Bitcoin experiences near-historic levels of net profit realization

Bitcoin experiences near-historic levels of net profit realization Quick Take

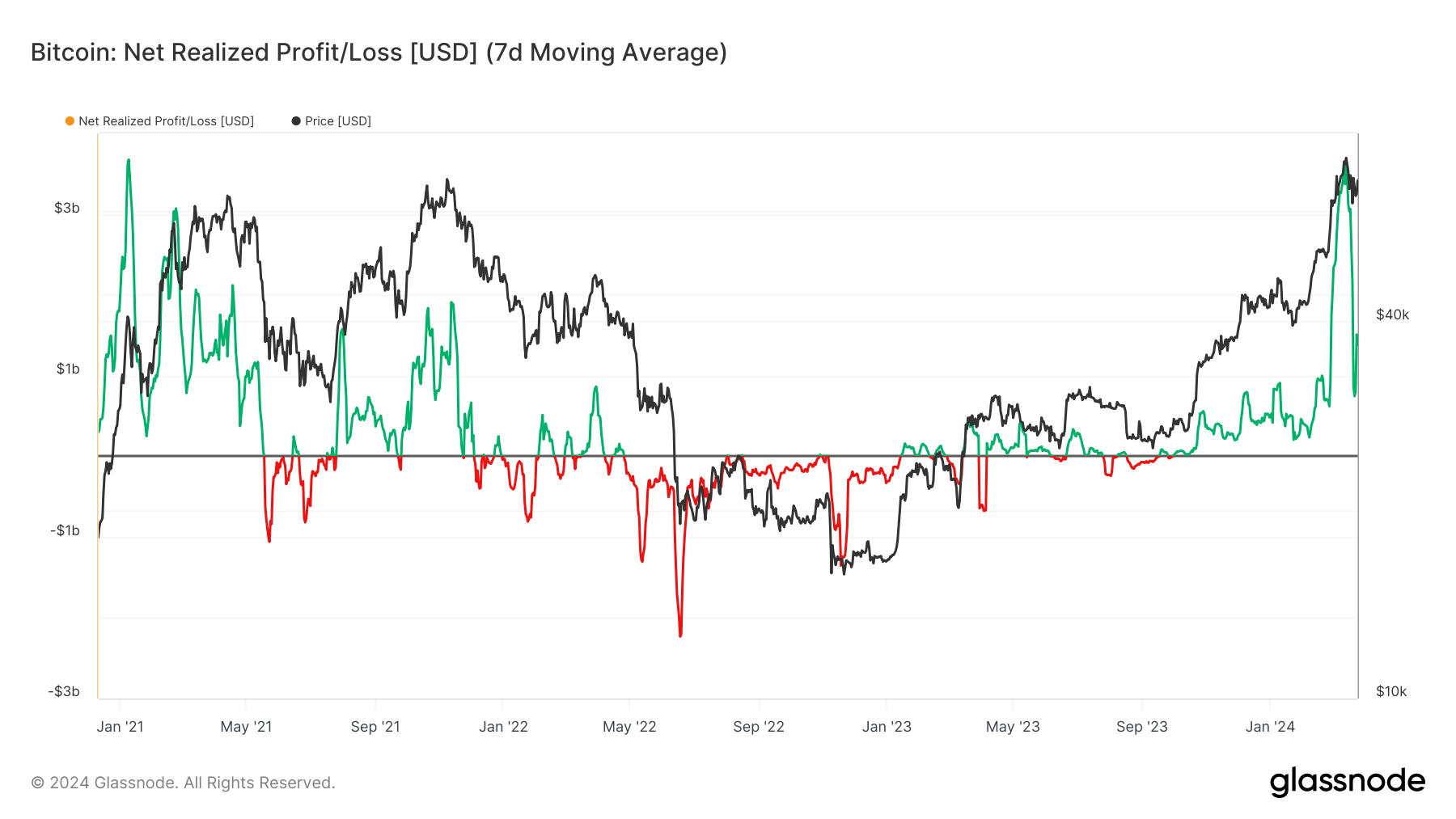

Analyzing Bitcoin’s net profit/loss, a key metric calculated from the difference between realized gains and losses. Utilizing a seven-day moving average to sift through the noise and pinpoint a more accurate trend, Bitcoin’s net realized profit nearly matched its record high set in January 2021 – a whopping $3.8 billion.

This trend was particularly notable on March 14, when Bitcoin reached its zenith of roughly $73,600, witnessing approximately $3.6 billion in net realized profit.

Interestingly, this cyclical trend of net realized profit-taking has been on the rise. On Feb. 26, CryptoSlate recorded a 128-day net realized profit-taking. Fast forward a month, and the number surged to 157 days, surpassing the 155-day period in 2021.

As of March 24, net realized profit dropped to $1.5 billion, slightly higher than pre-peak figures but less than half of the peak at $3.6 billion. This decline corresponds with Bitcoin’s dip from its peak, an event largely attributed to the record profit-taking.