Options traders target $50,000 Bitcoin in Q1 2024

Options traders target $50,000 Bitcoin in Q1 2024 Quick Take

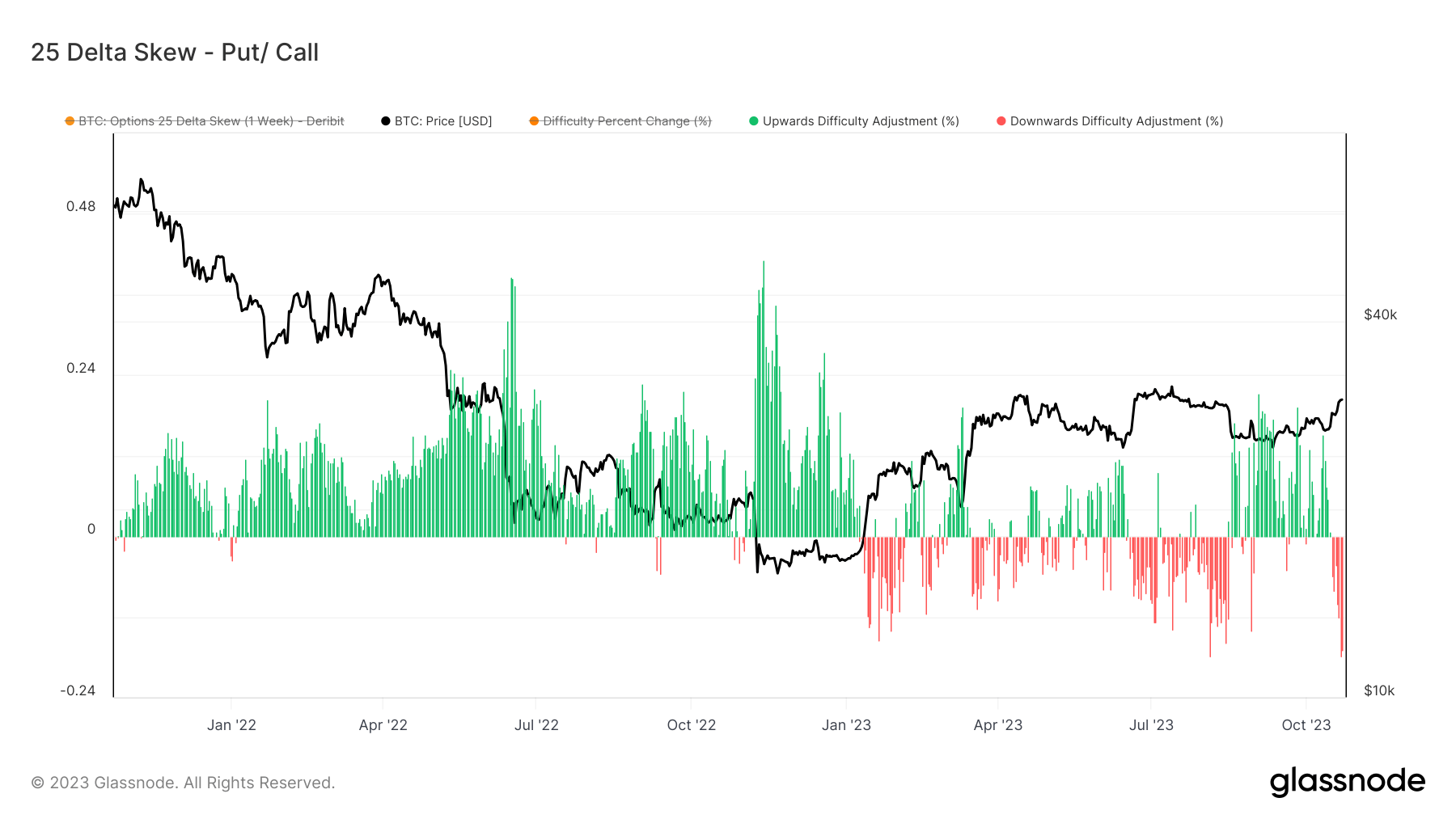

The Bitcoin (BTC) options market is currently signaling a strikingly bullish sentiment, with an unprecedented premium on calls over puts. Analysis of the 25 Delta Skew (1 week), a measure that captures the market’s perception of implied volatility, reveals an unusual tilt. This skew reflects a significant premium on calls—a remarkable -16.93%—indicating that markets are as bullish as ever on Bitcoin in the short term.

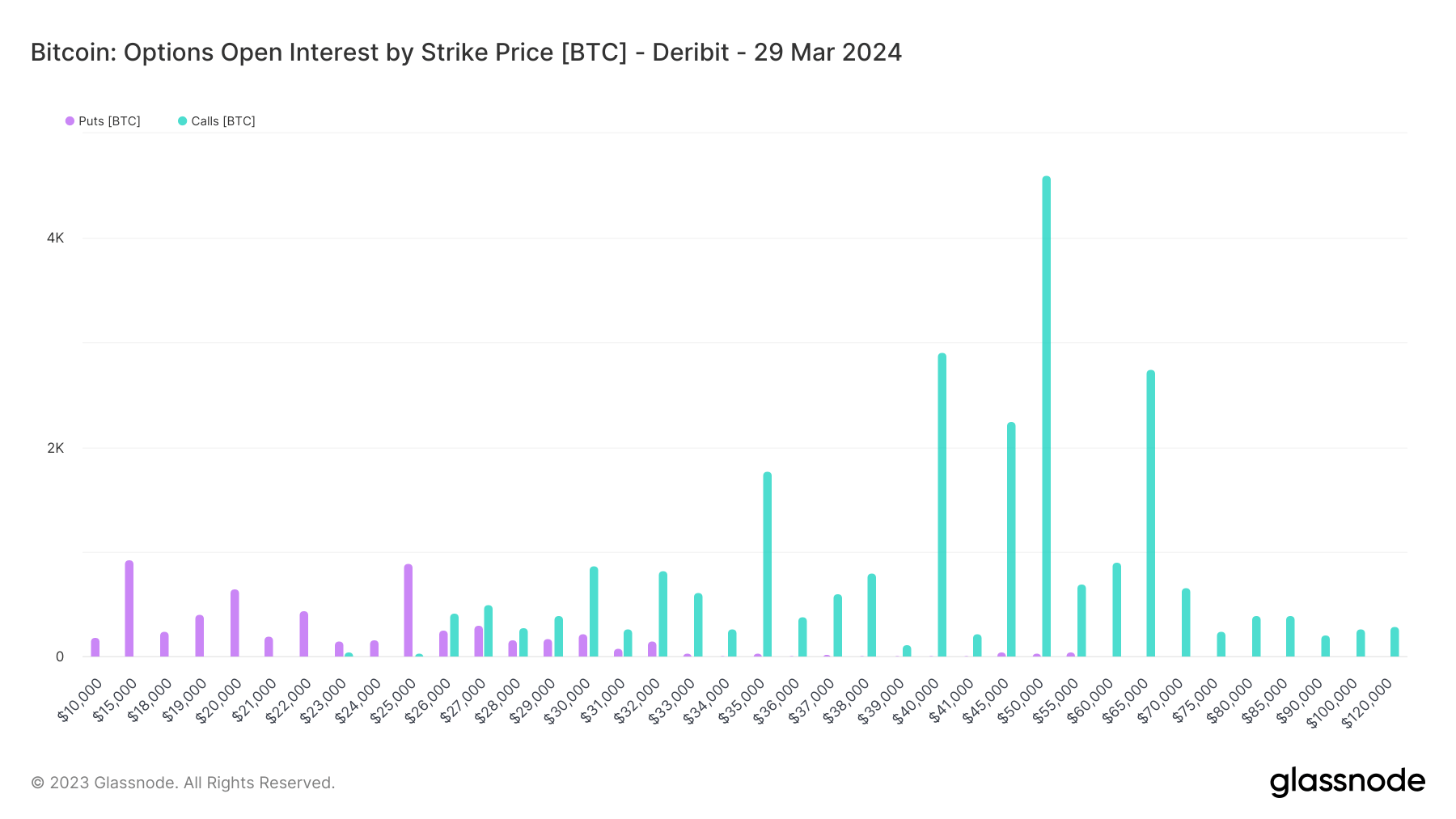

Looking ahead to Q1 2024, the total open interest of call and put options by strike price reveals that traders are targeting $50,000, particularly around the halving period in April 2024 and amidst speculation of a potential spot ETF. This is indicative of a strong belief in Bitcoin’s continued growth.

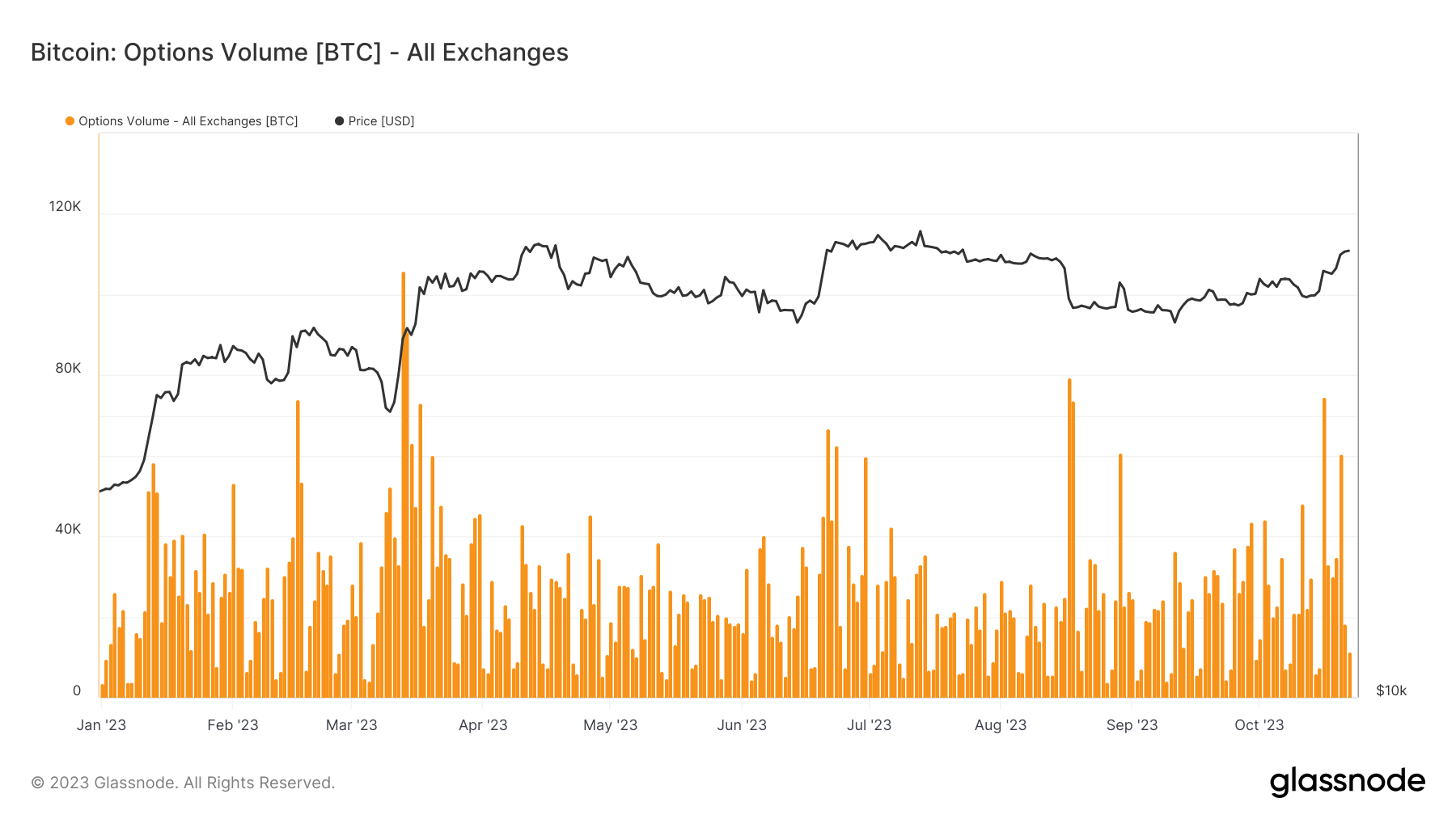

Additionally, the options market has shown a surge in volume traded over the past week. With over 60,000 Bitcoin in options contracts traded on two separate days, these activity levels are among the highest seen this year, pointing to heightened interest and robust activity in the Bitcoin options market.