Bitcoin miner Hut 8 to develop mining facility for bankrupt Celsius in Texas

Bitcoin miner Hut 8 to develop mining facility for bankrupt Celsius in Texas Bitcoin miner Hut 8 to develop mining facility for bankrupt Celsius in Texas

Hut 8 said mining site will house around 66,000 miners and will be powered by more than 215 megawatts (MW) of energy.

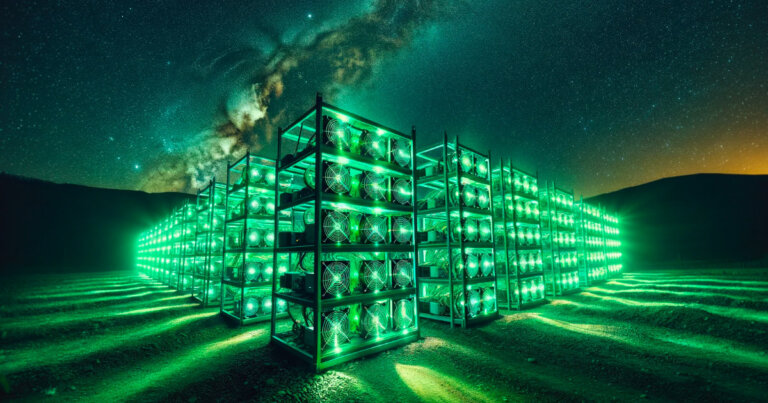

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin (BTC) miner Hut 8 said it signed an interim agreement to build and install mining operations for bankrupt crypto lender Celsius in Cedarvale, Texas, according to a Dec. 18 statement.

The proposed mining site will house around 66,000 miners and will be powered by more than 215 megawatts (MW) of energy.

Under the agreement, construction for the site will begin in a few weeks. Hut 8 will provide end-to-end development services, including design, engineering, financial modeling, budgeting, accounting, construction management, procurement, and logistics.

Hut 8 president Asher Genoot said the firm’s goal is “twofold,” saying:

“[The first] is to build equity with creditors of Celsius while also growing the strength and vitality of our managed services business, which we anticipate will have more than 895 MW of infrastructure under our umbrella once the site is up and running.”

Meanwhile, the news did not impact Hut 8 shares, down by around 1% pre-market to $10.40 as of press time, according to Yahoo Finance data.

Hut 8 is a newly launched Bitcoin mining firm formed from the merger of Hut 8 Mining Corp., a North American Bitcoin miner, and US Bitcoin Corp (USBTC).

Celsius’s bankruptcy

Celsius was one of the numerous cryptocurrency lending firms, including Genesis, BlockFi, and others, that capitulated last year due to their risk management framework and reckless dealings.

Following its bankruptcy, several regulatory authorities across different states in the United States filed actions against the company.

Subsequently, the Federal Trade Commission (FTC) reached a record $4.7 billion settlement with Celsius. The regulator also permanently banned the firm from offering any product or service that could be used to deposit, exchange, invest, or withdraw any assets.

Additionally, other U.S. federal agencies, like the Securities and Exchange Commission (SEC), brought legal actions against the firm’s CEO, Alex Mashinsky.

However, the lender’s bankruptcy process is gradually ending as it opened withdrawals for eligible custody users last month. CryptoSlate reported that several users of the defunct firm complained about the slow process.