Bitcoin’s price is “very attractive” because of this one simple indicator

Bitcoin’s price is “very attractive” because of this one simple indicator Bitcoin’s price is “very attractive” because of this one simple indicator

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Following an extended bout of sideways trading, Bitcoin and the aggregated cryptocurrency market has been able to post some decent upwards momentum, with BTC climbing above its previous key resistance level at $9,000.

The latest upwards movement was not entirely unexpected, as one prominent analytics firm had previously noted that on-chain data seemed to suggest that Bitcoin was bound to see a rebound.

The same firm is now noting that this uptrend may be far from over, as multiple fundamental metrics seem to paint a bullish picture for what’s to come next for the benchmark cryptocurrency.

Bitcoin’s on-chain fundamentals recover as network activity increases

In their latest “Week On-Chain” report, Glassnode explained that Bitcoin is currently seeing heightened network activity, which comes in tandem with the cryptocurrency’s recent price rise from lows of $8,700 to its current price of $9,100.

“Along with price, on-chain fundamentals also show signs of recovering, with the number of transactions and active entities in the network on the rise.”

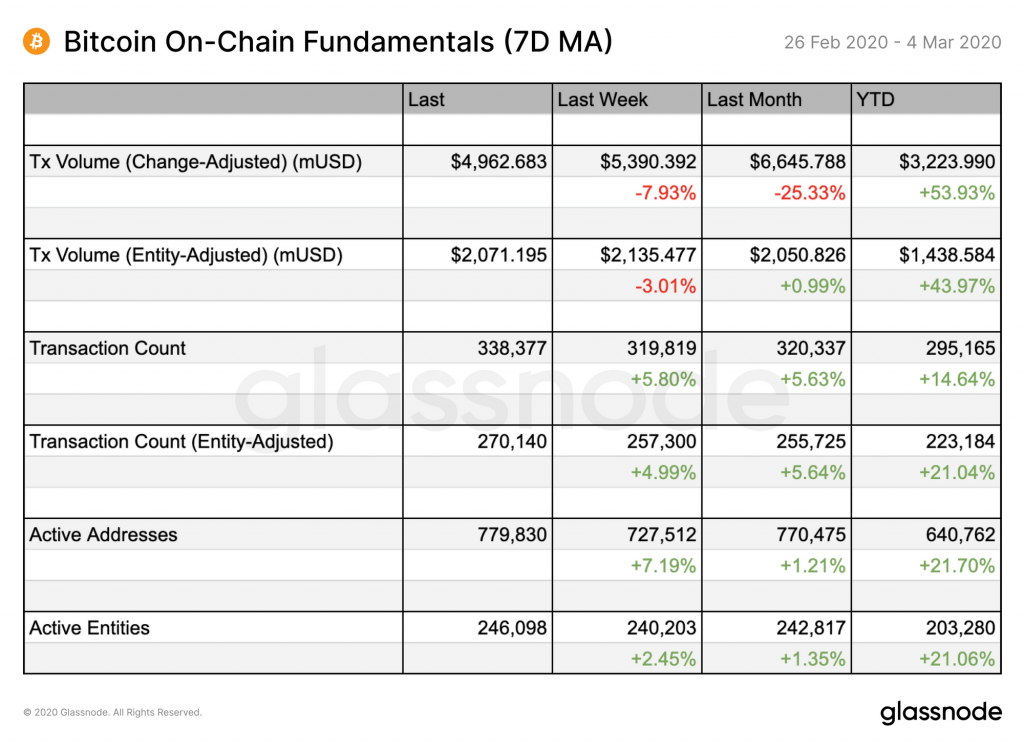

Over a one-week period, the only network figure that have decreased has been Bitcoin’s transaction volume – both change-adjusted and entity adjusted – which have declined by 7.9 percent and 3 percent respectively.

Other indicators of network activity, including active addresses, transaction counts, and active entities have all increased, climbing 7.2 percent, 5.8 percent, and 2.4 percent respectively.

This increase in network activity also coincides with a boost in investor confidence, with Bitcoin’s ASOL indicator seemingly suggesting that long-term investors are incredibly confident in the cryptocurrency’s near-term future.

Glassnode spoke about this in their report, noting this indicator’s value is quite low, which is a positive sign for sentiment surrounding the crypto.

“ASOL (Average Spent Output Lifespan) represents long-term investor confidence by showing when long-term HODLers are exiting the market… ASOL levels remain low, supporting the thesis that long-term investors are not exiting their positions.”

This indicator shows BTC’s price may be “very attractive”

Heaping on to the bullish narrative that all these aforementioned factors support is the fact that the crypto’s “Reverse Risk” is currently at low levels, which means that Bitcoin’s risk/reward ratio is “attractive.”

“This metric, which is used to assess the confidence of long-term holders relative to price, shows high investor confidence in BTC at current price levels. Along with other on-chain fundamentals, it suggests that BTC has more room to grow imminently.”

The culmination of all these factors certainly seems to suggest that Bitcoin’s ongoing upswing has significantly further room to extend.