Bitcoin tumbles to $66,000 triggering over $240 million in market liquidations

Bitcoin tumbles to $66,000 triggering over $240 million in market liquidations Quick Take

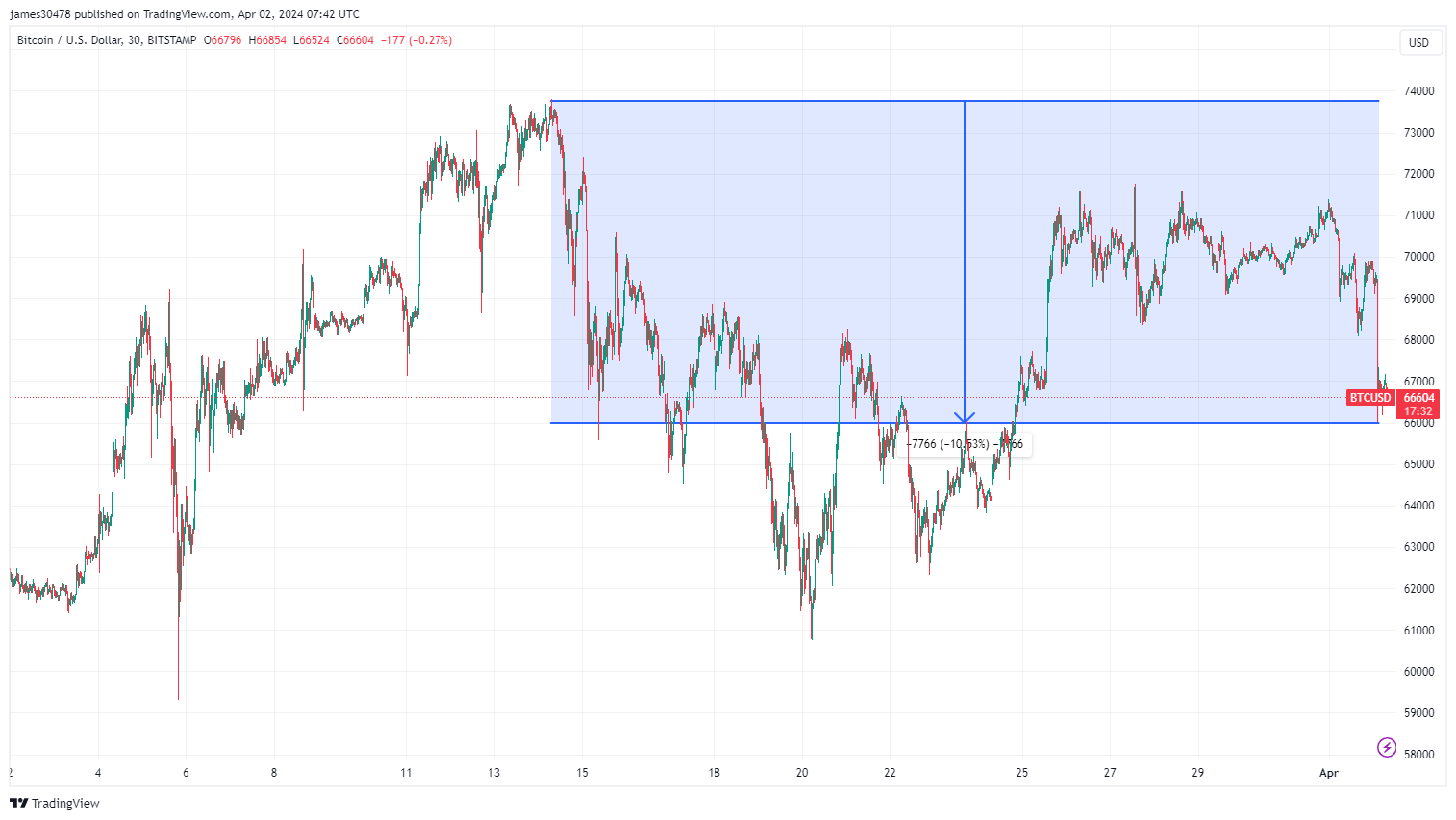

Bitcoin’s price took a tumble on April 2, briefly dipping just to $66,000 before recovering slightly to around $66,500 as of press time. This drop from the digital assets’s all-time high of approximately $73,500 on March 14 represents roughly a 10% decline.

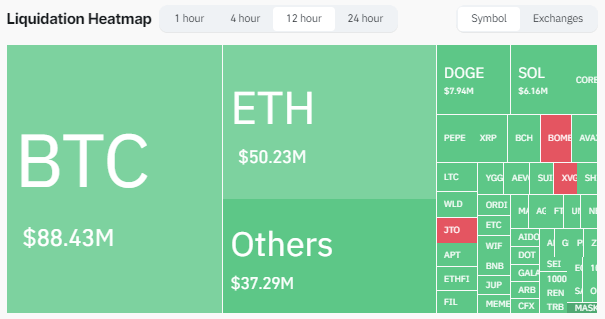

Coinglass data shows that the plunge triggered a flurry of liquidations across the digital asset ecosystem, with over $240 million worth of positions being closed out in the past 12 hours. A staggering $190 million of long positions were liquidated, significantly outweighing the roughly $50 million in short liquidations. Almost $400 million has been liquidated across all assets in the last 24 hours.

Coinglass data reports that Bitcoin accounted for the lion’s share of the bloodbath, with $88.43 million in total liquidations. A noteworthy $63 million consisted of long positions being closed out. This marks Bitcoin’s largest long liquidation event since March 19, underscoring the volatility that continues to roil the leading digital asset.