Bitcoin’s biggest ally could surprisingly be central banks: analysis

Bitcoin’s biggest ally could surprisingly be central banks: analysis Bitcoin’s biggest ally could surprisingly be central banks: analysis

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

To most, Bitcoin’s rally from literal irrelevance to being one of the most valuable assets in the world is hard to explain. After all, a digital coin that was once given away for free through “faucets” is now worth over $7,000 a pop.

A new analysis, though, has weighed in on one of the potential trends behind BTC’s macro movements. And this analysis suggests that the cryptocurrency is likely on the verge of its biggest rally yet, one that will take it past its $20,000 all-time high.

Central banks could prove to be Bitcoin’s biggest ally

While central banks are unlikely to ever outright buy Bitcoin as they do with bonds and other asset classes, the cryptocurrency could benefit greatly from these centralized monetary authorities, new analysis has found.

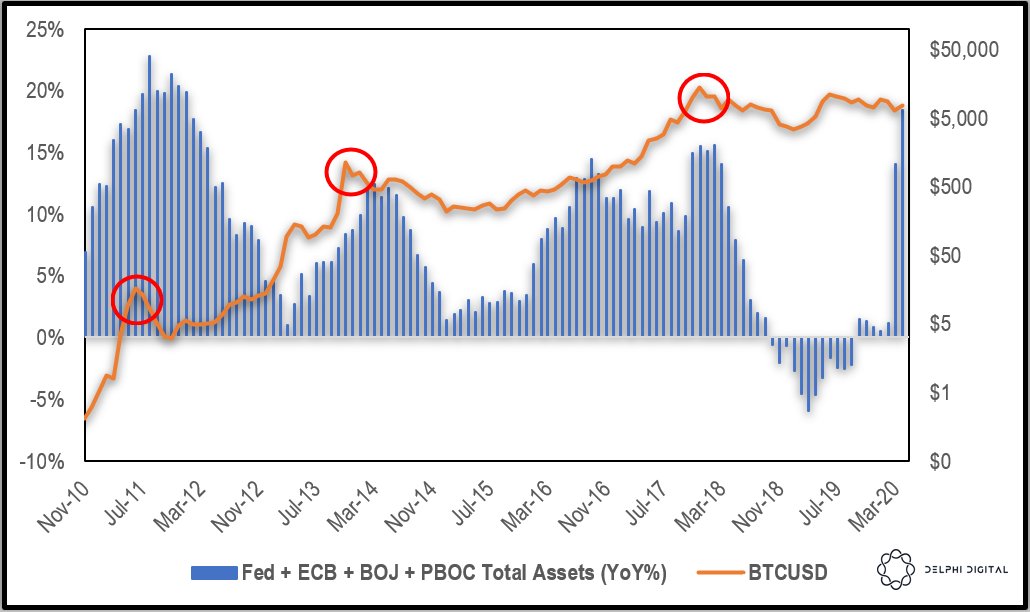

Teddy Vallee — founder and CEO of Pervalle Global, a global macro hedge fund — recently published the chart seen below.

Highest conviction view over the next 1-3 yrs is that CB balance sheets are going in one direction – up. Given this premise, it seems the best form of expression is via $BTCUSD. While the chart below will need to prove itself, it holds weight both empirically and intuitively. pic.twitter.com/GIjOa15hJ4

— Teddy Vallee (@TeddyVallee) April 23, 2020

Although the investor was hesitant to call the chart perfect, he explained that there’s a potential correlation between the total amount of assets the world’s central banks (Federal Reserve, Bank of Japan, etc.) and the value of Bitcoin on a logarithmic scale.

For instance, when central bank balance sheets started to plunged in early-2018, so did the crypto market. It didn’t happen on the same date, but the tops line up from a long-term perspective.

So why does it matter today?

Well, ever since the coronavirus crisis began, central banks have gone into overdrive, printing trillions of dollars in an attempt to save the economy. The Federal Reserve’s balance sheet alone has gone up by $2 trillion in the past two months.

The trend the chart depicts holding, even loosely, means that Bitcoin is highly likely to surpass its all-time high above $20,000 in the coming years, with the value of central bank balance sheets topping its last high set when the crypto market top.

Kevin Kelly, the co-founder of crypto research firm Delphi Digital, backed up this sentiment with the below chart, writing that the reacceleration in the growth of balance sheets is “bullish [for] Bitcoin.”

It’s not a perfect chart, but the argument makes sense

As a note, some did argue that the correlation between these two metrics may be spurious rather than truly cointegrated.

But, analysts say that fundamentally, central bank asset buying, especially in the quantities we’re currently seeing, is decisively positive for Bitcoin, whether or not the abovementioned correlation exists.

Per previous reports from CryptoSlate, Dan Morehead — a Wall Street trader-turned-head of one of the first crypto funds, Pantera Capital — explained in a recent newsletter:

“As governments increase the quantity of paper money, it takes more pieces of paper money to buy things that have fixed quantities, like stocks and real estate, above where they would settle absent an increase in the amount of money. The corollary is they’ll also inflate the price of other things, like gold, bitcoin, and other cryptocurrencies.”

Michael Novogratz, CEO of Galaxy Digital, corroborated this. He said to Bloomberg that he thinks BTC has become a “macro weapon” due to its potential to weather the impending economic crisis as an asset that is scarce, much unlike fiat money.