The return of Ethereum food coins? Multiple DeFi tokens surge hundreds of percent

The return of Ethereum food coins? Multiple DeFi tokens surge hundreds of percent The return of Ethereum food coins? Multiple DeFi tokens surge hundreds of percent

Early in September, every Ethereum developer was launching tokens branded with a type of food. There was Pizza Finance, Tendies, Springroll Finance, and projects based on almost any food under the sun.

It’s no secret that the market got quickly saturated. This resulted in a decline in the value of these tokens as many realized they were blatant copycats of more reputable projects like Yam Finance and SushiSwap.

But in a weird turn of events, certain food coins have begun to surge hundreds of percent off their lows. Here’s more on why.

Food-themed Ethereum tokens surge hundreds of percent

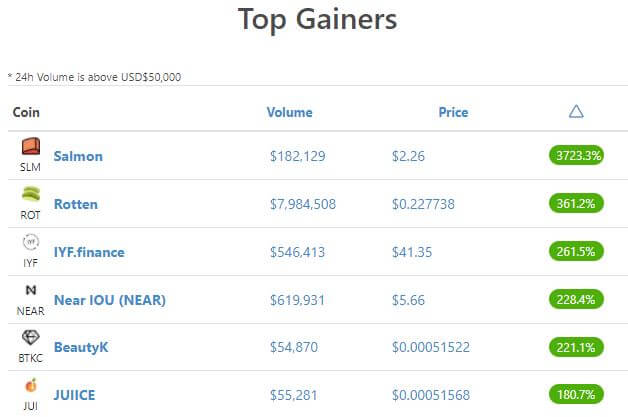

According to CoinGecko, three out of the six top-performing cryptocurrencies are food tokens. Salmon (SLM), a Tron-based food farming project, has gained 3,700 percent in the past 24 hours while Rotten and Juiice have each gained hundreds of percent apiece.

Adding to this, there is a swath of other food coin projects such as Donut, Tacos, and Shroom that have gained dozens of percent in the past 24 hours.

Many of these food coins, namely Rotten and Shroom, are benefiting from an ongoing transition from traditional yield farming to non-fungible token (NFT) farming. This is in an attempt to capitalize on the ongoing digital art craze, where users are spending thousands to buy NFTs representing jpgs and gifs.

Yield farming not sustainable in the long term

Despite the ongoing pivots to service the NFT market that is likely boosting these Ethereum tokens in the short term, most analysts still assert that in the long run, food coin farming is not sustainable.

Tony Sheng, a former analyst at Multicoin Capital now heading a new project called Cozy Finance, commented on food coins in August:

“i’m pretty scared by this grocery coin thing. not for defi insiders who know how to diff contracts and manage their own risk, but for their friends and friends of friends who show up to play the ‘game’. A big loss of funds is inevitable be it a hack or a scam.”

i'm pretty scared by this grocery coin thing

not for defi insiders who know how to diff contracts and manage their own risk

but for their friends and friends of friends who show up to play the "game"

a big loss of funds is inevitable be it a hack or a scam

— Tony Sheng (@tonysheng) August 19, 2020

This skepticism about the long-term sustainability of yield farming and the price of these food coins has been echoed by others in the space.

Ethereum founder Vitalik Buterin once weighed in:

“It’s a short-term thing. Once these enticements disappear, you could easily see the yield rates drop back down to close to 0%. […] That’s not something that could make DeFi break, but it should definitely be a sign that [this isn’t something] we should be pushing it out in front of the entire world [right now].”