Investors bullish as Ethereum (ETH) settles $6.2 trillion in transactions over the last 12 months

Investors bullish as Ethereum (ETH) settles $6.2 trillion in transactions over the last 12 months Investors bullish as Ethereum (ETH) settles $6.2 trillion in transactions over the last 12 months

Ethereum continues powering on despite a range of concerns over its viability.

Image by Miloslav Hamřík from Pixabay

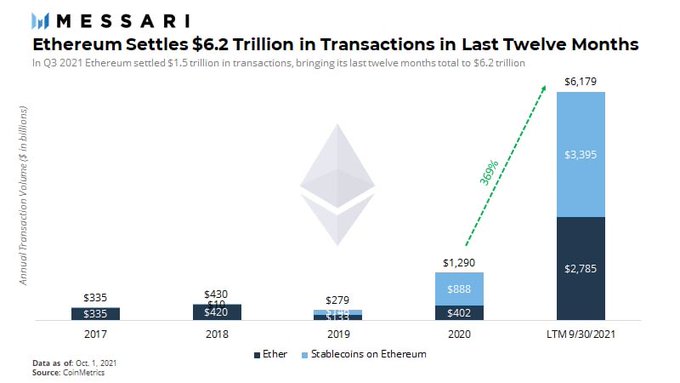

According to data analysis firm Messari, Ethereum settled $6.2 trillion over the last twelve months. More impressive is that this figure is up over 350% compared to the previous twelve-month period.

Messari Researcher Ryan Watkins signed off the tweet saying, “[it’s] probably nothing.”

“In the past 12 months Ethereum settled $6.2 trillion in transactions.

This figure is up 369% compared to 2020, and was powered by a strong Q3 where Ethereum settled $1.5 trillion.

Probably nothing.“

However, the data suggests the Ethereum economy is going from strength to strength. Even despite the limited effect of the London upgrade, intensifying competition from other smart contract platforms, and late August’s chain split bug.

Nonetheless, in a display of doggedness, some might even say sheer stubbornness, the Ethereum chain continues pushing on.

Ethereum rises despite the woes

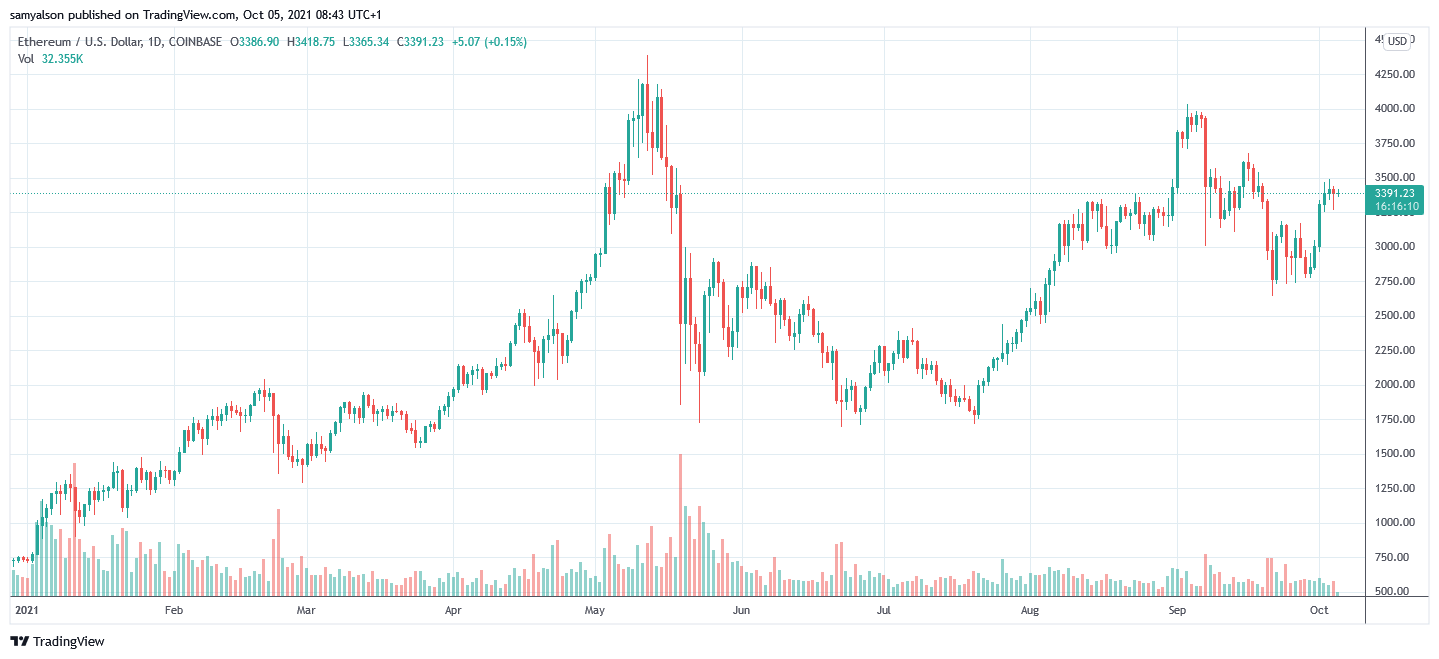

September was a difficult month for Ethereum. From start to end, it lost 22% in value against the dollar, finding support at $2,750 during the final week of the month.

But a decisive break above $3,180 resistance on October 1 showed investors had not lost faith and bought the dip when the opportunity arose.

Nonetheless, September is a month best forgotten. Firstly, the London upgrade, which went live on August 5, was supposed to stabilize gas fees. But fee spikes in September demonstrate that the upgrade is not fit for purpose.

Last month, Cardano rolled out Alonzo, bringing smart contract functionality to the chain. While it’s still early days in terms of building out its ecosystem, fears of “eating Ethereum’s lunch” are rampant.

Also, a recent chain split caused by a hacker exploiting a coding bug brought renewed concerns over Ethereum’s security.

However, Mati Greenspan, the founder of Quantum Economics, played down these incidents. He said there’s no doubt that these factors have led to “impact on the speculation side.” However, he pointed out that September was a challenging period for the entire crypto market as a whole.

“But don’t forget that ethereum has appreciated quite handsomely so far this year and the entire market seems to be in consolidation at this time. So I wouldn’t try to read too deeply into these short-term movements.”

How is this happening?

Twitter user @robdogeth posted his thoughts on why Ethereum continues pushing higher. He laid out an argument that Ethereum has become the most efficient economic system known.

Touching on a range of factors, such as transparency, no regulation, and globalization, he concluded by saying the chain has become the go-to choice for sucking up capital as institutions switch from legacy to crypto.

“A black hole for capital

With tremendous growth, efficiency and talent, comes a plethora of opportunities to deploy capital. Private investors and institutions are dumping their old bags for cryptos, and once your money gets sucked into crypto it has no reason to leave.”

With questions over the protocol’s soundness, high gas fees, and intensifying competition, it’s illogical that Ethereum is where it is.

But since when was crypto logical?