Spot Bitcoin ETFs see ninth consecutive day of inflows with Fidelity leading the charge on the day

Spot Bitcoin ETFs see ninth consecutive day of inflows with Fidelity leading the charge on the day Quick Take

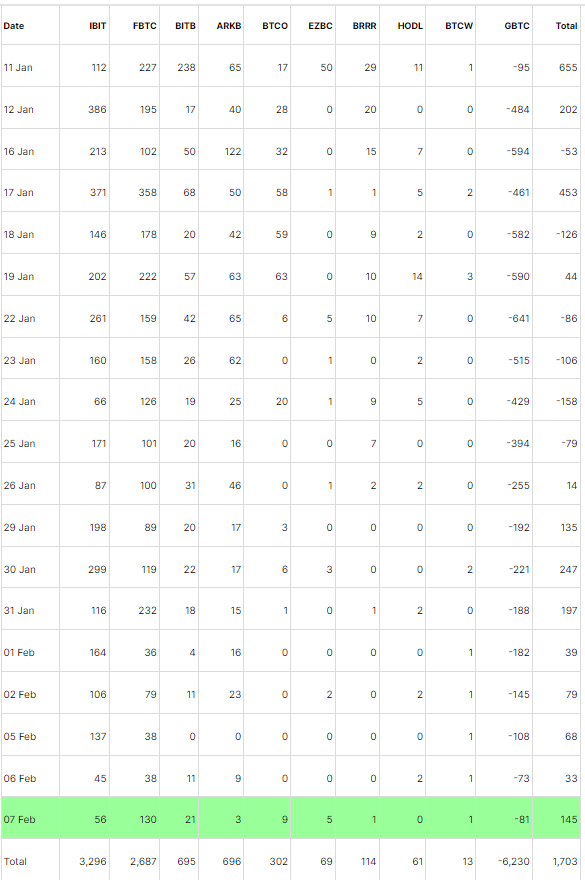

On Feb. 7, spot Bitcoin ETF products witnessed a solid net inflow, marking the ninth consecutive day of net inflows, Farside Investors data shows.

This inflow was the highest so far in February, with Farside Investors reporting a hefty $145 million net inflow. Fidelity’s FBTC emerged as the frontrunner, registering $130 million in net inflows. This was FBTC’s highest net inflow since Jan. 31, boosting its total net inflows to $2.7 billion.

Meanwhile, BlackRock’s IBIT exhibited a modest $56 million net inflow, a figure that elevated its total net inflows to a hefty $3.3 billion. On the other hand, according to Farside Investors, GBTC experienced a minor net outflow of $81 million, deepening its total net outflows to a stark -$6.2 billion.

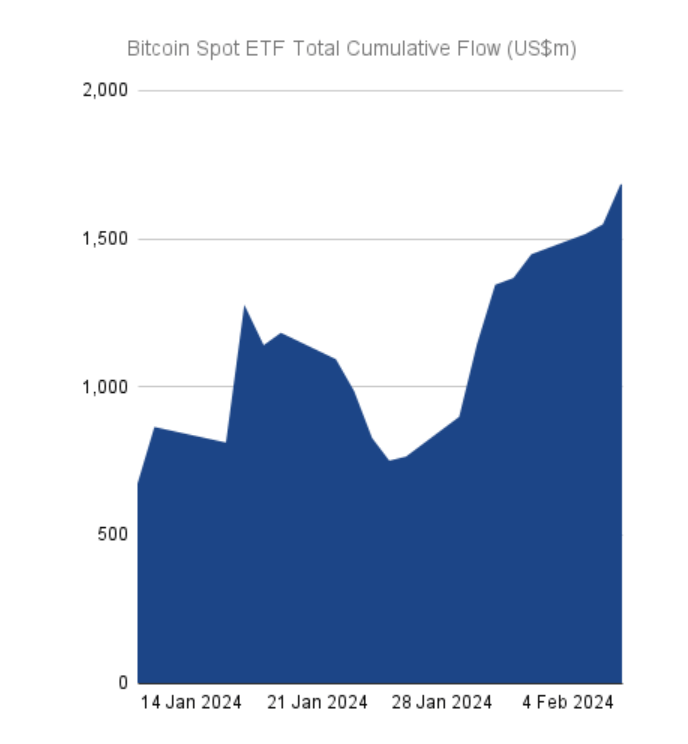

Despite the GBTC outflows, the overall scene remained positive, with total net inflows reaching a robust $1.7 billion, indicating investor confidence in Bitcoin ETF products.

Farside Investors

Farside Investors

CoinGlass

CoinGlass