Bitcoin briefly flips Tesla, becomes the 10th largest asset by market cap

Bitcoin briefly flips Tesla, becomes the 10th largest asset by market cap Bitcoin briefly flips Tesla, becomes the 10th largest asset by market cap

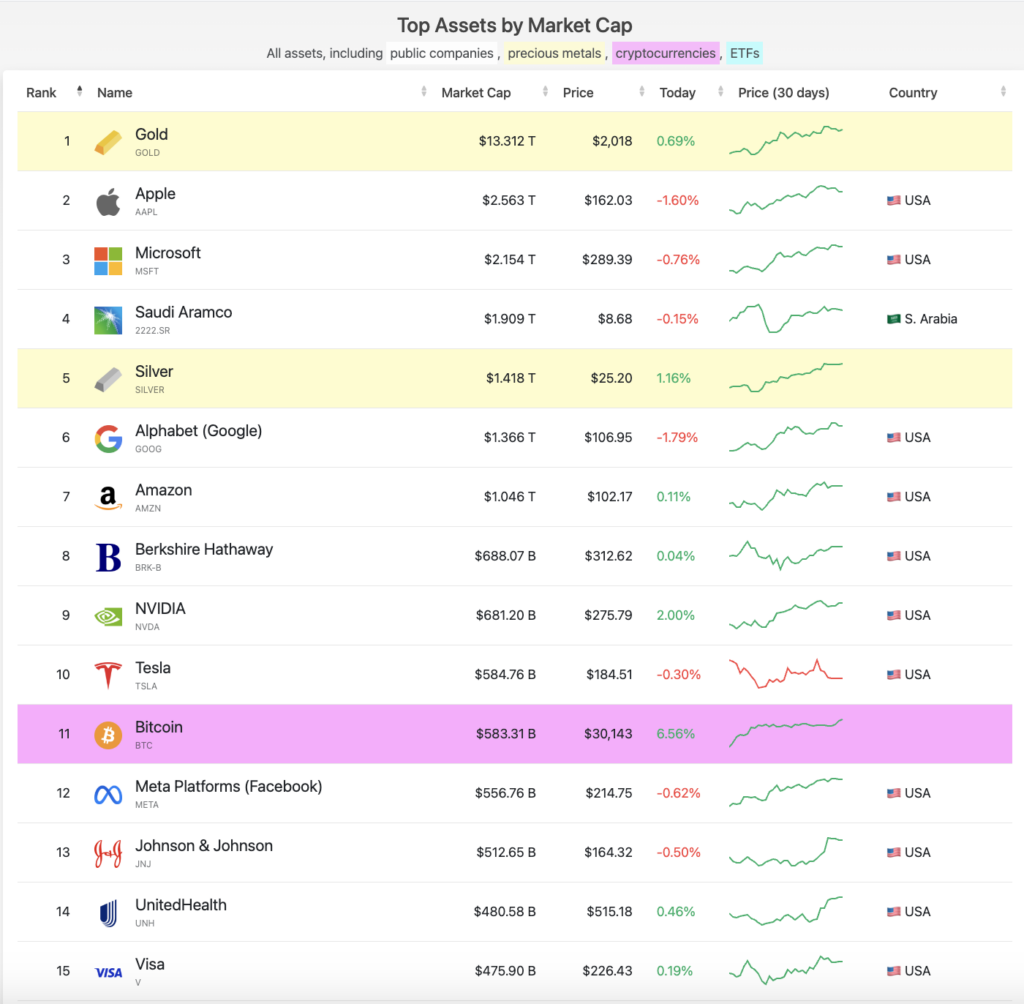

Bitcoin's rally past $30,000 put it in the top 10 assets by market capitalization — briefly surpassing Tesla's $584.7 billion value.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin (BTC) rallied last night to a 10-month high, peaking at $30,380 after two days of a meteoric rise. In that rally, BTC’s market cap hit $585.05 billion — briefly making it the 10th largest asset in the world.

While BTC has since consolidated to just over $30,000 — potentially creating some support — the market sentiment remains overwhelmingly bullish.

Data from CompaniesMarketCap showed BTC spent several hours above Tesla — whose $584.7 billion market cap ranked it 11th among the top 100 public companies, , cryptocurrencies, and ETFs. The consolidation to $30,000 pushed Bitcoin back to 11th place — allowing Tesla to reclaim its 10th place.

However, BTC still ranks higher than Facebook’s Meta — whose $556.7 billion market cap makes it the 12th largest asset in the world.

This isn’t the first time Bitcoin surpassed established, legacy corporations. However, this is the first time public companies could experience significant turmoil in the near future.

Current macroeconomic conditions spell trouble for stocks and other assets. If the U.S. market enters stagflation — rather than a recession — stock prices would be the first to take a beating. A decade of low interest rates and a historically unprecedented pandemic stimulus have pumped stock prices to their all-time highs.

Maintaining those prices through rising interest rates and a potential stagflation will be difficult and could lead to massive losses across markets. As more investors rush to Bitcoin as a way to protect their liquidity, we could see another major rally that pushes Bitcoin past Tesla again — and closer to trillion-dollar giants like Amazon and Alphabet.