Resurgent stablecoin flow into Bitcoin marks possible market shift

Resurgent stablecoin flow into Bitcoin marks possible market shift Quick Take

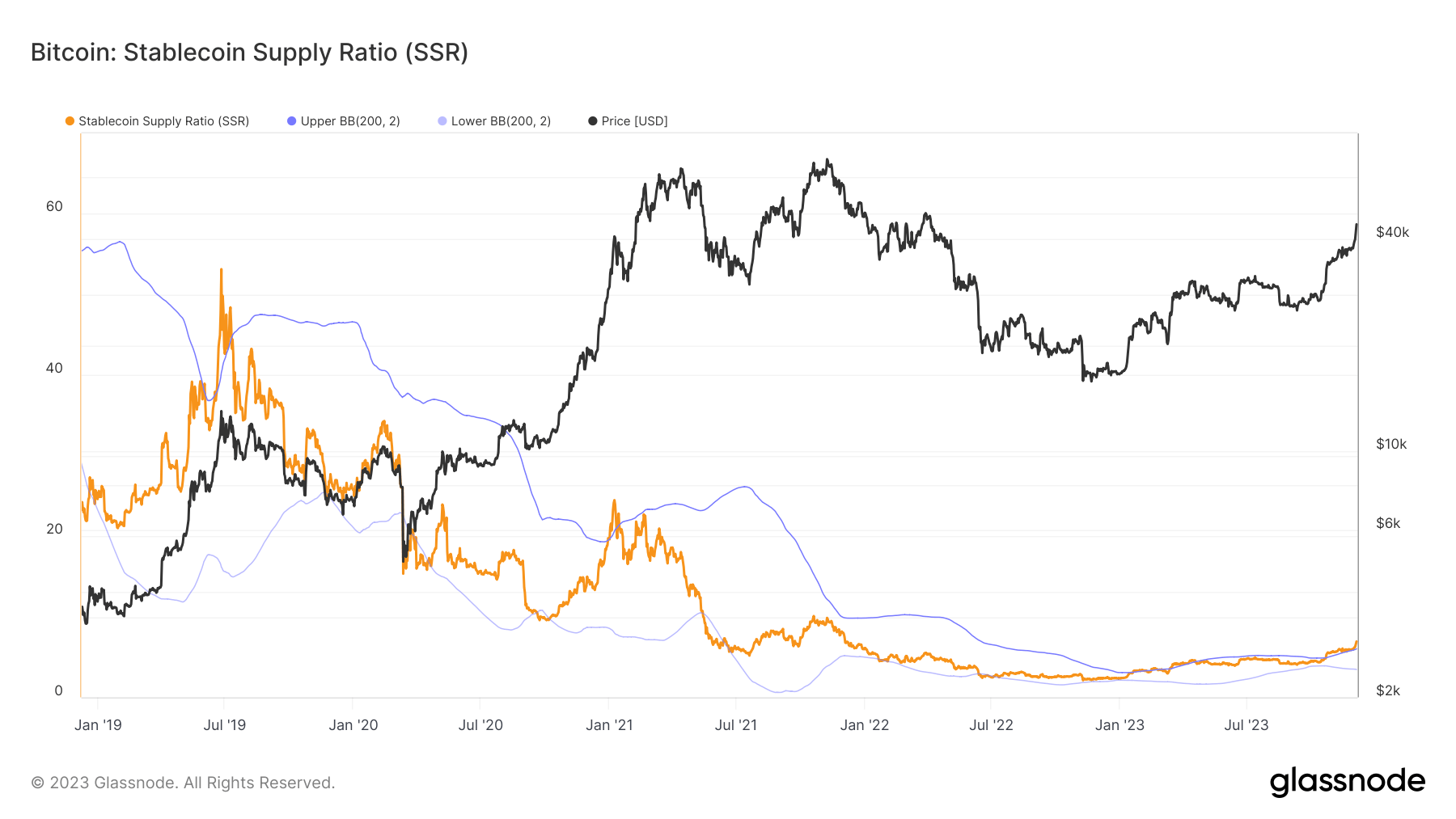

The Stablecoin Supply Ratio (SSR), a critical parameter gauging the buying power of stablecoins against Bitcoin, has seen significant movement lately. This ratio, calculated as Bitcoin Market Cap divided by Stablecoin Market Cap, offers key insights into the supply-demand dynamics between Bitcoin and USD. The lower the SSR, the greater the potential purchasing power of current stablecoins for Bitcoin.

The SSR surpassed its upper bound in late October, indicating a potential oversupply of Bitcoin relative to stablecoins. Interestingly, recent data indicates a resurgent stablecoin influx into Bitcoin, suggesting a possible market shift.

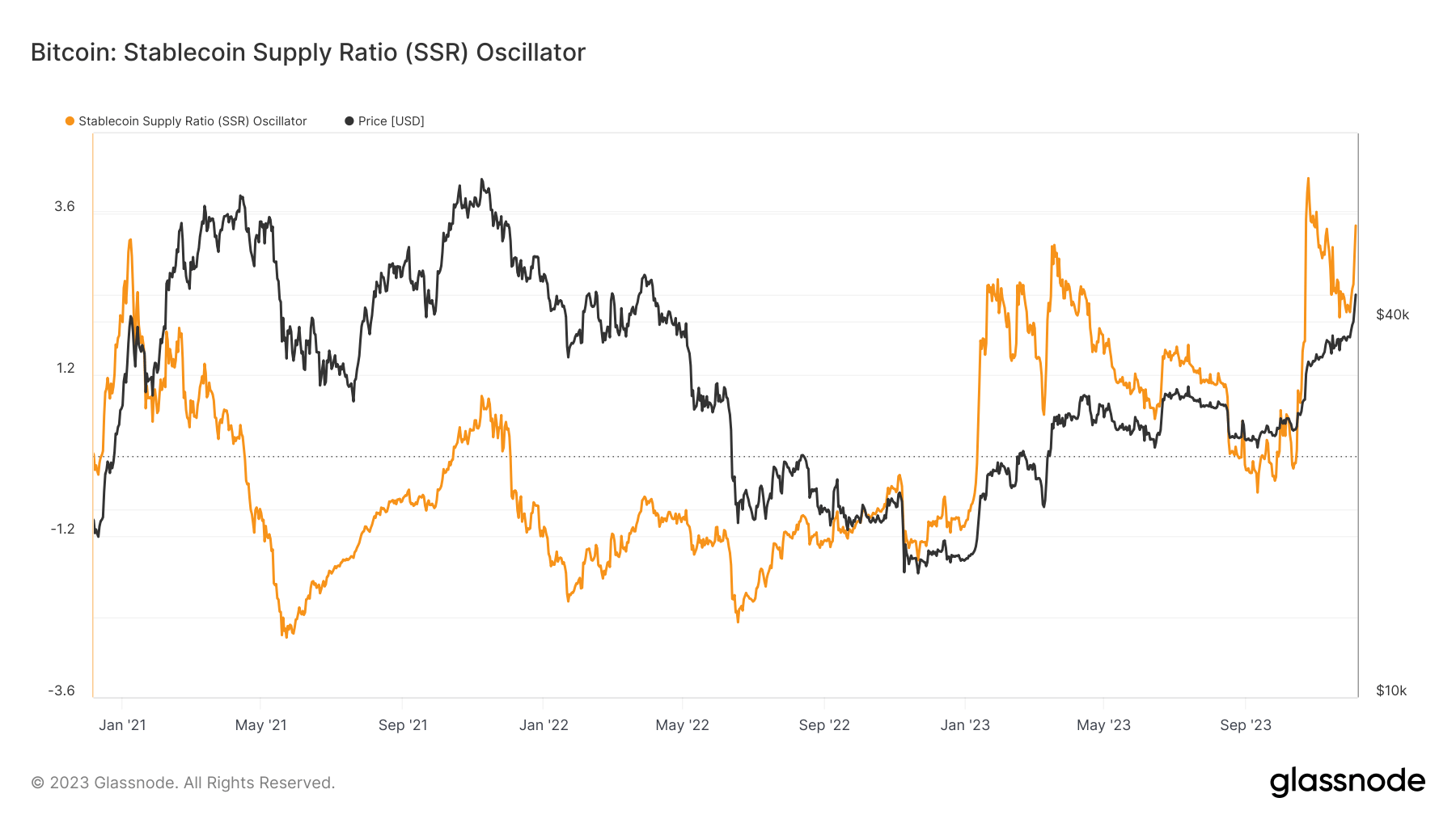

This observation finds support in the Stablecoin Oscillator, an analytical instrument deriving from the SSR. The Oscillator measures the movement of the 200-day Simple Moving Average (SMA) of the SSR within the Bollinger Bands (BB).

A recent reading records the Oscillator at 3.42, slightly down from the October high of over 4.1. However, this uptick substantiates the recent surge in stablecoin rotation into Bitcoin, particularly visible during the latest Bitcoin pump.