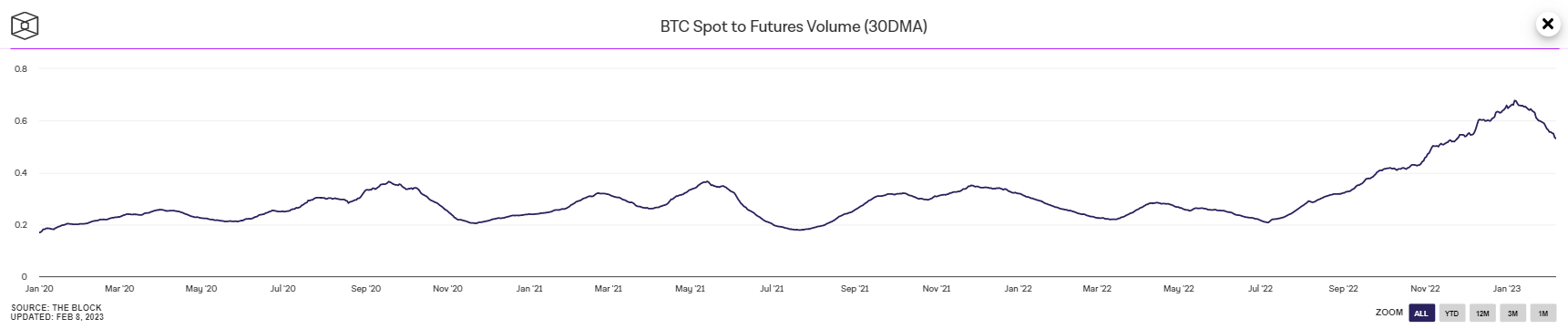

- Throughout 2020 and 2021, Bitcoin hovered around 0.2 – 0.3 spot to futures, which is low, while we were in the bull run supported by the derivatives market.

- However, at the end of 2022, Bitcoin’s ratio hit an all-time high at 0.66 — indicating more spot price action than futures; this has come off in recent weeks but still slightly supports higher spot action.

- Meanwhile, Ethereum has had a low, consistent ratio which shows it is being supported by the futures market considerably.

- Ethereum is currently at 0.16 — almost at an all-time low — which is not healthy or sustainable for price action.