Ethereum (ETH) outflows spike to ATHs after dip to $4,000

Ethereum (ETH) outflows spike to ATHs after dip to $4,000 Ethereum (ETH) outflows spike to ATHs after dip to $4,000

Data shows confidence in Ethereum wasn't affected by its recent dip.

Photo by Art Rachen on Unsplash

On-chain data shows that Ethereum exchange outflows reached their all-time highs yesterday as ETH lost almost 15% of its value, dipping as low as $4,000.

This shows that the majority of Ethereum holders retained their confidence in the token and have been buying the dip en masse.

Ethereum holders were quick to buy yesterday’s dip

While this week’s market correction might have looked scary to some, experienced traders seem to have jumped at the opportunity to buy the newly presented dip.

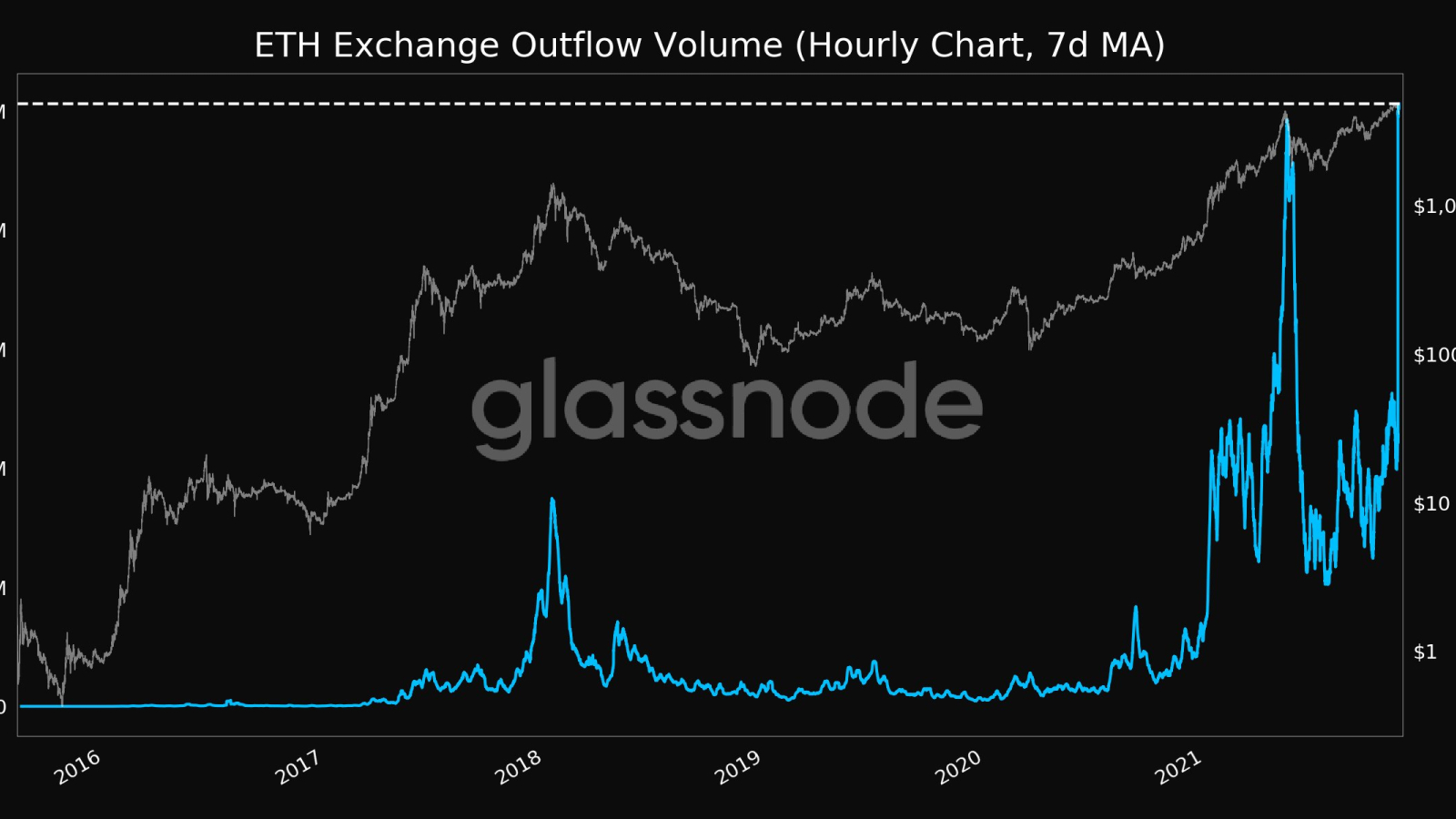

According to data from crypto analytics platform Glassnode, Ethereum’s outflow volume from exchanges reached its all-time high yesterday, topping $100 million in a day. This means that traders and investors are withdrawing their funds from exchanges, actively removing the selling pressure on ETH.

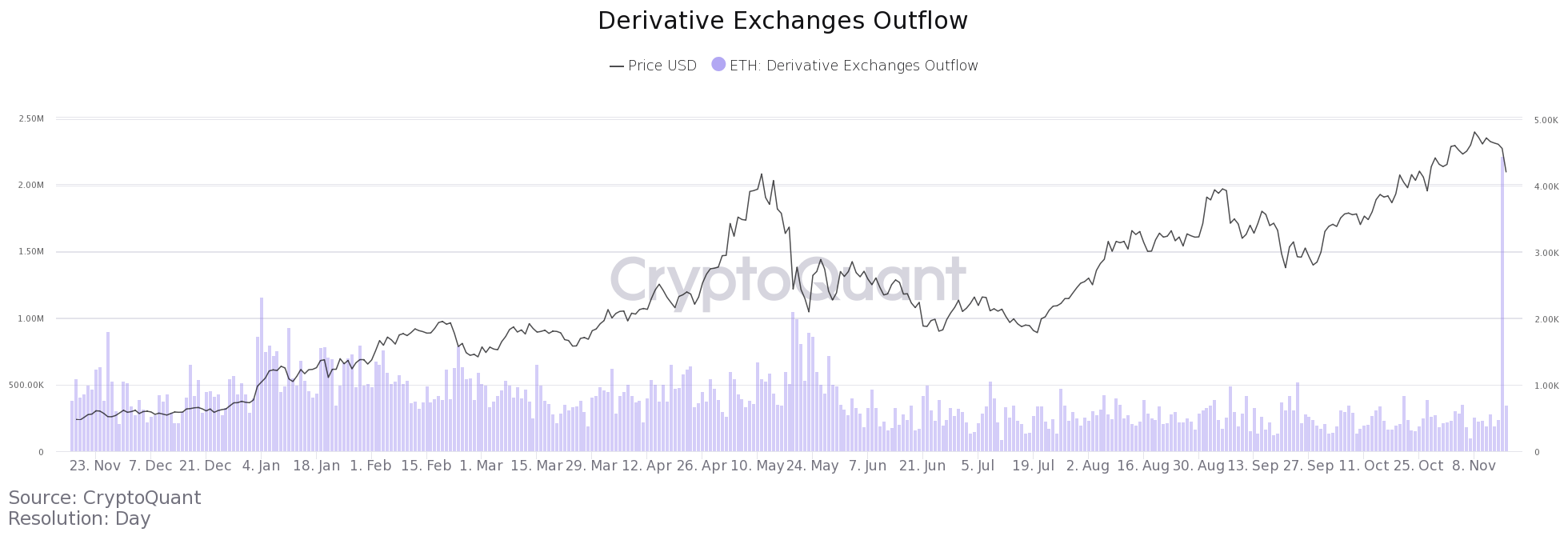

Further analysis of exchange data showed that there has also been a significant increase in derivative exchange outflow. Data from CryptoQuant showed that there has been an almost tenfold increase in the number of ETH withdrawn from derivative exchanges between November 14th and November 15th.

As most increases in exchange outflow correlate with price increases, it’s safe to say that a significant number of Ethereum traders and investors used this week’s dip to increase their holdings. We are yet to see how other on-chain metrics, including price, react to the sudden lack of ETH on exchanges in the long run.