Massive staked Ethereum withdrawals by whales allow arbitrageurs to profit

Massive staked Ethereum withdrawals by whales allow arbitrageurs to profit Massive staked Ethereum withdrawals by whales allow arbitrageurs to profit

Peckshield also reported that a whale withdrew 42,400 stETH from Aave.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Lido (LDO) staked Ethereum (stETH) traded at a discount to Ethereum (ETH) on Curve after a whale removed 84,131 ETH ($101 million) from the protocol, allowing arbitrageurs to profit from the situation.

Peckshield also reported that a whale withdrew 42,400 stETH from Aave.

#PeckShieldAlert A Whale has withdrawn ~42.4k $stETH (~$50M) from Aave Protocol V2 pic.twitter.com/d0lcbf0cFC

— PeckShieldAlert (@PeckShieldAlert) November 24, 2022

Lookonchain reported that an MEV bot arbitraged 104 ETH ($124,800) from this situation. According to the on-chain analytics, the bot transactions took this format:

“MEV Bot uses flash loan to obtain 8,000 WETH from 0x2718. His exchange path is 8,000 ETH → 8,272 stETH → 7,537 wstETH → 8,104 WETH.”

An hour ago, a whale removed 84,131 $ETH ($101M) from #Curve. Which caused the stETH/ETH pool out of balance, and stETH/ETH depegged to 0.9682.https://t.co/0jdd8VeYCg

SmartMoneys have already made money on the temporary depegging of stETH/ETH.

1.🧵

Share with you. pic.twitter.com/G1UDBqYK91— Lookonchain (@lookonchain) November 24, 2022

Another trader, Mandalacapital.eth, has longed stETH on Aave with a plan to take profit after stETH/ETH returns to peg. The trader deposited 4,513.70 stETH on Aave to borrow 3,193 ETH. He then exchanged the borrowed ETH for 3,258.46 stETH and borrowed again to increase the long leverage.

3.

mandalacapital.eth longs stETH on #AAVE and takes profit when stETH/ETH returns to the peg.

He deposited 4,513.70 stETH to #AAVE and borrowed 3,193 ETH.

Exchange 3,193 ETH for 3,258.46 stETH.

Then borrow again to increase the leverage of long.https://t.co/nUTSbJKZH3 pic.twitter.com/KkTTwMaNCv

— Lookonchain (@lookonchain) November 24, 2022

In another case, an address exchanged 2000 ETH for 2,053.48 stETH at a rate of 0.974. This means that they can later redeem it for ETH. That would mean a profit of 53.4 ETH.

4.

Address "0x9026" swaped 2,000 $ETH for 2,053.48 stETH at a rate of 0.974.

When stETH is redeemable, he can redeem 2,053.48 $ETH at a ratio of 1:1 and make a profit of 53.48 $ETH ($64,176).https://t.co/dYKj3qjhpd pic.twitter.com/fYleOT8cK9

— Lookonchain (@lookonchain) November 24, 2022

Following Terra’s implosion in May, stETH/ETH depeg caused massive market volatility and liquidity issues that affected bankrupt crypto companies like Celsius and Three Arrows Capital.

According to CryptoSlate data, ETH is currently up by 2.8% and trading at $1,196, while stETH is up by 2.4% and worth $1,172. The stETH-ETH peg is at 0.9817.

Wrapped Bitcoin depeg

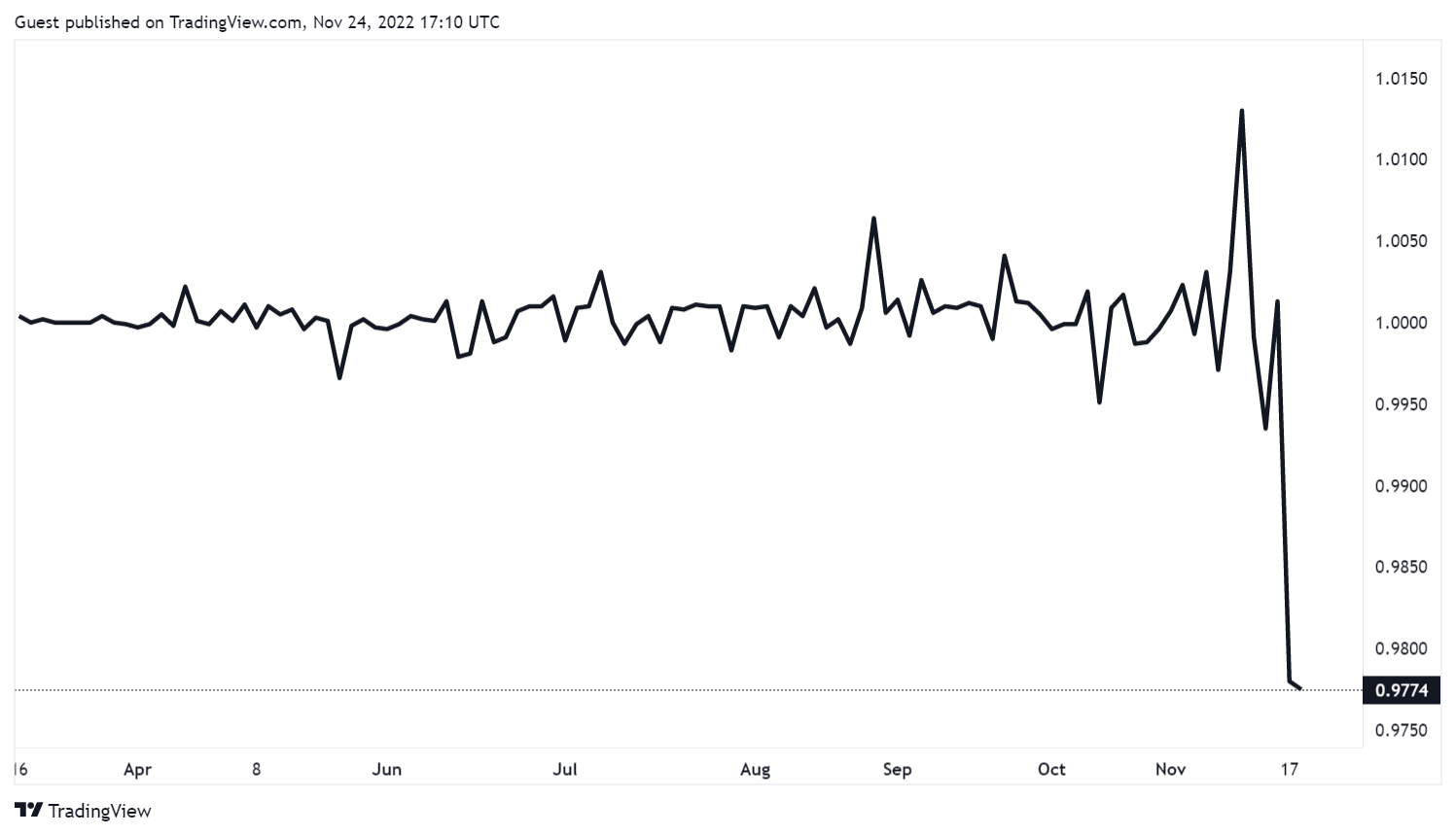

Tradingview data shows that Wrapped Bitcoin (WBTC) has depegged for over a week. According to the graph below, WBTC lost its parity with Bitcoin (BTC) on Nov. 13, when it fell to 0.9990.

Since then, the chasm has widened and fallen to 0.9774. Wrapped Bitcoin is an ERC-20 token. It is a 1:1 representation of BTC on the Ethereum blockchain network.

The depeg places 235,000 WBTC at risk as arbitrageurs could take advantage of the situation.

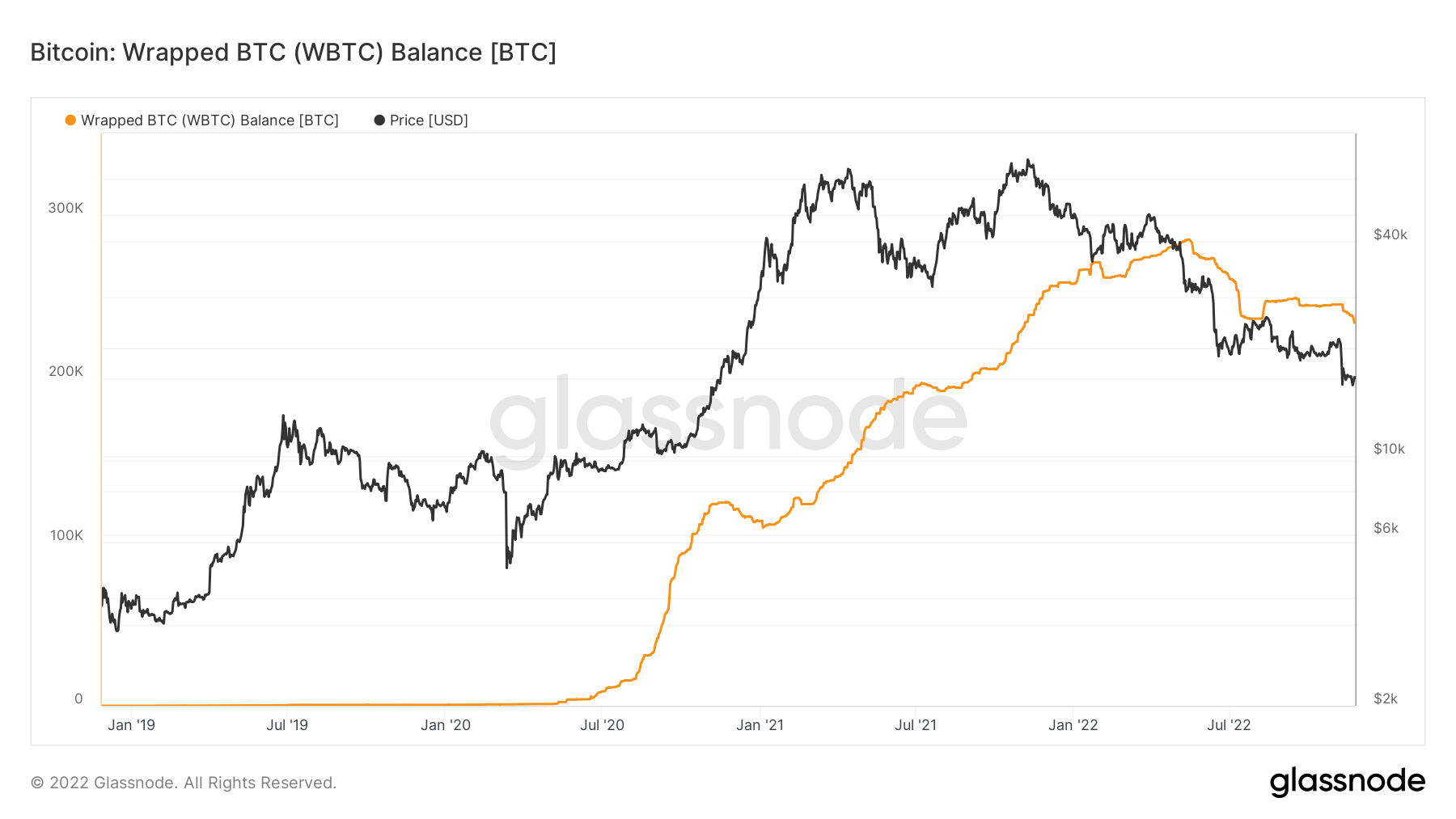

Meanwhile, Glassnode data shows that WBTC supply has decreased by 50,000 since May 2022 when the industry was reeling from Terra LUNA’s crash.

WBTC is trading for $16,573, while BTC is exchanging hands for $16,634, according to CryptoSlate data.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass